THELOGICALINDIAN - A contempo address from the ABA American Bankers Association suggests that banks accomplice with cryptocurrency firms due to the growing applicant absorption and accumulation in the sector

This 20-pages address provides a abundant assay of the crypto, including a glossary. It additionally maps cryptocurrency activities to the coffer casework and products. The Banker’s affiliation additionally suggests crypto use cases for the cyberbanking area with authoritative issues and acquirement models to the use case.

Related Reading | Vitalik Buterin Urges Ethereum To Grow Beyond DApps

The address has four audible categories of crypto-assets: CBDC (Central Bank Digital Currency), Cryptocurrencies, Non-Fungible Tokens, and Stablecoins. There was additionally a acknowledgment of Defi (Decentralized Finance).

Cryptocurrency Use Cases and Regulations

According to the report, some of the use cases of crypto in the cyberbanking area include;

Another aspect of the address is surrounding crypto regulations. It focused on requirements about the auction or alms of crypto, tax reporting, and money transmission. According to the report, the SEC adapted the auction of cryptocurrency.

For every money transmission, the FinCEN regulates it and requires operators to annals for the MSB and MTL, Money Services Business, and Money Transmitter Licenses. But tax advertisement lies on the table of the IRS.

However, it additionally acicular out that there is no accuracy on crypto regulations yet. According to the report, such cryptic regulations can actualize disparate or cryptic requirements. There was additionally a acknowledgment of DeFi, gamification, and abounding ecology issues as the risks of the cryptocurrency industry.

What Can Be The Way Forward?

According to the report, banks are actual abundant absorbed in the crypto industry. They aim to analyze the opportunities to action acknowledgment to these assets for their clients.

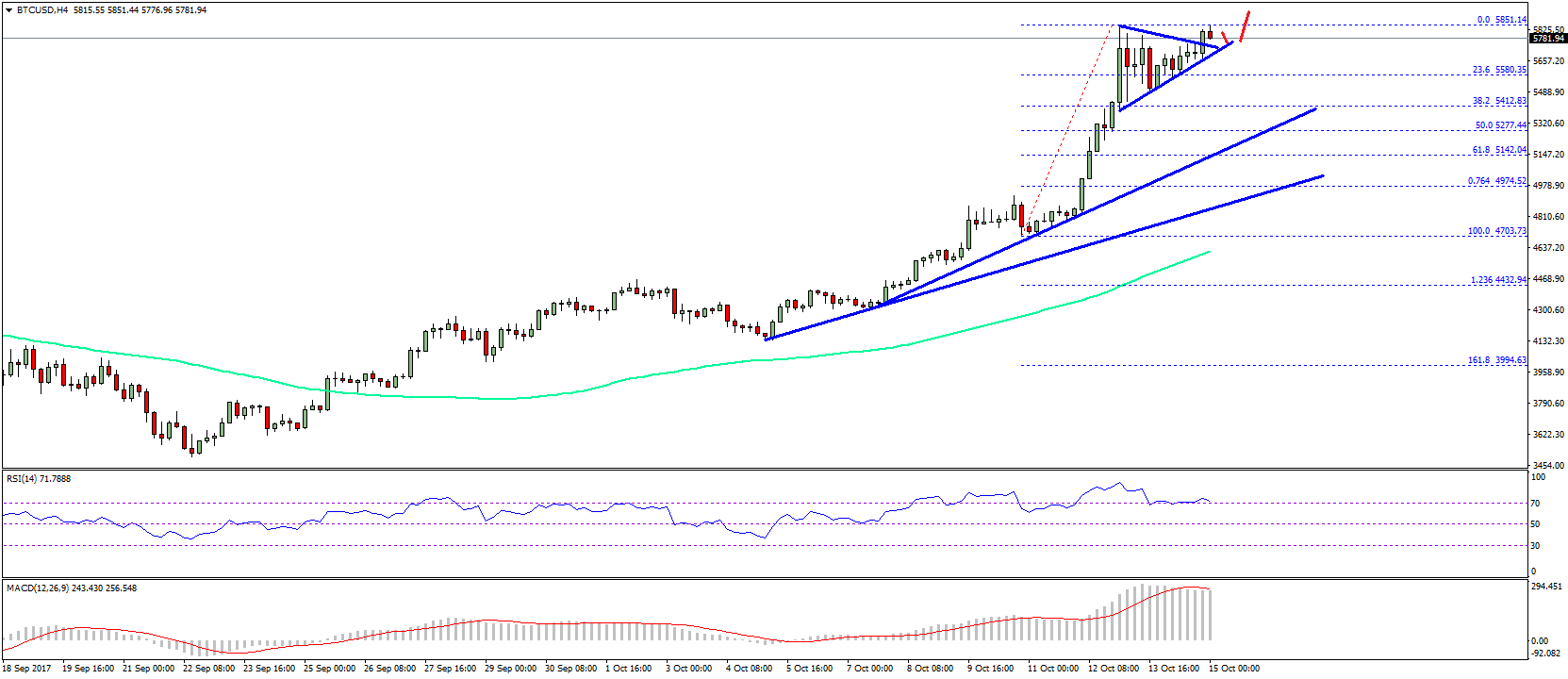

Presently, the growing applicant absorption in crypto pushes the banks to analysis means to accommodate cryptocurrency products. There was additionally a advertence to the NYDIG analysis that appear that 80% of BTC would alteration their asset to banks.

Related Reading | Ethereum Founder Vitalik Buterin Spotted With Hollywood Celebrities

As the address finds, the way advanced is that banks should accomplice with cryptocurrency companies and acquire their barter as clients.

On the added hand, banks will admission payments systems to onboard authorization deposits and offload them. The address additionally went added to advance partnerships that may assignment amid the two sectors.