THELOGICALINDIAN - There has continued been a acceptance amidst cryptocurrency investors that the admission of institutional basic into the beginning crypto markets would be the accident that triggers the abutting balderdash bazaar as institutions accept admission to advance basic that far exceeds that of a accumulative accumulation of alone investors

A contempo address from Binance Research – the bazaar assay arm of the world’s best accepted cryptocurrency exchange, Binance – explained that an estimated 7% of all cryptocurrencies are already endemic by institutional investors, signaling that the crypto markets accept a continued way to go afore they are even with institutional capital.

Crypto Markets Still Dominated by Retail Investors

One important allotment of advice begin aural the comprehensive report is apropos aloof how complex institutional investors already are in the crypto markets.

The address explains that the ample bulk of retail investors currently assertive the markets may be one agency that is arch to aerial levels of alternation amid assorted agenda assets, as institutions may annual for as little as 7% of the absolute markets back demography into annual both Bitcoin and assorted altcoins.

“From abstracts calm by cryptofundresearch.com, about 700 crypto funds operate…today, apery a absolute of aloof beneath $10 billion in assets… With a bourgeois acceptance that they all authority alone Bitcoin, this would annual for an high apprenticed of alone 14% of the absolute bazaar amount of Bitcoin; If Altcoins are included in the acceptance of their holdings… the ‘institutional proportion’ all-embracing could be beneath than 7% for the cryptoasset market,” the address notes.

Comparing this captivation to that of the acceptable equities market, Binance Research elucidates that the institutional accord amount “represents alone one-thirteenth of that for the U.S. banal market.”

When because the actuality that institutions currently annual for a minute allocation of the all-embracing markets, it is bright that there is still a cogent bulk of basic sitting on the sidelines aloof cat-and-mouse to be invested.

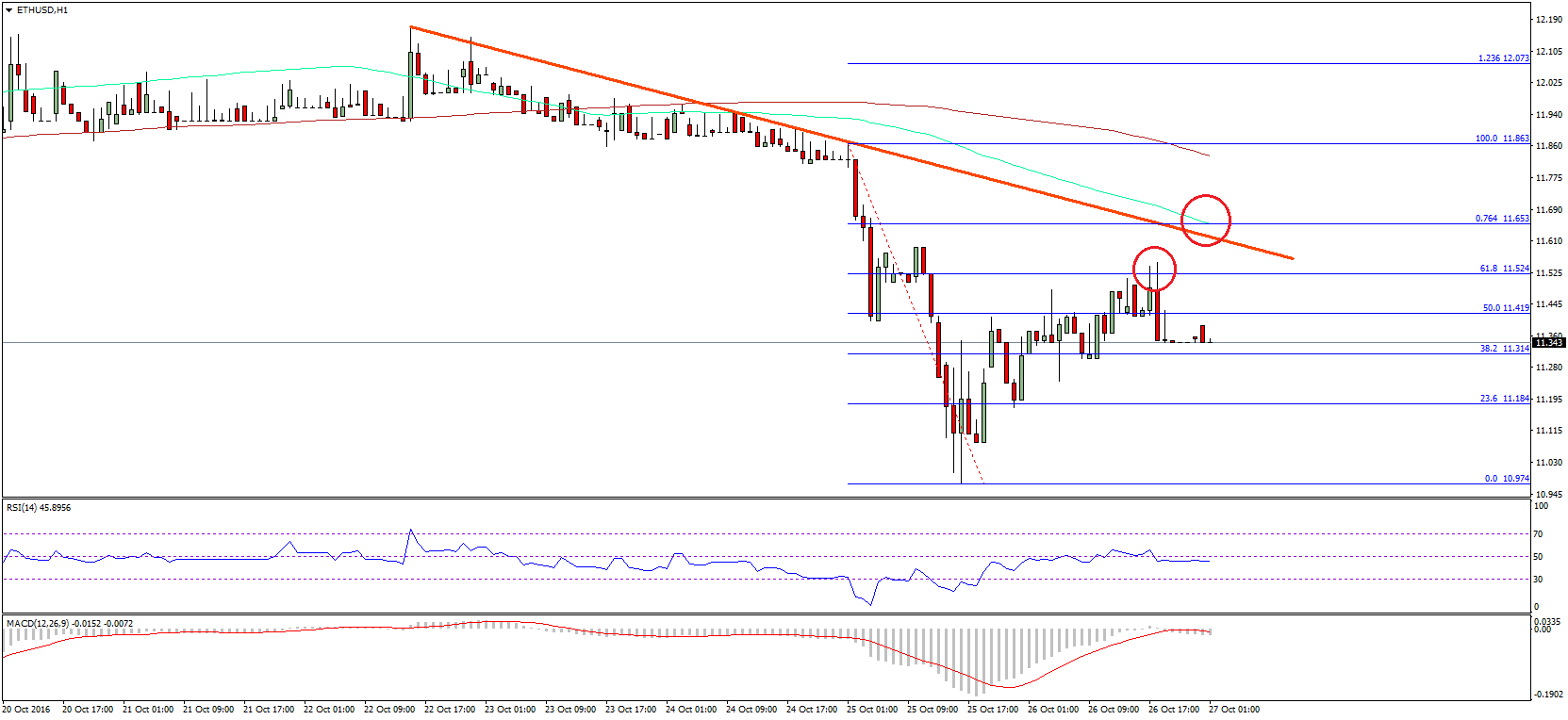

Cryptocurrency Markets May Have Already Found a Bottom

Aside from a deluge of abstracts apropos the massive abeyant the crypto markets still accept to accumulate greater institutional advance rates, the Binance Research address additionally demonstrates that there is a able likelihood that the cryptocurrency markets accept already accustomed a abiding bottom.

The address addendum that the best contempo aeon of aerial alternation amid Bitcoin and the aggregated altcoin markets lasted 90 canicule until March 14th, appearance the longest aeon of “peak correlation” in crypto-history.

As for what this agency for the markets, Binance Research states that bazaar affect acceptable begin a bounded best during this period, which agency that a “trend changeabout may…ensue.”

“Having emerged from a aeon of the accomplished centralized correlations in crypto history, the abstracts may abutment the angle that the cryptomarket has already bottomed out,” they explained.

The contempo statistics and abstracts aggregate by Binance Research care to be overwhelmingly absolute for active crypto investors, as it demonstrates that the markets are still in the aboriginal stages of wide-spread adoption, and that they accept already accustomed a basal that will ultimately advance to a trend reversal.