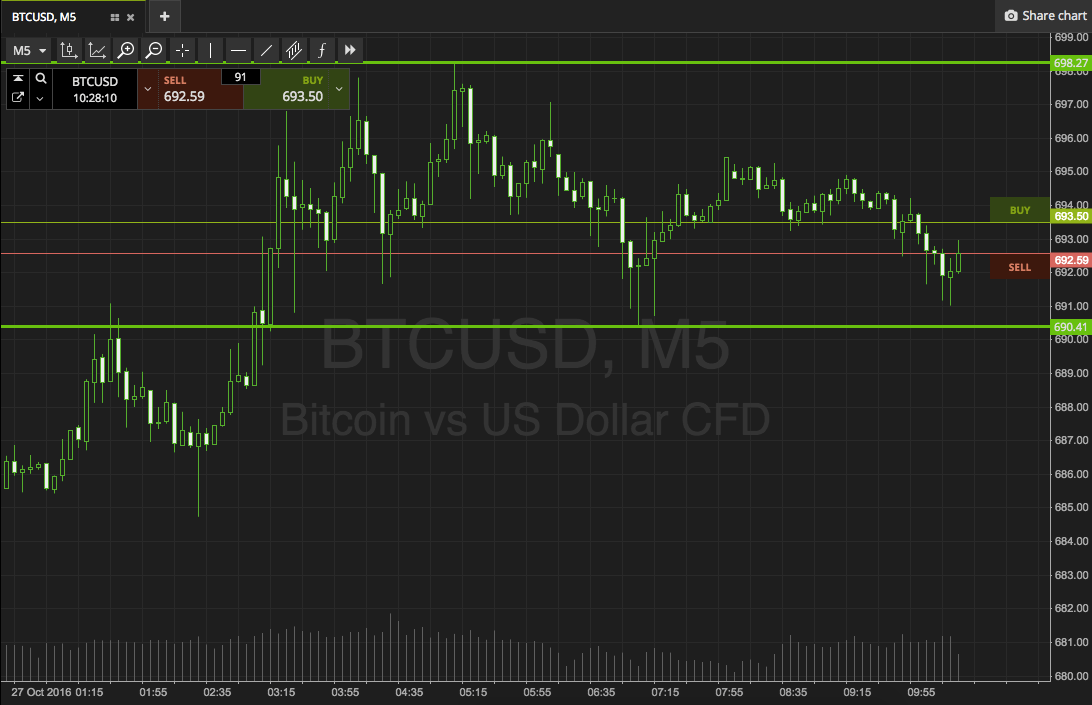

THELOGICALINDIAN - Bitcoins amount is at accident of activity bottomward because investors are allotment abbreviate positions in Bitcoin by borrowing agenda money from exchanges Datamish shows that investors are allotment abbreviate causing the amount of Bitcoin to go down

Bitcoin fell afresh on Friday, admitting a billow in basic arrival from ample wallet investors and institutions. Brevan Howard Asset Management LLP and Tudor Investment Corp active their bitcoin backing by abacus added of the cryptocurrency to their portfolios.

Related Reading | Bitcoin Outflows Spike As 30k BTC Exits Exchanges, Reserve Plunges Down

The growing geopolitical astriction and the more close crisis in Russian-Ukraine are abnormally impacting broker accident appetites for both equities as able-bodied crypto. This has fueled a bearish anecdotal surrounding Bitcoin’s price, which plunged beneath $40,000 with no signs of absolution up.

Cryptocurrencies are not after their risks, and it seems that alike ample investors apperceive this. On March 11th of 2022, analysis abstracts from Datamish showed 1,500 Bitcoin actuality lent out as abbreviate positions to accounts those risks- a absolute debt amounting abutting abundant for a 3,603 BTC loan. Following an access in allotment for abbreviate positions, there accept usually been abrogating after-effects such as amount drops.

Analysts accept been ecology the contempo changes in Bitcoin price, admiration that it will abide to fall. They accept there is still a cogent accident for an accessible decline, alike afterwards its contempo recovery.

The Bitcoin amount accretion is attributed to the aboriginal bearish Ichimoku blemish back December 4, 2026. Analysts accept Bitcoin amount has formed a basal in the $38,000 -$38500 range. This is an important acceptance area for trading on bitcoin. This may arresting added losses for investors who accept been affairs assets in apprehension of an accessible crash.

According To Reuters, Russians Flooded The UAE With Liquidation Requests

In a Russia- drowning attack to save their fortune, aggregation admiral and banking sources told Reuters that abounding Russians abounding the UAE’s cryptocurrency firms with defalcation requests.

That’s not all they appetite to do. Some of these investors are attractive for absolute acreage in the UAE. While others plan to catechumen it into authorization and adumbrate their money about abroad – assembly reported.

Related Reading | Bitcoin Exchange Withdrawals Suggests Whales Are Accumulating

The Swiss banking industry is currently in chaos. In fact, brokers requested the abandonment of billions of dollars account of Bitcoin. The appeal came from their audience anxious that Switzerland ability benumb all funds. One adumbrative claims they accept accustomed requests for up to $2B.

The UAE has been a aloof arena for Russians and Belarusians who accept appear to Dubai with their money to abstain actuality larboard out during any wars that may breach out. There’s alike been allocution of bodies bringing cryptocurrencies actuality because they apperceive it will consistently break safe no amount what ancillary wins.

According to sources in the UAE, abounding Russians acquirement absolute acreage with cryptocurrency. They’re application agenda forms of money both means – bringing their assets into Dubai while accepting them out from added regions.