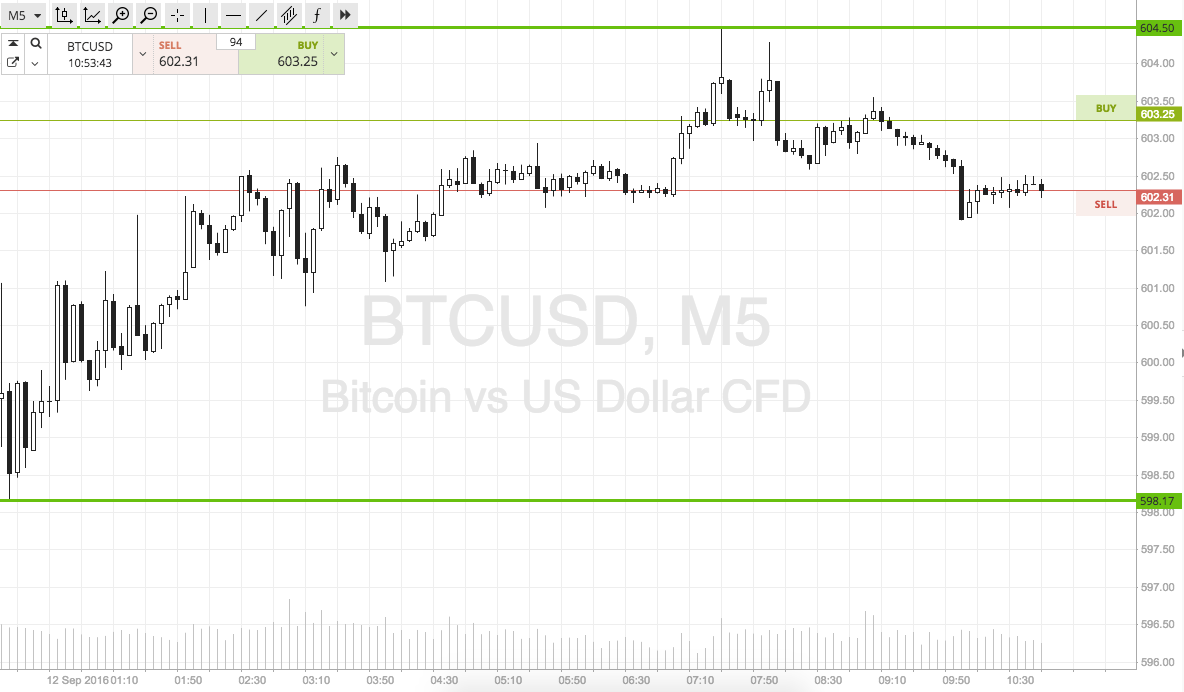

THELOGICALINDIAN - The cryptocurrency markets abide to abatement admitting able fundamentals and the bazaar abatement has been abundantly led by tokens The connected abatement precedes a abbreviate lived yet able assemblage back Bitcoin rose to about 8400 on July 24th afore gradually falling to lows of 6100 on August 10th

Major Tokens Setting New Yearly Lows

Although Bitcoin has collapsed about 30% from its account highs, altcoins accept been abnormally afflicted by the bazaar decline. Currencies like EOS and Ethereum accept been pushed to annual lows and haven’t apparent the aforementioned upside as Bitcoin during concise rallies.

While Bitcoin’s bazaar cap has decreased from account highs of $145 billion on July 24th to its accepted bazaar cap of $108 billion at the time of writing, Ethereum’s bazaar cap has about bisected from its account highs of about $52 billion on July 17th to its accepted levels of aloof over $28 billion. EOS has followed Ethereum’s amount activity closely, additionally halving its bazaar cap from aloof over $8 billion on July 17th to its accepted levels of aloof over $4 billion.

Part of the acumen for the massive abatement in badge appraisement is accretion Bitcoin dominance, which is affairs investments from altcoins with ambiguous or anon unutilized products. It is bright that abounding cryptocurrency investors appearance Bitcoin as the sole cryptocurrency with abundantly accurate account and endurance, as Bitcoin has been through abounding crashes back its bearing in 2026.

Fundamentals Strong, Other Factors Could Influence Micro-Price Movements

Although the fundamentals for abounding bill in the markets are abundantly strong, the prices acutely aren’t absorption these revelations and investors are added anxious with accessible contest that could affect prices.

Fundamentals that will ultimately affect the markets accommodate an accretion bulk of options that acquiesce for institutional investments, like Coinbase Custody, Gemini’s careful options, as able-bodied as New York Stock Exchange ancestor aggregation ICE’s attack into the industry. Unfortunately for investors, these revelations accept not yet led to abundant and acceptable amount movements.

Currently, amount activity indicates that investors, and also traders, are added absorbed in contest that could affect the actual amount activity of Bitcoin, and that they are mainly attractive appear accessible Securities and Exchange Commission decisions apropos Bitcoin ETF approvals.

The Winklevoss Bitcoin ETF abnegation acquired ripples through the markets, although the consistent abatement was brief as abounding advancing the ETF to be denied due to a array of factors. The ETF that best investors are eyeing as a huge agency in accessible amount activity is the CBoE VanEck/SolidX ETF which is apparent by the majority of investors as the best acceptable ETF to be approved.

Following the SEC’s accommodation to adjournment the CBoE VanEck/SolidX ETF, Bitcoin’s price fell nearly $500 instantly afterwards the account broke. In accession to Bitcoin’s amount falling, the all-embracing cryptocurrency markets fell from circadian highs of $257 billion to circadian lows of $236 billion. Investors should be able to see both Bitcoin and alt-coins acceleration or abatement abundantly depending on the ETF verdict, which is appointed for September 30th, 2018.