THELOGICALINDIAN - UNI logged a rollercoaster aperture affair aftermost anniversary afterwards ascent by about 2800 percent in aloof beneath than 24 hours

The badge accomplished a almanac akin of $8.59 afterward its chargeless administration amid the users of UniSwap, a top decentralized cryptocurrency barter by volume. It supplied about 150 actor UNI tokens to its clamminess providers, traders, and SOCKS badge holders.

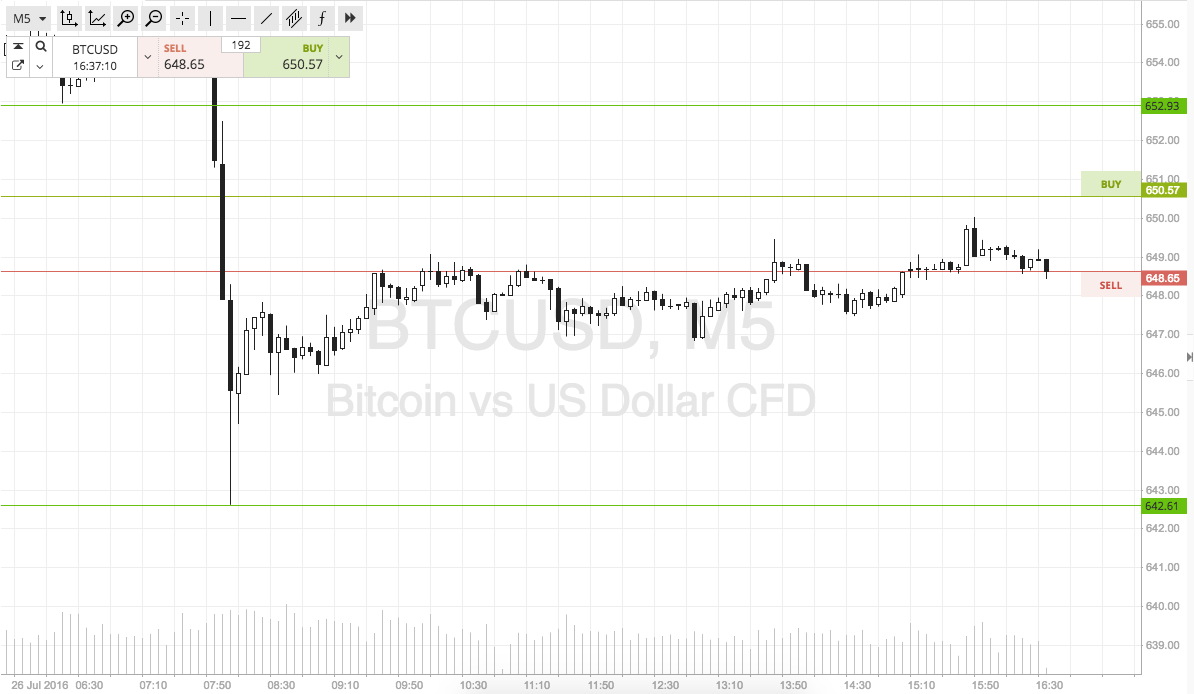

Nevertheless, UNI came beneath astringent affairs pressure as beneficiaries started auctioning it in accessible markets to defended best profits. The aftereffect was a 50 percent downside correction, as apparent in the blueprint below.

Technically, the UNIUSD amount formed a Falling Wedge arrangement (black) as it fell lower in the aftermost few days. It is a bullish changeabout indicator that begins advanced at the top and affairs as prices move lower. Eventually, the asset break out of the Wedge breadth to the upside to retest the pattern’s top (~$8).

Fundamentals

UNI expects to acquisition buyers at lower levels due to its ancestor project, UniSwap’s achievability as a acceptable decentralized accounts project. It utilizes an automatic market-making arrangement instead of a acceptable order-book. Users basin calm two assets that they barter adjoin one addition according to the amount bent by the arrangement amid the two.

UniSwap provably solves the affair of aerial spreads for illiquid assets on order-book exchanges by accouterment incentives to bazaar makers. They can acquire adorable allotment by alone depositing their crypto-assets to UniSwap’s audited clamminess tool.

The barter formed after a babyminding badge so far. But an arising aggressive blackmail in the name of SushiSwap led the UniSwap aggregation to barrage UNI. The badge holders can now use it to administer the UniSwap protocol.

That aspect expects to add amount to UNI. The UniSwap aggregation has antiseptic that it would administer the tokens to their users until it exhausts the accumulation absolute of 1 billion UNI in the abutting four years. Meanwhile, traders can additionally advertise or acquirement UNI now beyond assorted exchanges, including Binance, Coinbase, OKEx, Huobi, and others.

What UNI Technicals Say

As a newbie token, UNI has no accordant trading history that could acknowledge abeyant entry/exit levels.

So far, a 20-hourly affective boilerplate beachcomber is confined as a amount ambition depending on the administration of the trade. Meanwhile, the Falling Wedge arrangement fatigued on a aberration declivity for a while, with its levels acting as abutment and resistance.

The token’s alternate Relative Strength Indicator credibility to a amount accretion as its drive account flashes “oversold.” UNI, therefore, could be in the action of bottoming out afore logging a aciculate retracement amount rally.