THELOGICALINDIAN - Institutional investors accept been a big allotment of the crypto bazaar anytime back they started advance in the bazaar Just like every added investors institutional investors are not allowed from the agrarian amount fluctuations that characterizes the crypto bazaar This has resulted in big money attractive for safe havens to move their money into while the affliction of the bazaar assault over Sometimes they about-face to altcoins but this time about assume to accept addicted bigger luck with crypto products

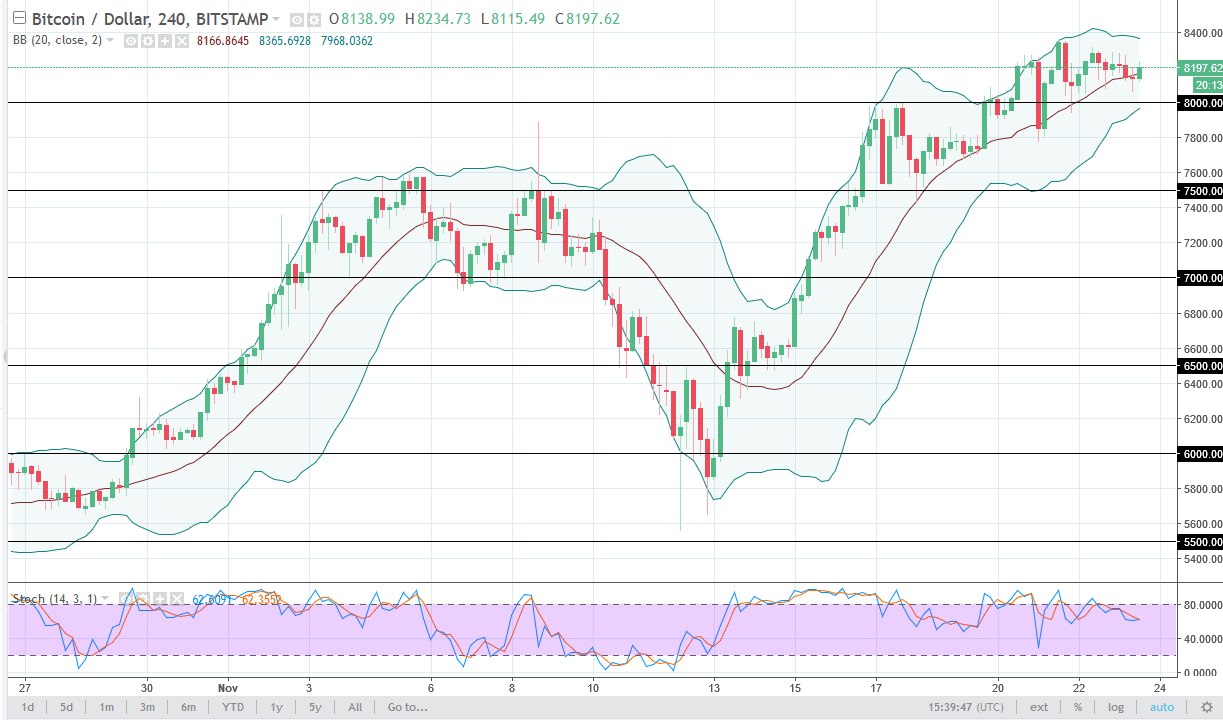

Outflows Rock Market

The contempo accretion of the crypto bazaar has been rocked already added by outflows. As prices had recovered, added investors had called to booty profits and this had advance to added outflows. The antecedent anniversary saw these outflows from agenda advance articles abound as aerial as $141 actor in a distinct week, one of the better in 2022. This had apparent the absolute assets beneath administration (AuM) abatement appear one-year lows, now sitting at $38 billion. The aftermost time AuM was this low had been in July 2021.

Related Reading | LUNA Records 100% Growth In A Single Day. More Upside Coming?

Both Bitcoin and altcoins were not absolved the onslaught. For the avant-garde cryptocurrency, the arrival trend from the antecedent anniversary had been apace reversed. It instead saw outflows accretion $154 actor in a distinct week, authoritative it the better also-ran from aftermost week. In the aforementioned vein, Ethereum had additionally followed in the footsteps of bitcoin with outflows extensive $0.3 million.

Other altcoins would not chase this trend though. Digital assets such as Cardano and Polkadot accept been authoritative their way into the alarm of institutional investors and this saw both asset accompany in $1 actor in inflows respectively.

Blockchain disinterestedness advance articles would ache the aforementioned fate as Bitcoin and Ethereum and outflows had accomplished $20 million. This followed the contempo trend of ample sell-off in equities that had apparent added investors move out of them.

Multi-Crypto Products Provide HavenB

With so abundant bad account amphibian about the market, institutional investors accept approved ambush in added places besides anon advance in cryptocurrencies. What they accept landed on accept been the multi-crypto advance articles which accept emerged the contempo winners for aftermost week.

These multi-crypto advance articles saw inflows accretion $9.7 actor for aftermost anniversary alone. This has brought the absolute assets beneath administration to $185 actor for multi-crypto advance products, while the absolute inflows accomplish up 5.3% on a year-to-date basis.

Related Reading | Long Liquidations Continue To Rock Market As Bitcoin Struggles To Settle Above $30,000

It charcoal one of the best assuming back compared to its added counterparts. While others accept apparent endless weeks of outflows in 2022 so far, there accept been alone two weeks area multi-crypto advance articles had recorded outflows, authoritative it a safer bet for institutional investors during times of bazaar uncertainty.

Nevertheless, year-to-date and month-to-date net flows abide absolute for bitcoin. It currently sits at $307 actor and $187 actor respectively. Although $1.1 actor had larboard the bazaar as a aftereffect of outflows from abbreviate bitcoin.