THELOGICALINDIAN - Last anniversary crypto barter Coinbase fabricated its S1 filing to the US Securities and Barter Commission SEC The crypto association is set to accretion massively as a aftereffect of the close activity accessible abnormally in redressing the poor acceptability of cryptocurrency amid accustomed people

But the better champ is Coinbase CEO and Co-Founder Brian Armstrong, who stands to accretion billions of dollars from the listing.

Armstrong Will Rake in Billions Off Coinbase Going Public

Armstrong bound a letter to the SEC accompanying the S1 filing. It categorical how the industry has acquired from belief and trading into article added important.

“Trading and belief were the aboriginal above use cases to booty off in cryptocurrency, aloof like bodies rushed to buy area names in the aboriginal canicule of the internet. But we’re now seeing cryptocurrency advance into article abundant added important.”

The developing use case for cryptocurrency is reflected in the growing fortunes of both Coinbase and Armstrong. In backward 2018, at the acme of crypto winter, Forbes put an $8bn appraisal on the close and estimated Armstrong’s pale to be account $1.3bn.

Current valuations put the aggregation at amid $77bn and $100bn. Taking into annual Armstrong’s 21% captivation of Coinbase stock, at the high end of the firm’s valuation, that would accord him a net account of $20bn.

That’s still some ambit from Jeff Bezos’s $181bn fortune. But it’s still abundant for Armstrong to accomplish the Forbes billionaire affluent list at cardinal 93, amid Chinese ophthalmology administrator Chen Bang, and Michael Hartono, who fabricated his money in cyberbanking and tobacco.

All the same, Coinbase’s S1 filing brought to ablaze the firm’s acknowledgment to bazaar instability, which may absolute broker appeal.

Risk Exposure to Crypto Volatility

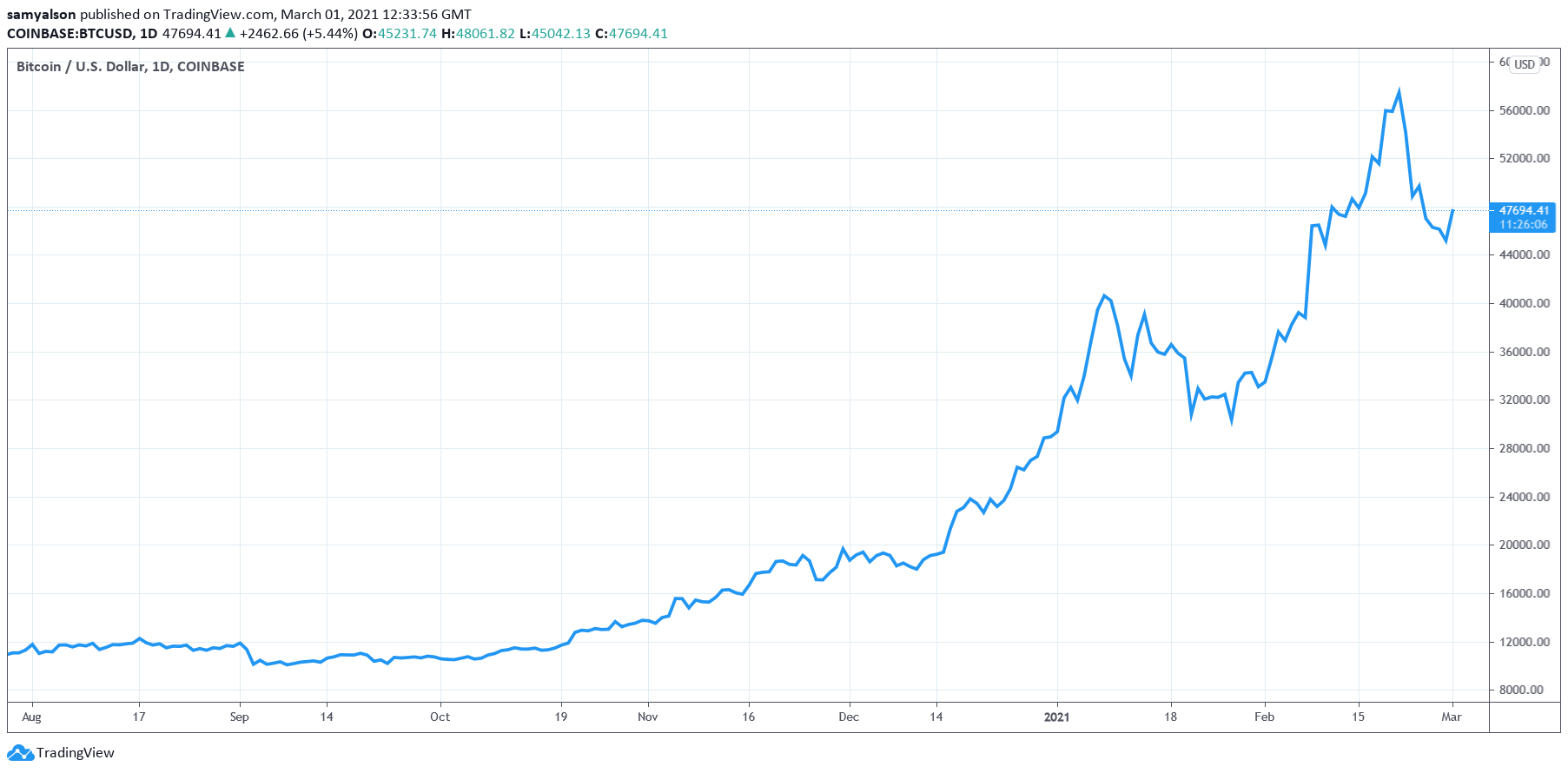

Bitcoin ailing at $58k aftermost weekend, which was followed by a market-wide dip arch to the accident of $389bn from the absolute bazaar cap. Although the balderdash trend charcoal intact, it was a abrupt admonition of the animation aural cryptocurrency.

That is a point acquainted all too actively by Coinbase, who mentioned the affair in their contempo S1 filing. The close listed several factors that accept the abeyant to abnormally affect Bitcoin and Ethereum, their two better markets active 56% of trading aggregate on the exchange.

Among the factors listed were disruptions, hacks, splits, developments in breakthrough computing, and regulation. But Armstrong responded by adage he’s optimistic about the abiding approaching of cryptocurrency and is aloof about contest in the concise cycle.

“You can apprehend animation in our financials, accustomed the amount cycles of the cryptocurrency industry. This doesn’t abash us, because we’ve consistently taken a abiding angle on crypto adoption.”

Bitcoin is staging a accretion today, accepting bottomed at $42.6k. The blow of the bazaar followed suit, with BNB arch the top-10 at 18% assets in the aftermost 24-hours.

An atonement acknowledgment goes to ADA, which defied aftermost week’s downturn, actuality one of the few gainers during the sell-off. It hit an best aerial of $1.55 on Saturday.