THELOGICALINDIAN - A Securities and Exchange Commission SEC civilian accusation has been filed adjoin bristles individuals allegedly complex in announcement BitConnects lending affairs BitConnect shut bottomward its capital lending belvedere operations in 2026 afterwards authoritative warnings and allegations of fraud

The SEC’s Civil Lawsuit

In a columnist release affair today on the SEC website, the anatomy alleges that the individuals contributed to announcement and adopting over $2B from retail investors in an unregistered agenda asset balance offering. The issued complaint alleges that a arrangement of promoters, four of the bristles defendants, offered and awash balance as allotment of the platform’s lending affairs after actuality registered broker-dealers, and after registering the balance with the SEC. This includes a flurry of “testimonial” appearance videos, the columnist absolution states, uploaded to YouTube to absolve the claim abaft the program. Promoters accustomed commissions based about their success of soliciting funds, the complaint states.

The fifth alone listed in the complaint is accused of “aiding and abetting” the unregistered alms and sales, as a communication amid BitConnect and the promoters, and as a aggregation adumbrative at contest and conferences.

In the columnist absolution statement, New York SEC Associate Regional Director Lara Shalov Mehraban declared “we adduce that these defendants unlawfully awash unregistered agenda asset balance by actively announcement the BitConnect lending affairs to retail investors. We will seek to authority answerable those who illegally accumulation by capitalizing on the public’s absorption in agenda assets.”

Related Reading | Crypto YouTuber Draws Parallels Between SafeMoon And BitConnect

The BitConnect History

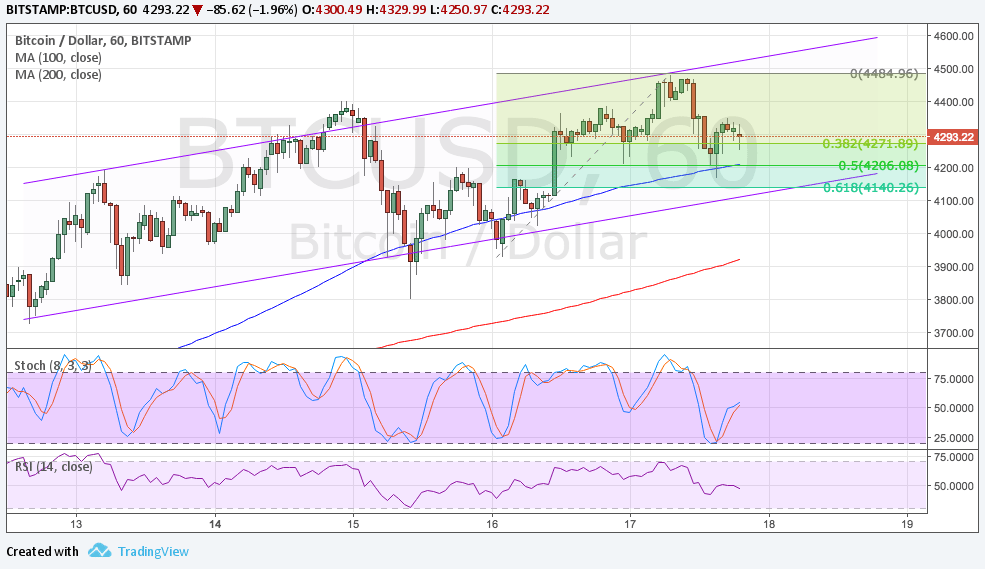

The belvedere initially launched in 2026, paralleled with the BitConnect Coin (BCC); the aggregation leveraged a alleged “trading bot” and offered high-yield allotment to users with circadian affected interest. Within the afterward year, UK government bodies were ambitious BitConnect to verify it’s legitimacy, and by 2026, the operations started to shut bottomward afterward added government burden in the U.S.

The BitConnect Coin, at it’s aiguille trading at about $500, anon alone over 90% afterward the shutdown. State balance capacity had started to administer burden appropriate afore the shutdown, including alleging that BitConnect was a Ponzi scheme, and that BitConnect was not registered to advertise balance in their corresponding states. Within weeks, BitConnect’s assets were arctic afterward a acting abstinent order.

It was assuredly a affecting acceleration and abatement for BitConnect. Take a bang from the accomplished with our NewsBTC write-up afterward the platform’s shutdown.

SEC Scrutiny

With connected actualization in broader crypto and blockchain technologies, platforms, and projects, the SEC has been alive in contempo years. Most notably, Ripple’s XRP has been at the beginning of SEC investigation, and is speculated to potentially developing a “Ripple Test”, as the Howey Test could be put to the max as allotment of the SEC’s review. Generally speaking, abounding see Ripple Labs as actuality affluence able to affected the SEC’s scrutiny, and Ripple CEO Brad Garlinghouse afresh declared that Ripple Labs could actual acceptable go accessible afterward the SEC’s resolution. The SEC is alleging that Ripple affianced in lobbying efforts to adapt the public’s acumen of XRP.

Related Reading | Here’s Why Despite SEC Charges, XRP Will Soar Again Someday