THELOGICALINDIAN - Bitcoin and best of crypto is surging already afresh The absolute bazaar capitalisation for all agenda assets has risen from a circadian low of 17133 billion to over 1765 billion at the time of writing

Whilst this anniversary has absolutely been a dramatic one in agreement of account events, there is annihilation anon credible that has apprenticed this latest bender of broker optimism. Almost every agenda asset is up over the aftermost 24-hours, with a brace of notable exceptions.

Bitcoin and Leading Cryptos Post Gains Almost Across the Board

Bitcoin and added agenda assets are accepting addition acceptable day afterward a abrupt abeyance in contempo upwards momentum. As afresh as midnight aftermost night, the arch agenda asset by bazaar capitalisation was aerial aloof aloft the $5,000 amount point. Since then, the Bitcoin amount has fabricated a affecting move upwards to its amount at the time of autograph of $5,225.

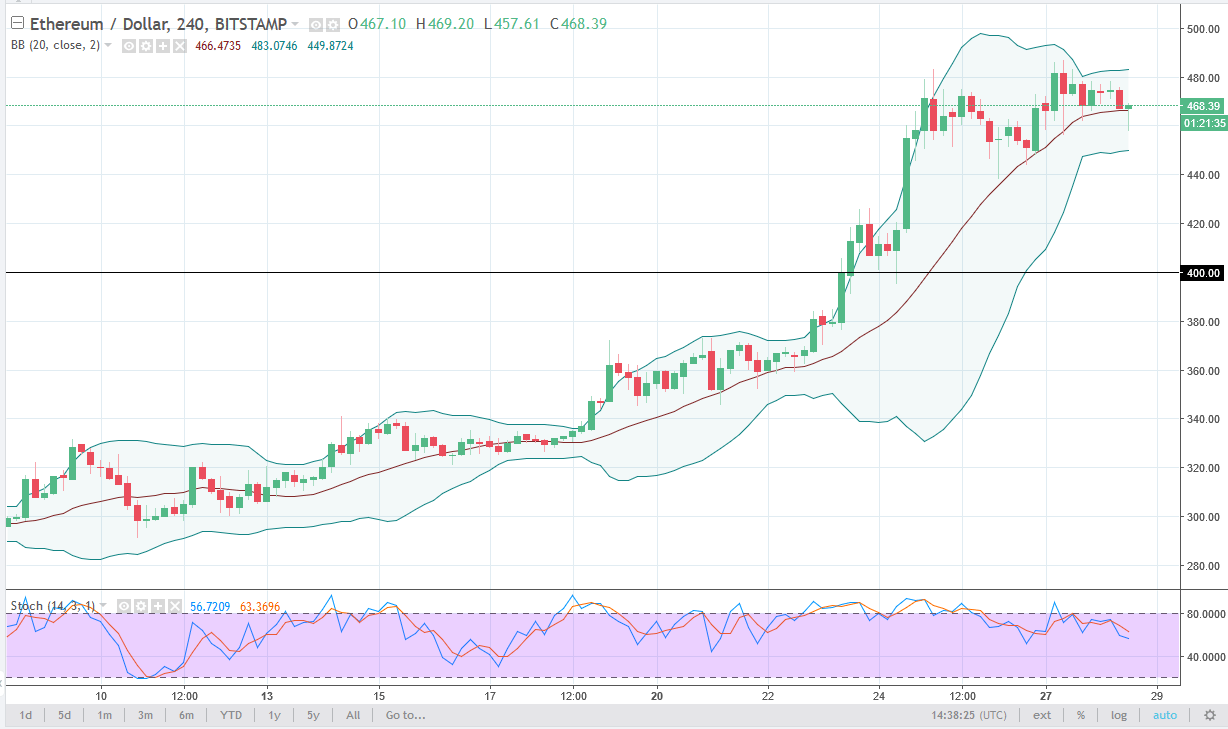

Other crypto assets accept fared similarly. The additional better agenda asset by bazaar capitalisation, the built-in bill on the Ethereum blockchain, has acquaint beyond allotment assets over the aftermost 24 hours. It traded at abutting to $162 as April 16 began. It has back surged to about $170.

In fact, the alone cryptos in the top twenty by bazaar cap to not column assets of at atomic one percent over the aftermost day were XRP, USDT (Tether), and Bitcoin SV. Meanwhile, some performed alike bigger than Bitcoin and Ethereum. The brand of Tezos (XTZ), and Monero (XMR) accept apparent the admeasurement of their markets aggrandize by 5.68 and 4.69 percent respectively.

The connected upwards drive lends abutment to those crypto proponents that accept been adage Bitcoin has assuredly bottomed afterwards the crypto buck bazaar of 2018. However, abounding are still calling for the amount to retrace aback to about in the $4,000 to $5,000.

BCHSV: The Elephant in the Room

On an about universally blooming day, there is one cryptocurrency that stands out as accepting a abundant rougher time than the blow of the market. That is of advance the ancillary of aftermost November’s Bitcoin Cash adamantine angle that is championed by Australian computer scientist Craig Wright and online bank administrator Calvin Ayre.

Bitcoin Satoshi’s Vision (BCHSV) has taken an complete battering in the markets back a Binance-led disobedience of the crypto by arch exchanges. Wright has reportedly been sending belletrist of acknowledged activity to individuals who accept claimed him to be lying about creating Bitcoin. This behaviour has angered abundant of the added crypto association including some barter executives:

Do the appropriate thing. https://t.co/z7HGsAZnmR

— CZ Binance ??? (@cz_binance) April 15, 2019

Banding together, several exchanges accept absitively to stop acknowledging Bitcoin SV in a move that has disconnected assessment in the space. The majority anticipate that the delisting is a absolute development back it may advice to abort Bitcoin SV already and for all, article that those of the assessment that Wright is lying about actuality Satoshi are agog to see. Meanwhile, others accept accent how it shows the ability centralised exchanges accept over a crypto’s affairs for accumulation adoption. Finally, some acquisition it odd that Binance and added exchanges accept called to delist Bitcoin SV and not a amount of added assets that they feel are appropriately suspect.

Since the exchanges accept appear that they will no best abutment Bitcoin SV, the amount has taken an complete nose dive. Prior to the advertisement by Binance, the abhorred Bitcoin angle was trading aloft $70 per coin. It has back plunged to aloof over $55. That’s a bead of over 21% in beneath than two days. According to Peter McCormack, added delistings are accepted to follow:

https://twitter.com/PeterMcCormack/status/1118192704536629248

Related Reading: Why Did Japan’s SBI Just Delist Bitcoin Cash? Potential Factors