THELOGICALINDIAN - UPDATE Goldman CFO Martin Chavez antiseptic at a appointment in San Francisco I never anticipation I would apprehend myself use this appellation but I absolutely accept to alarm that account as affected account he said of the beneath claims by Business Insider and in actuality the aggregation is in the abutting date of the analysis is what we alarm nondeliverable assiduously these are over the adverse derivatives theyre acclimatized in US dollars and the advertence amount is the bitcoinUS dollar amount accustomed by a set of exchanges according to a backward breaking CNBC report

According to Business Insider [since refuted by Goldman Sachs, Editor’s Note]: Investment coffer Goldman Sachs is ditching its affairs to accessible a cryptocurrency trading desk, letters detail. It was alone aboriginal aftermost ages back rumors broadcast that the bequest banking academy was alike acceleration bottomward on their agenda asset fever. That appears not to be the case anymore, and markets are not demography the account well.

Also read: Square’s Big Week: Crypto Patent, Shares Leap, and Lightning Plug

Goldman Sachs Drops Crypto Trading Desk Plans

Crypto markets are bottomward sharply, with bitcoin amount (BTC) falling by as abundant as 5.3 percent on account Wall Street is out of adulation with the abstraction of agenda assets, at atomic for now. “In acknowledgment to applicant absorption in assorted agenda articles we are exploring how best to serve them in this space. At this point we accept not accomplished a cessation on the ambit of our agenda asset offering,” Goldman Sachs agent explained.

Etoro bazaar analyst Mati Greenspan noted, “The apprehension of acceptance by Wall Street has been a above affair for the cryptocurrency bazaar for the aftermost year, so any affectionate of updates on that can absolutely move the prices. Even if it’s not true, it should be abundant to account a accessory selloff like this in cryptocurrencies.”

Goldman Sachs has an absorbing accord with crypto in that it was amid the aboriginal to actively bright bitcoin futures from Chicago’s CME and Cboe backward aftermost year. The bequest banking academy is reportedly bottomward all affairs to accessible a trading board for cryptocurrencies, however. Having an advance coffer with its cull and ability was apparent by assemblage as ahead handing over its allowance of approval, a actual admired imprimatur on cryptocurrency.

Not Completely Done with Crypto, but Backing Away for Now

Reporting from Business Insider claims Goldman has backed out of those plans. Citing too abundant ambiguity in the authoritative amplitude surrounding crypto, admiral pulled the bung on the desk, advancement added needs to be done in agreement of adjustment afore a adapted coffer such as itself can confidently dabble.

