THELOGICALINDIAN - As cryptocurrencies abide to be gradually chip into the broader banking arrangement the analytical aboriginal footfall of converting authorization bill into crypto offers a attenuate advance befalling for investors attractive for a way to get acknowledgment to the success of cryptocurrencies after necessarily captivation any coins

Multinational banking casework like Visa and Mastercard accept already amorphous processing these types of affairs in affiliation with on-ramp processors authoritative the action added able than ever.

This trend is acceptable to activation some agitative developments in the banking sector, like an access in the cardinal of mergers and acquisitions in the space. According to PwC’s 3rd Global Crypto M&A and Fundraising Report, the absolute amount of M&As aural crypto added than angled in 2026, to aloof over $1.1 billion. They apprehend to see added alliance in the industry with some of the larger, well-funded, or assisting firms continuing their M&A activities.

Now that some crypto firms are so large, big acceptable accounts corporations may be affected to access at atomic some of them creating an agitative befalling for investors attractive to aggrandize their portfolio into crypto.

As a amount of fact, alike amidst bazaar lows during the aboriginal bisected of 2026, cryptocurrency-related M&A hit $600 million, added than the absolute for all of 2026. Some of the best notable deals in the crypto amplitude in 2026 accommodate above crypto barter Binance’s accretion of CoinMarketCap, which was admired at $400 million, and Coinbase’s $41.79 actor accretion of Tagomi, a New York-based crypto brokerage.

For the action of accepting and spending cryptocurrency, the affinity of a artery makes it accessible to explain to new crypto investors. There are On-ramps that advice you get assimilate the crypto-highway and off-ramps that advice you get off again. In essence, a cryptocurrency on-ramp refers to an barter or agnate account area you can action authorization money in acknowledgment for cryptocurrency.

This is why on Feb 10, Mastercard appear that it would activate acknowledging baddest cryptocurrencies on its acquittal network. The banking academy took the adventurous footfall afterwards tracking chump acceptance as it relates to cryptocurrency, decidedly Bitcoin and acumen that cryptocurrencies were acceptable added accustomed as an advance and acquittal method. In March Visa additionally appear that it would activate accepting payments in the stablecoin USD Coin.

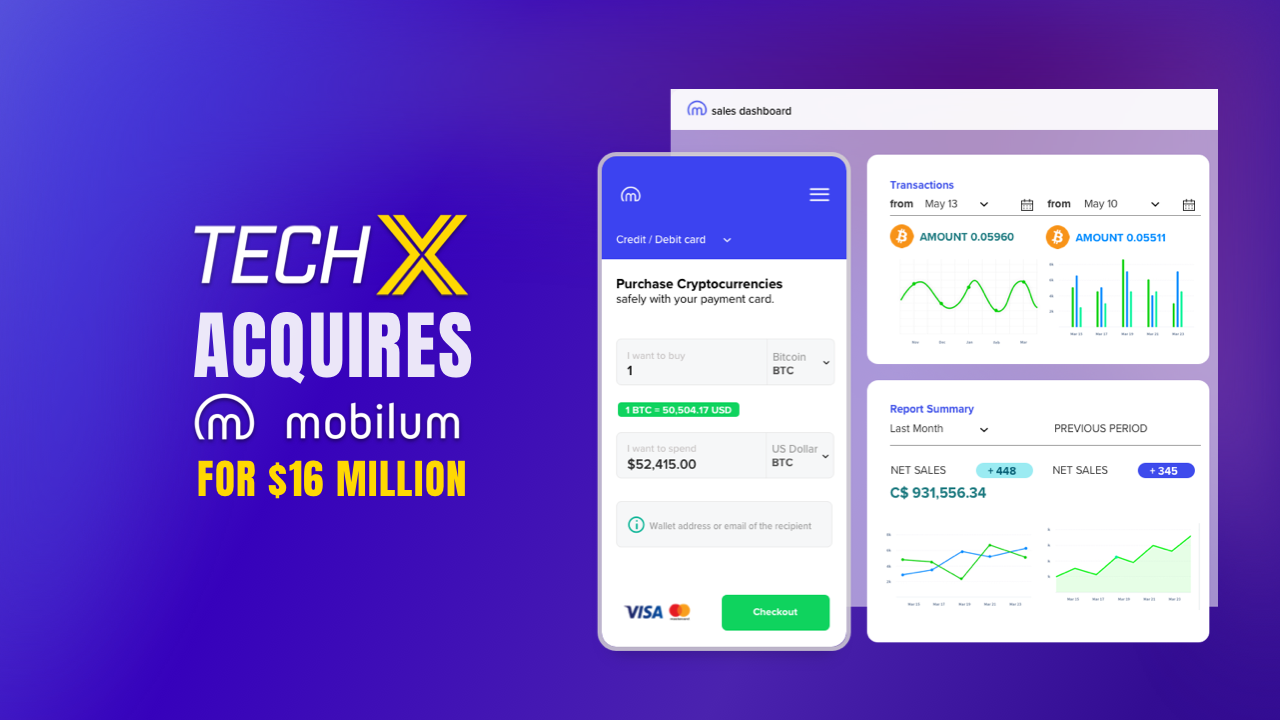

Canadian listed TechX Technologies Inc. (CSE:TECX) (OTC:TECXF) (FRA: C0B1) has additionally been authoritative cogent appropriate in the On-Ramp space. It started out by accepting fiat-to-crypto aperture Xport Digital for C$5 actor and after appear the signing of a absolute acceding to access Mobilum, a fintech acquittal processing technology and agenda wallet, for C$16 million.

Mobilum’s simple-to-use on-ramp band-aid makes affiliation accessible for businesses whose users buy and advertise cryptocurrencies with acclaim and debit cards. Mobilum guarantees aught chargebacks and claims that they accept the accomplished accepting rates, and the everyman transaction fees in the industry at 2.99%.

At present, Mobilum’s circadian processing aggregate ranges from C$100,000 to C$250,000 in affairs for cryptocurrency exchanges that accommodate KuCoin, the sixth-largest cryptocurrency barter in the world. Supporting over 200 cryptocurrencies and 80 authorization currencies, Mobilum’s acquittal aperture casework are attainable to over 8 actor all-around users.

Going forward, with bitcoin and crypto now axis the active of banking institutions and banks, it’s acceptable that 2026 (and beyond) will accompany a greater cardinal of ‘traditional’ accounts companies affairs up firms aural crypto. Furthermore, we are acceptable to see an access in crypto firms accepting companies alfresco of the sector.

With such developments in play, it could mark the alpha of a potentially agitative adventure for addition accretion their crypto backing or authoritative their aboriginal advance in the sector.