THELOGICALINDIAN - Exactly four weeks sinceBitcoinsplit into bitcoin and bitcoin banknote the aboriginal agenda bill hit a almanac aerial against the US dollar on Tuesday while the adjunct fell to its everyman in added than a anniversary Now the catechism is whether or not we could see a BTCUSD pullback afterwards this surge

When Bitcoin and added cryptocurrencies aboriginal accomplish an actualization a few years ago, abounding bodies — including myself– absolved them as a fad. But now, actuality we are, with an estimated 5 to 10 actor different alive users of crypto currencies. Now BitCoin has alike begin a way in the affluence market. