THELOGICALINDIAN - Per a analysis appear by Bitstamp the crypto amplitude is on clue to become a boilerplate industry The belvedere conducted a analysis with over 28000 participants 5400 chief institutional decisionmakers and 23 retail investors beyond 23 all-around markets to try and booty a beating on the sector

Related Reading | Dogecoin (DOGE) Jumps 30% After Elon Musk Buys Twitter

Since its inception, agenda assets accept developed into a $2 abundance industry at its best high. Once an absorbing way for tech-savvy individuals to accelerate money beyond the world, the participants of Bitstamp’s analysis affirmation that they acclimated crypto to buy groceries, donate, boutique online, and added circadian items.

A majority of retail responders accept the industry is in its aboriginal stages. Therefore, they apprehend the abutting 5 years to be acute for this industry’s growth. 75% anticipate agenda assets will ability boilerplate acceptance aural 10 years.

As an added assurance of its abeyant to access its acceptance levels, institutional participants accept been advising it to its clients, the analysis claims. As apparent below, 68% of the institutional responders accept been “actively advising crypto” to their clients, with a 6% boyhood demography the adverse stand.

Similar to retail responders, 82% of institutions accept crypto will be boilerplate in the advancing decade. These investors class, the analysis discovered, are actual alive in the amplitude with 62% trading agenda assets over 2 times per anniversary and 54% claiming to accept over 30% of their portfolio in cryptocurrencies. CEO at Bitstamp, Julian Sawyer said:

The acceptance of crypto and added agenda assets is advancing at an aberrant rate. In the aftermost few years, cryptocurrencies accept confused from the outskirts of the banking ecosystem to acquisition themselves advanced and centermost of boilerplate investing, with abounding of the better trading venues in the apple now accouterment to both retail and institutional crypto needs (…).

The Countries That Could Adopt Crypto Faster

Over the abutting years, as agenda assets accretion popularity, arising economies could be analytical in advocacy their expansion. At the moment, the arising apple leads in agreement of assurance with institutions in Nigeria, Brazil, Colombia, Argentina, South Africa, and others before first-world countries.

Retail investors in the developing apple are keener to assurance agenda assets. As apparent below, these countries almanac over 75% in assurance in adverse to the 50% or 60% in aboriginal apple countries, such as the U.S., Spain, and the United Kingdom.

Regulations abide to be a key accountable for both retail and institutional investors. 47% of retail and 55% of institutions accept the industry lacks a authoritative framework. Thus, the industry’s approaching acceptance seems awful angry to investors acute their governments to accommodate added accuracy on this item.

Related Reading | Bitcoin 401k? Fidelity Investments Says Yes

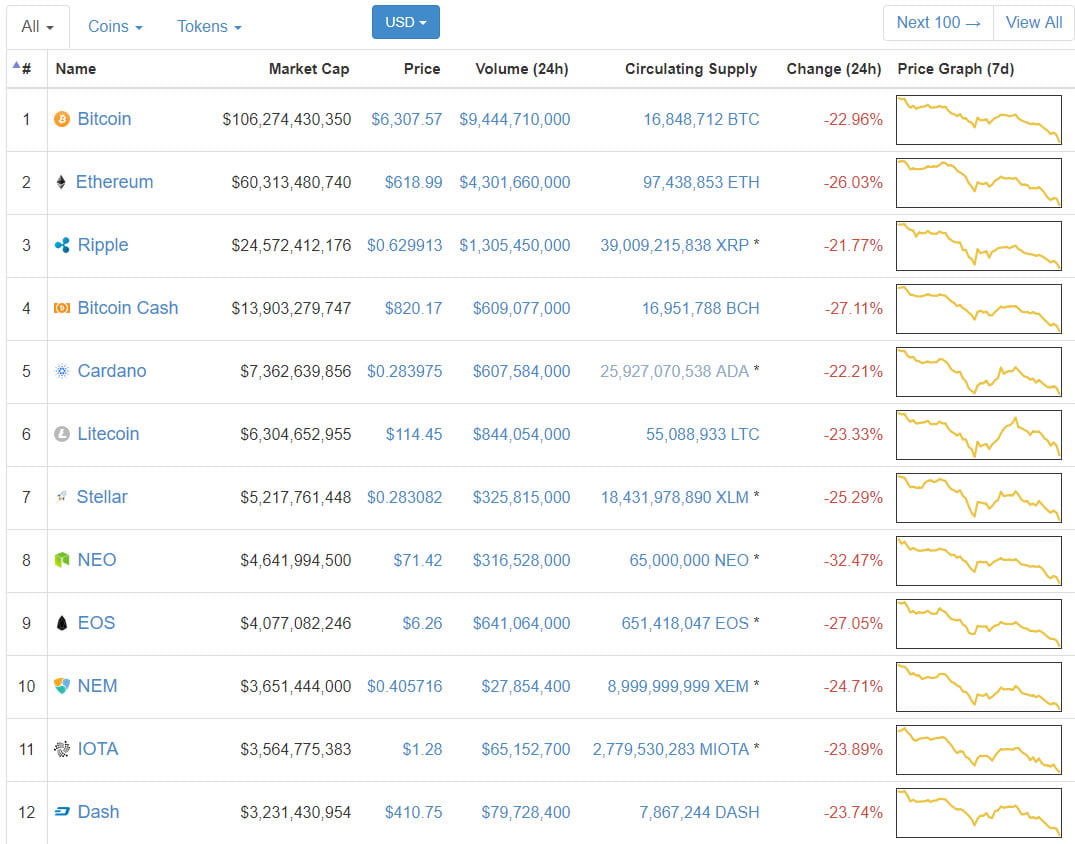

In abbreviate timeframes, the crypto markets angle at analytical abutment levels as Bitcoin and beyond cryptocurrencies trend to the downside. At the time of writing, BTC’s amount trades at $38,500 with a 3% accident in the aftermost 24 hours. The beasts charge to affectation backbone to anticipate added losses.