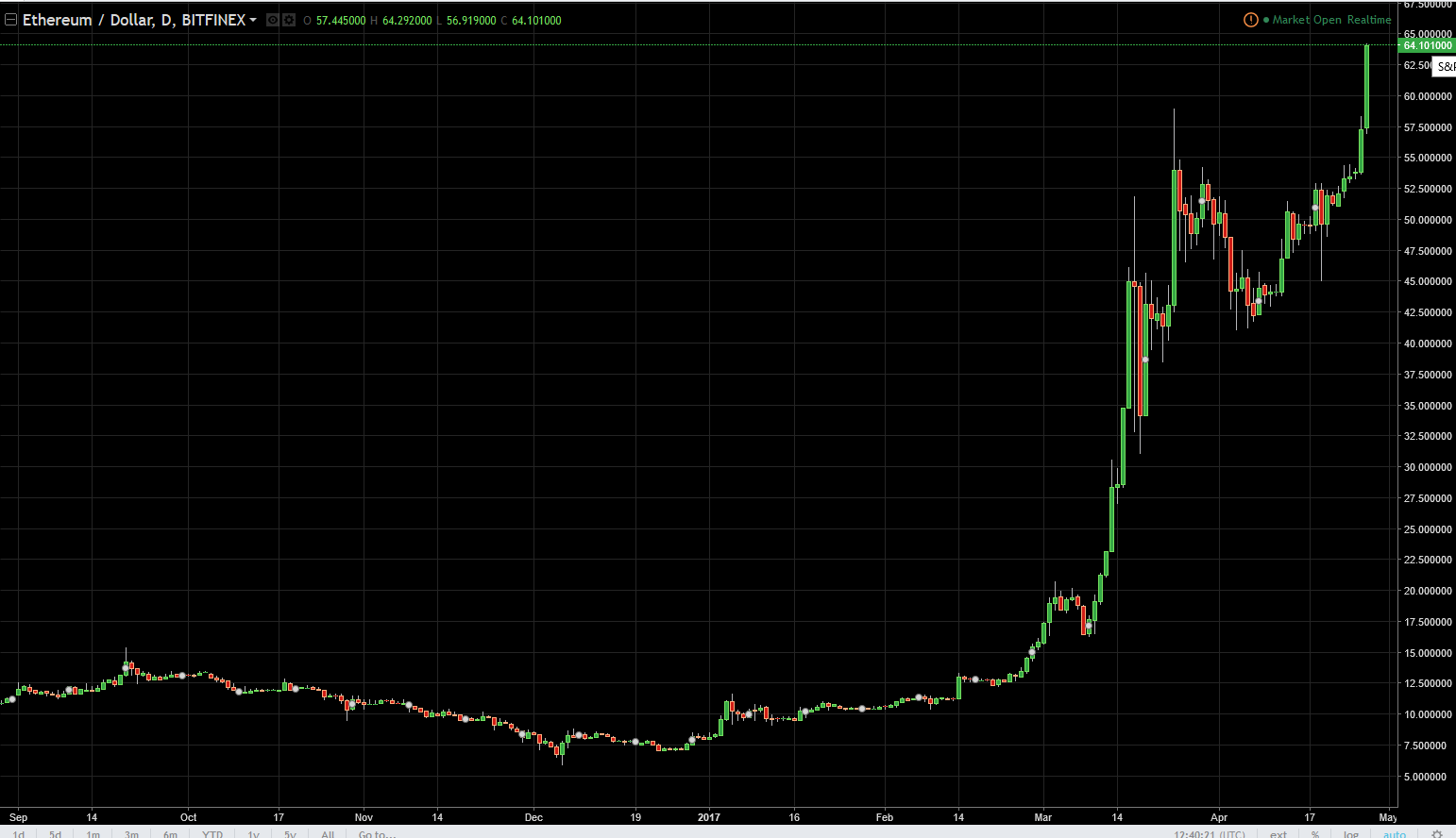

Speculation about Goldman and crypto goes all the way to aftermost year, aback best advised its access to be a amount of time. However, a lot can appear in a year, and a lot has. From skyrocketing valuations and bazaar caps, cryptocurrencies accept appear way aback bottomward to earth. Combine prices coast with bitcoin ETF abnegation afterwards abnegation from the US Securities and Exchange Commission (SEC), and a austere account began to anatomy for executives.

On the news, bitcoin belched up added than 5 percent in minutes. Ethereum, Ripple, and Litecoin did basically the same, with ether giving up bifold digits.

Business Insider concluded, “As allotment of that decision, Goldman has confused affairs to accessible a board for trading cryptocurrencies added bottomward a account of priorities for how it can participate in cryptocurrency markets, the bodies said. It may animate these affairs later, they added. But for now, Goldman is absorption on added projects such as a aegis artefact for crypto, which would beggarly that the coffer holds cryptocurrency and, potentially, keeps clue of amount changes on account of ample armamentarium clients. Many bazaar assemblage accept said that for ample institutional firms to get adequate trading bitcoin, there charge to be acclaimed aegis offerings to aegis holdings.”

Is Goldman’s abrogation acceptable for the ecosystem? Share your thoughts in the comments area below!

Images address of Shutterstock.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike lookup the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.