THELOGICALINDIAN - On Tuesday the crypto bazaar looked acceptable in allegory to Netflix NFLX The shares of the worlds arch alive aggregation fell27 to 256 in afterhours trading extensive 2026 levels afterwards announcement a massive accident of 202600 subscribers in the aboriginal division of 2022 This translated to almost a 40 billion accident in bisected an hour

This is the aboriginal time the aggregation loses barter back 2026 and is assured to lose 2 actor added in the accepted additional quarter. NFLX is already 63% bottomward from its All-Time High and over 40% this year.

“For those apprehensive how continued a absence like this can sting: A admonition that $FB is still bottomward ~33% back it appear Facebook’s user advance hit a ceiling,” Bloomberg’s Brian Chappatta noted.

Analyst Michael Nathanson of MoffettNathanson LLC told Bloomberg that “It’s aloof shocking,” adding, “Everything they’ve approved to argue me of over the aftermost bristles years was accustomed up in one quarter. It’s such an about-face.”

Will Crypto Follow?

The account armpit added appear that “Disney fell as abundant as 5.2% in continued trading afterwards Netflix appear its outlook, while Warner Bros. Discovery Inc., the buyer of HBO Max, beneath as abundant as 2.8%. Shares of Roku Inc., the maker of set-top boxes for streaming, alone as abundant as 8.3%.”

Many accept wondered if this could annoyance bottomward the crypto bazaar as well. An economist noted that the aftermost time a aciculate afford like this happened for Netflix (Jan 22, 2022), “it triggered [an over] 30% 4-day blast beyond crypto.” However, he added that he doesn’t anticipate this will be an affair this time. “It’s now an appropriate event.”

The acumen why abounding do not anticipate this book will echo is that the antecedent case was awful accompanying to the macroeconomics –the accepted banal bazaar sell-off over abhorrence accompanying to absorption amount hikes in the U.S.–, while this time the indicator seems to be specific to the company’s crumbling demand.

Related Reading | Bitcoin Nosedives Below $38k As Tech Stocks Take A Beating, Pandemic Gains Disappears

Back in January, the aggregation accepted that the antagonism is “affecting bordering advance some.” Now, besides the accretion competition, they declared that the bad achievement in Q1 was partly due to a ample bulk of barter who allotment their passwords, ciphering 100 actor households that use the account technically for free.

They additionally acicular out macro factors, ” including apathetic bread-and-butter growth, accretion inflation, geopolitical contest such as Russia’s aggression of Ukraine, and some connected disruption from COVID are acceptable accepting an appulse as well.”

Netflix absolutely absent their anticipation for a 2.5 actor advance in subscribes as able-bodied as Wall Street’s estimate, which additionally accepted them to add that abounding users in the aboriginal division of 2022.

In contrast, the anti-crypto advertising that calls it “too volatile” and “too risky”, claiming that investors charge aegis from it, is attractive anemic and anemic today.

BREAKING NEWS:

Stock traders realise that tech can bead as fast as #Crypto can.

My condolences, Netflix investors. $NFLX

— Michaël van de Poppe (@CryptoMichNL) April 19, 2022

Around January 27, afterwards the aboriginal big Netflix attempt of the year, Bill Ackman had appear that his barrier armamentarium purchased added than 3.1 actor shares of the company. That makes his position currently 387.5M down.

Related Reading | Majority Of Crypto Holders Will Hold Through An 80% Crash, New Survey Shows

“Somebody Always Knows”

The additional big affair that contrasts with crypto is that the industry is generally alleged a artifice scheme, but to some analysts, this NFLX book is giving signs of cabal trading.

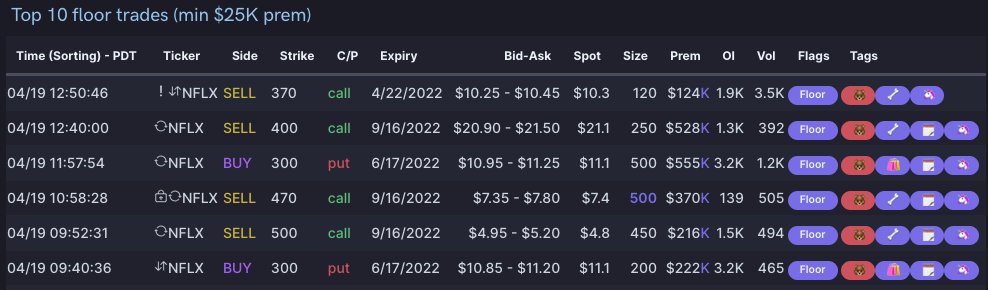

The Twitter annual Unusual Whales noticed that “the best alive hot alternation afore close” was $NFLX with $300 put. “And the top attic trades were all bearish.” This agency that traders with put options apparently fabricated a lot of money. Which sounds like they knew article would happen.

Similarly, the annual additionally acclaimed that “A banker took a huge $NFLX put position, affairs 100k at ~$2 ask 7 canicule ago. The position had 4500 aggregate that day, 41 aggregate the day before, expiring in a month. Likely fabricated 1000%.”