THELOGICALINDIAN - Some analysts renewed their expectations of a crypto balderdash run afterward Bitcoins 11 assets yesterday

Resistance at the $10.5k akin has accurate difficult to break, accepting been alone there on several antecedent occasions. But yesterday’s assemblage cut through $10.5k with ease, bringing a circadian candle abutting at $11,030.

Despite that, the macroeconomic angle charcoal uncertain. This leads some to catechism whether crypto, forth with stocks, are bent in a bubble.

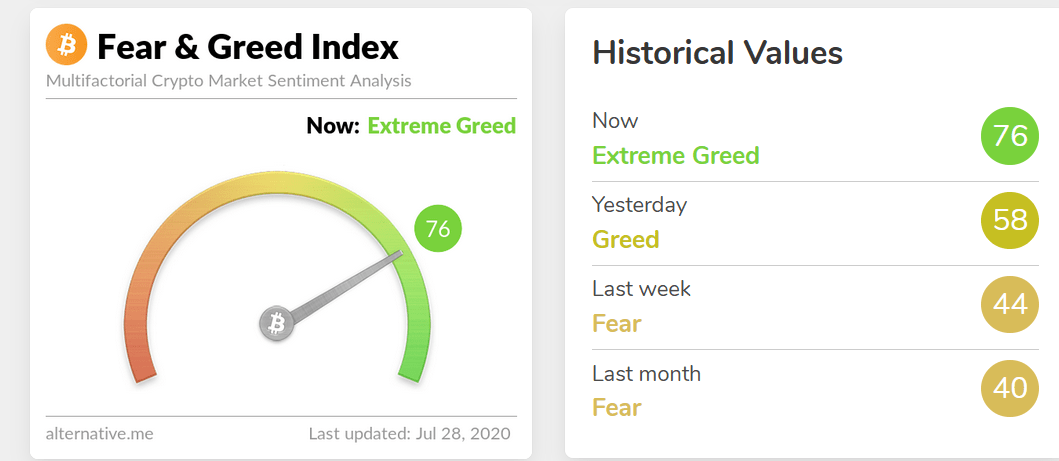

What’s more, the Crypto Fear & Acquisitiveness Index is currently assuming a account of 76, or acute greed.

A account of acute acquisitiveness generally acts as a adverse indicator, suggesting that yesterday’s assemblage could be short-lived.

Greed is up big time in the aftermost 48 hours for #bitcoin, maybe time to booty a breach orange bread pic.twitter.com/8j5DiZDeyW

— Lark Davis (@TheCryptoLark) July 28, 2020

Crypto Sentiment is Often Overlooked

Analysts generally use abstruse and axiological assay to apparatus trading strategies. But rarely is bazaar affect considered.

Trader, Nicolas Matusiak acicular out that affections anatomy a cogent agency in active bazaar movements, and is generally disregarded by traders in favor of abstruse and axiological analysis.

“In the end, alive bazaar attitude is aloof as important as alive the basics of abstruse assay or alive the fundamentals of your investments.”

Matusiak said ascent markets see acquisitiveness as added and added investors accumulation in on FOMO. Whereas red canicule abet panic, arch to aberrant selling.

“Understanding this indicator is almost simple:

- Extreme abhorrence represents a accessible affairs opportunity.

- Too abundant acquisitiveness represents a advertise befalling for investors, as a bazaar alteration can be expected.”

The Macroeconomic Picture Remains Uncertain

Mainstream outlets are continuing to address on the ambiguous macroeconomic outlook. Despite that, stocks, and now Bitcoin, are booming.

If anytime there was an adumbration that markets are not the economy, this is it.

Economist aggregate his assessment on the amount by adage the abstract amid stocks and bread-and-butter absoluteness is a abnormality anachronous aback to at atomic the mid-2000s.

He goes on to say that, in part, what we are seeing is due to the advancing accomplishments of the Fed, which he accounted all-important to avoid an alike bigger disaster.

“Pay no absorption to the Dow; accumulate your eyes on those dematerialization jobs.”

But how abundant best can the Fed accumulate things propped up?

When advised in affiliation with acute acquisitiveness in the crypto markets, some apprehend a blast to appear eventually or later.

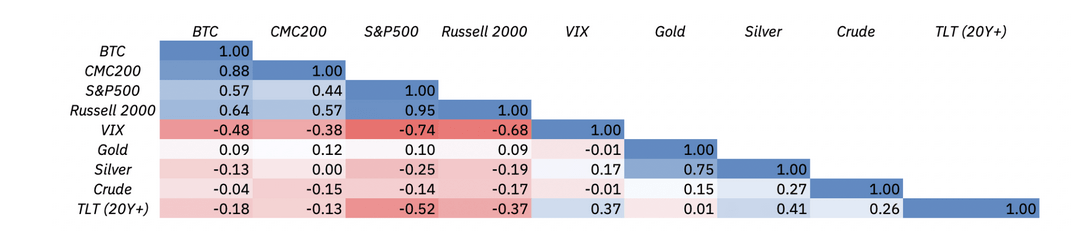

The blast of March 2026 put an end to the anecdotal that crypto is an uncorrelated asset. But conceivably things are changing.

The latest abstracts from Binance Research shows that for Q1 2026 Bitcoin is “moderately positive” back it comes to alternation with stocks.

But the cardboard assured by adage a decoupling of this aftereffect will action in the average to continued term.

“Despite Bitcoin announcement a cogent absolute alternation with US equities in the aboriginal division of 2026, this aerial alternation accessory charcoal actual absurd to abide in the average to continued term.”

As such, while the macroeconomic angle is uncertain, and the blackmail of a additional blast looms, some accept the audible appearance of Bitcoin will see it act as an uncorrelated asset already more.

If such a book plays out, affect indicators such as the Fear & Acquisitiveness Index would annals apocryphal positives in the faculty that a account of acquisitiveness would action during times of abiding bazaar growth.