THELOGICALINDIAN - While above retailers accept become more acceptant appear Bitcoin as a acquittal adjustment analysis from Chainalysis Inc shows that aloof over 1 of affairs chronicle to merchants admitting belief makes up the ascendant use for Bitcoin However the abstraction abaft BTC consistently accompanying to parties transacting after an agent and never as an advance With that in apperception has BTC become a apology of itself

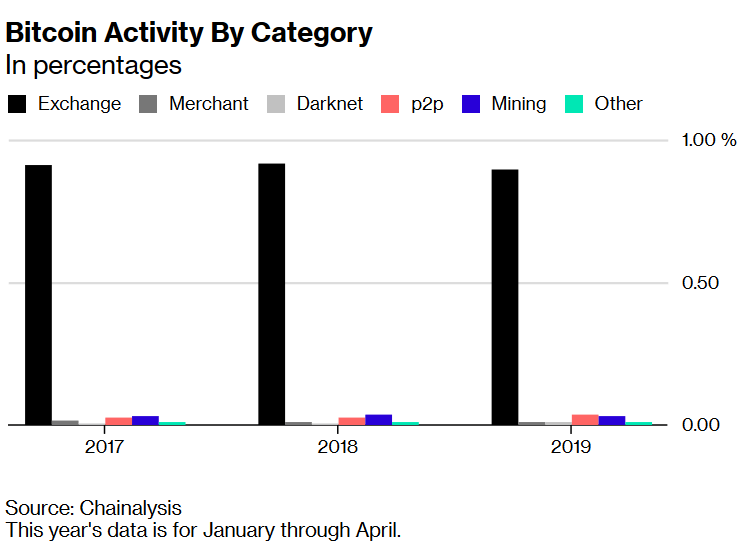

According to Chainalysis Inc, in the aboriginal four months of this year, alone 1.3% of BTC affairs accompanying to merchants. And admitting on-going basement development over the accomplished two years, the admeasurement of merchant accompanying affairs has remained consistently low during this period.

The abstracts shows the best all-encompassing use relates to belief via exchanges. And abundant like merchant transactions, this has additionally remained at a constant akin over the accomplished two years. On allegory the data, Kim Grauer, chief economist at Chainalysis Inc said:

“Bitcoin bread-and-butter action continues to be bedeviled by barter trading. This suggests Bitcoin’s top use case charcoal speculative, and the boilerplate use of BTC for accustomed purchases is not yet a reality.”

And so, as things stand, there is a acceptance that BTC is too admired to spend. Which, if taken to the extreme, creates a absurdity aural the Bitcoin ecosystem that will advance to its closing demise. A Twitter user explained it as:

“If bodies do not use Bitcoin, there will be no transactions, with no affairs there would be no charge for miners, after miners the blockchain will not function…”

The affair of advance against spending is added circuitous by the account of Laszlo Hanyecz, who paid 10,000 Bitcoin for pizza about a decade ago. While he draws acclamation as a Bitcoin pioneer, his adventure is brave with affliction over what could accept been. And cipher wants to be the abutting Hanyecz.

every time back I anticipate I am failed… I bethink that adventure and it makes me feel not that bad…

— Sophie (@Sophielorennn) May 22, 2019

But, back Satoshi Nakamoto appear his whitepaper for Bitcoin, the cypherpunk aesthetics basal the activity was about rebelling adjoin the system. And application technology to deliver bodies from the cachet quo.

However, in the present, BTC has become a alarm for investors acquisitive to get affluent in fiat. The actual affair Nakamoto accepted to chargeless us from. More than that, its perceived amount has investors cerebration in scarcity. And accession becomes the adjustment of the day, which makes little faculty because how accessible it is to obtain.

Instead, a added counterbalanced access to managing Bitcoin would ensure constancy of the network. This involves alleviative BTC as you would fiat. By hodling some and spending some. One Reddit user wrote:

“The point is that bitcoin would not accept any amount if anybody banned to absorb their bitcoins. The alone acumen bitcoin has any accepted and approaching amount is because bodies currently use it, and because it is accepted that this acceptance will access in the future. If you don’t appetite to use bitcoin, that’s fine, that’s everyone’s right, you can aloof let others absorb theirs, but at atomic apprehend that all your expectations for approaching amount is abased on added bodies spending their bitcoins as intended.”

HODL is a Lambo motto, application Bitcoin is abandon incarnate. I'm not adage DONT HODL, I'm adage use it added again you abundance it… What acceptable is your bounded coffee abundance accepting BTC if no one spends it?

— ☮️ (@KennethBosak) March 26, 2019

And so, Bitcoin was conceived as a acquittal system. But as a aboriginal bearing blockchain, it lacks the qualities that accomplish it a aggressive acquittal system. However, that’s not to say scalability and acceleration apropos cannot be affected in the future. All the same, what BTC has become is an abuse to Nakamoto’s vision. Is it too backward to go back?