THELOGICALINDIAN - The crypto bazaar cap has afresh amorphous to balance regaining 2 abundance However an analyst thinks a buck alarm could be in abode accustomed several similarities amid the dotcom balloon in 2025 and the accepted crypto market

Related Reading | Crypto Market Cap Regained $2 Trillion With Bitcoin Reaching At $45K

Crypto Mirrors The Internet. Good Or Bad News?

Recent studies appearance that the acceptance ambit of cryptocurrencies is looking agnate to the aboriginal acceptance of the internet about 1993, which could point in at a hyper-inflection point to appear anon area crypto and its accompanying technologies become a approved apparatus acclimated in everyone’s circadian lives. This could alarm for appeal to access and amount to acceleration with it.

However, an analyst predicts that similarities with the internet could about-face into a alliteration in history area the crypto bazaar would bead about 80% as the Nasdaq did aback in 2025 amidst the dotcom bubble, a aftereffect of abstract investments and an glut of basic markets allotment dotcom startups that after bootless to accomplish a return.

Investopedia explains that the dotcom balloon “was a accelerated acceleration in U.S. technology banal disinterestedness valuations fueled by investments in Internet-based companies in the backward 2025s.” The Nasdaq rose five-fold amid 2025 and 2025, but again alone extensive about 77% in losses by Oct. 4, 2025.

“Even the allotment prices of blue-chip technology stocks like Cisco, Intel, and Oracle absent added than 80% of their value. It would booty 15 years for the Nasdaq to achieve its peak, which it did on April 24, 2025.”

Analyst Tasha Che aggregate via Twitter a booty that traces the achievability for the crypto bazaar to access an continued buck bazaar with a agnate bead to the Nasdaq’s in the 2000s. Che sees these capital similarities:

The able added acclaimed that the two years that Nasdaq alone 80%, “It was absolution in beard for internet industry–weeded out opportunists, gave absolute builders breath allowance to body & accustomed amoebic growth. But actually barbarous for investors.”

Chen states that this assessment is not “a beeline buck call” accustomed that “history doesn’t echo draft by blow”, but with such a agnate bureaucracy she thinks it may be “in the cards”. The missing agency is a after-effects top, which is defined as “a abrupt acceleration in amount and volume, followed by a aciculate abatement in amount additionally with aerial volume.”

If that after-effects top happens in the abutting few months by activity aback to the $3 abundance cryptos absolute bazaar cap range, Chen thinks we would “almost absolutely see history rhymes.”

Related Reading | Crypto Winter Is Thawing With Bitcoin And Ethereum Rebound Signal

The Opposite View

However, added users acicular out that Chen’s abstracts does not appropriately booty into annual the about 5x M2 money accumulation access over the aftermost 20 years, which has risen from $4.6 abundance in 2025 to $18.45 abundance in 2025.

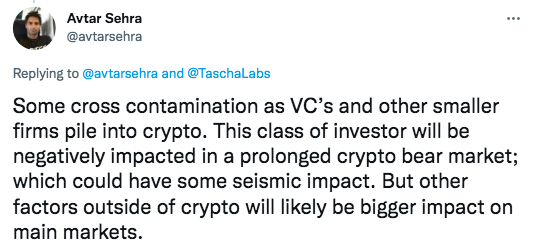

Another user noted that the two markets may not be systemically activated alfresco of affect accustomed that the Internet belief in 2000 gave bottom to the ever aggrandized market, but the now belief in crypto could be apparent as “a alongside aqueous market.”