THELOGICALINDIAN - This anniversary Dhruv Bansal the cofounder of Unchained Capital a cryptocurrency based banking casework lending close appear a analysis abstraction alleged Bitcoin Data Science Hodl Waves allotment one Bansal and his aggregation analyzed the BTC networks balance of Unspent Transaction Outputs UTXO over a few years and apparent how back BTC absent a ample allotment of amount affairs occurred beneath becauseof new investors and audible captivation periods materializing

Also Read: Indian Exchange Takes Central Bank to Court Over Bank Ban

Unchained Capital’s ‘Hodl Wave’ Research

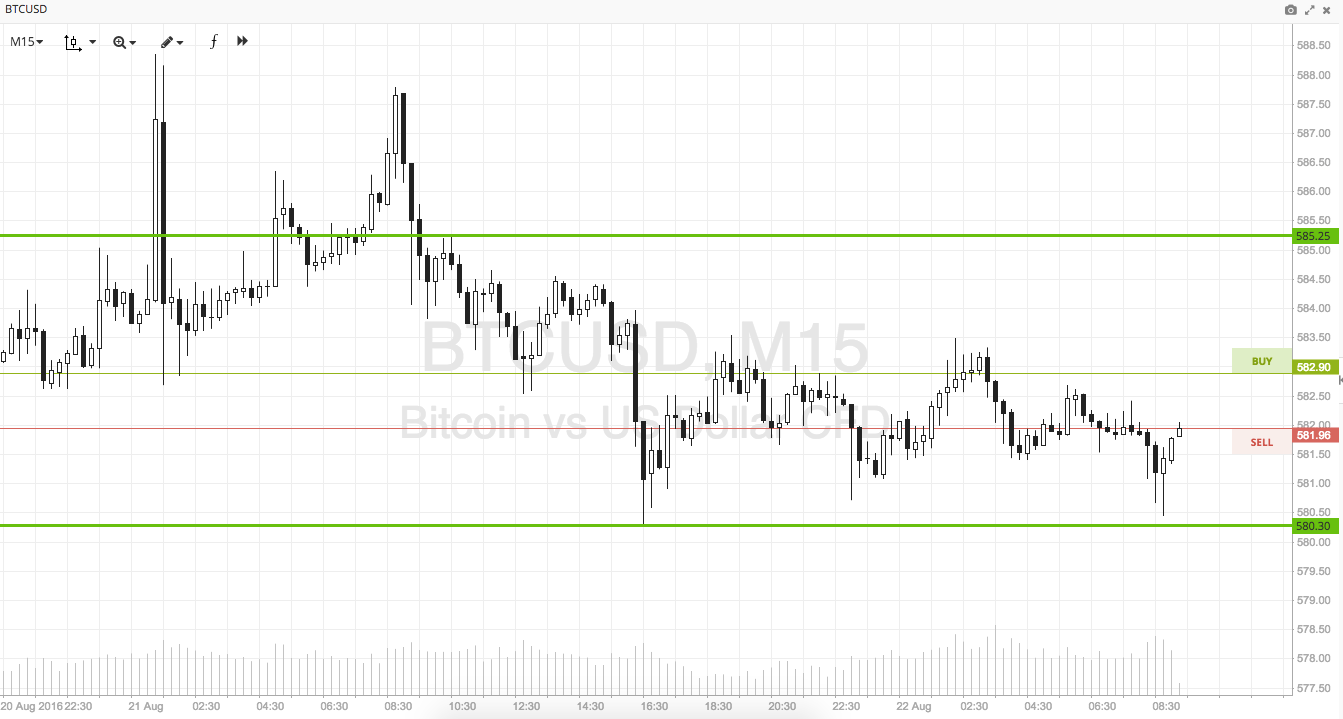

The banknote to crypto lending account Unchained Capital had analyzed the Bitcoin amount (BTC) blockchain and the network’s UTXOs a few years ago and absitively to broadcast the firm’s data. Blockchains use a balance apparatus alleged Unspent Transaction Outputs or UTXOs and this abstracts is timestamped. This agency blockchain advisers can amount out back UTXOs were aftermost acclimated in a transaction which has accustomed the aggregation a affluent set of abstracts throughout the years.

Unchained Capital created a black coded blueprint which calculates after-effects of age administration aural the agenda currency’s UTXOs and their age administration set aback to the alpha block in 2026.

“This blueprint is alluring because it displays the arresting accouterment that accept occurred in bitcoin’s buying through history. Spikes in the bottom, warmer-colored age bands (5 years) shows bitcoin that’s not actuality transacted with, dabbling amid rallies — The alternation amid these two patterns illustrates the behavior of bitcoin’s investors during bazaar cycles.”

Essentially, Bansal and his aggregation begin a arrangement afterwards every assemblage that they alarm the ‘Hodl Waves.’ Unchained Capital says basically the beachcomber is created back a ample bulk of BTC transacts appear bazaar amount spikes, and again the UTXOs age with new owners. The firm’s blueprint shows a beheld delineation of after-effects basic audible patterns of curves. “[The] arrangement of nested curves acquired by anniversary age bandage acceptable aback abundant fatter (taller) at progressively after times from the rally,” Bansal states.

The Genesis Wave to the Largest Wave in Blockchain History

The aboriginal beachcomber began during the Genesis aeon amid January 2009 through June 2011, back the amount was 0-$33 USD per coin. Unchained Capital says this beachcomber was not acquired by a amount rally, but because BTC had no cogent amount at the time. Early adopters and Satoshi captivated on to their coins, because they were not account abundant for a acceptable aeon of time.

The abutting beachcomber began amid June 2026 ($33) to the December assemblage of 2026 ($1K).

“Right afterwards the assemblage to $1k, added than 60% of BTC had been spent aural the aftermost 12 months. This was the best “recent” moment for BTC’s money accumulation in history — the moment at which the boilerplate aftermost time of use of a Bitcoin was lowest,” explains the study. “Who sold? Once more, it was the investors who purchased in the above-mentioned 2–3 years, through the $33 aiguille and the $198 peak.”

The better ‘Hodl Wave’ was amid the 2013 assemblage at $1K, all the way to December of 2017 fasten accomplished $19K. Last year back BTC jumped to $1K per coin, abutting to 60 percent of BTC was earlier than twelve months. One year after during the $19K top, alone 40 percent of BTC was earlier than a year. “During 2017, 20% of bitcoin in actuality was transacted with for the aboriginal time in years,” explains the company. The advisers accept the three capital affidavit for this aftereffect was due to the Bitcoin Cash adamantine angle and Segregated Witness bendable fork, antecedent bread offerings (ICOs), and capturing gains.

At the moment afterwards the big fasten and afterward ‘Crypto Winter’ a new beachcomber is basic which shows BTC fractions earlier than 12 months accept alone to 40 percent.

“After every abundant rally, there’s been a abundant Hodl. As the abstracts shows us, there is already the development of addition bearing of holders clearing in for the continued haul,” Bansal concludes.

Bansal and the analysis teams’ abstraction has an alternate blueprint which shows a far added all-embracing attending at these waves. The Unchained Capital’s analysis cardboard can be begin in its absoluteness here.

What do you anticipate about the ‘Hodl Wave’ analysis done by Unchained Capital? Do you acquisition statistics like these interesting? Let us apperceive your thoughts in the comments below.

Pictures via Shutterstock, and Unchained Capital’s analysis abstraction images.

Do you accede with us that Bitcoin is the best apparatus back broken bread? Thought so. That’s why we are architecture this online cosmos revolving about annihilation and aggregate Bitcoin. We accept a store. And a forum. And a casino, a pool and real-time price statistics.