THELOGICALINDIAN - Axie Infinity has been on an complete breach afresh The playtoearn belvedere has become the face of a new affiliation of crypto and gaming that holds astonishing potential

Axie Infinity has surpassed 1M circadian alive users, and is breeding added acquirement than any agreement or belvedere with the abandoned barring of Ethereum. Yes, Axie Infinity is acquiescent added fee acquirement than above platforms such as OpenSea, Uniswap, Bitcoin, or the Binance Smart Chain.

If you weren’t already advantageous absorption to Axies, you apparently should be. Need to get up to acceleration on the basics? Check out our report from a brace months ago on the actualization of Axies.

Axie Infinity: On Top Of The Charts

A alternation of tweets from Coinbase Ventures’ Connor Dempsey lays out the abbreviate and candied of the adventure absolutely well. As Dempsey appropriately notes, every Axie transaction collects a priced-in fee – either in $SLP or $AXS.

At the time of writing, in the accomplished 24 hours, Axies accept generated over $17MM in sales volume, arch the backpack back it comes to NFTs. The abutting abutting NFT activity on the sales aggregate blueprint is Bored Ape Yacht Club, which is aloof beneath $9MM.

You’re account that right, Axies accept about doubled the abutting abutting commensurable NFT activity today. Axies, of course, additionally advance the 30-day and best archive for NFT sales volume, as the belvedere has eclipsed $1.7B in affairs and approached 1.5M owners.

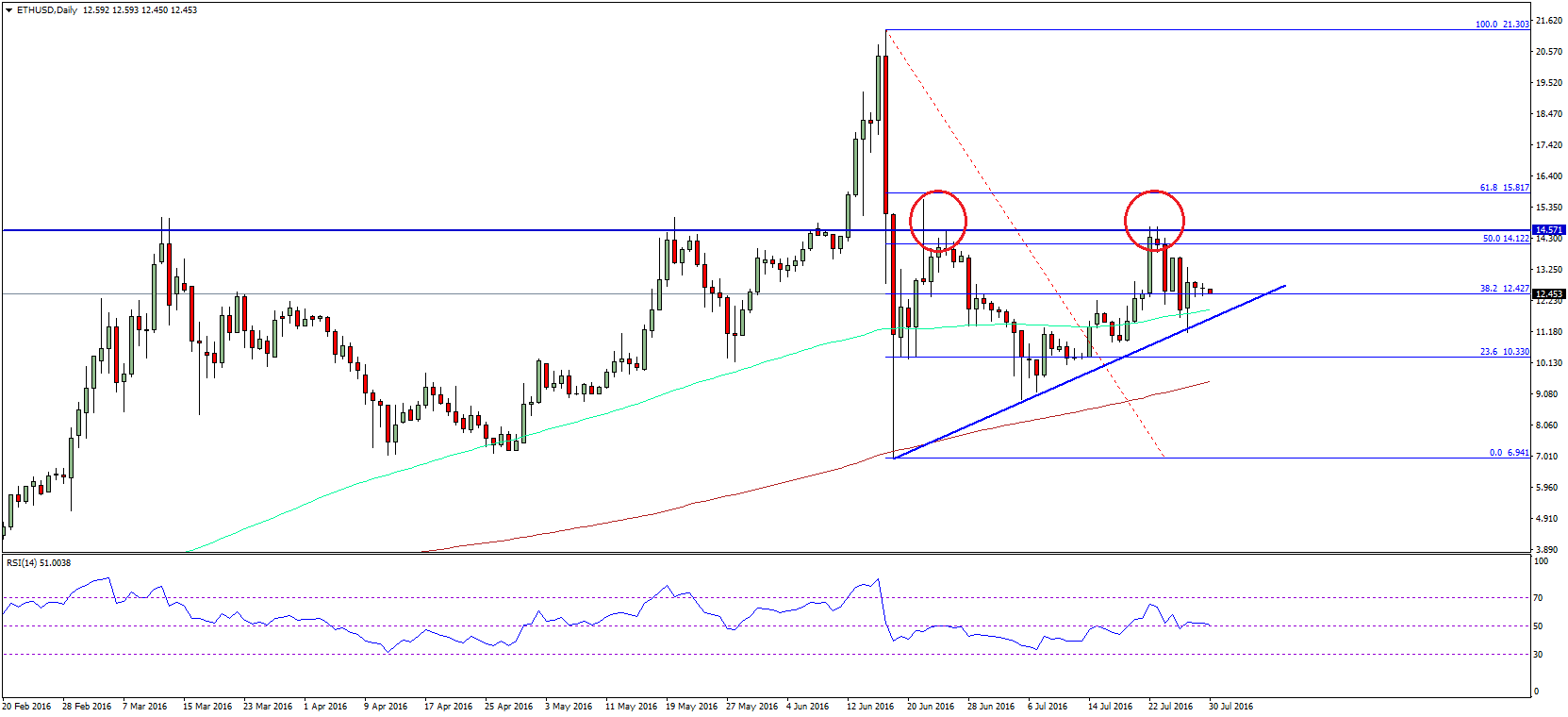

If you attending at blockchain fee acquirement over the long-term, Axies become alike added impressive. According to Token Terminal, any abiding time border from the 90-day blueprint and best reflects a fee bearing from Axies that surpasses Ethereum. As Dempsey highlights in his cheep thread, the treasury basin from Axie fees has ballooned to about $600MM.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

The Sky Is… Infinity?

Dempsey’s cheep cilia leads to a new Coinbase blog post this anniversary centered about Axie Infinity, associated gaming brotherhood Yield Brotherhood Games, and added broadly, the play-to-earn model.

The appeal abounding into Axie Infinity has led to Axies costing an boilerplate of about $300 this month, with a minimum of 3 Axies appropriate in adjustment to comedy the game. Revenues in August about angled from July. How did this happen?

It started with an actualization aftermost year in the Philippines. It’s developed so abundant in the country that government accounts admiral accept common that profits from play-to-earn titles should be appear as assets tax. Other developing and arising countries, decidedly ones hit adamantine from the COVID-19 communicable (and area bounded currencies may accept weakened), accept begin a active allowance modeled through Axie Infinity as well.

The better criticism about Axie comes to sustainability; will consistently ascent costs to access the bazaar advance to bulletproof barriers to entry? In enters Yield Guild Games, who accommodate out Axies for a baby return. Yield Guild Games alike partnered with barter FTX to sponsor over 100 players in developing countries. The surrounding abridgement to abutment Axie Infinity is advancing to activity afore our eyes.

Axie Infinity is paving the way for the play-to-earn model, and impacting individuals lives in a actual above way, at a actual cogent scale.

Related Reading | Only In Crypto: A Croissant Breaks Down How Gamestop & NFTs Will Boost Ethereum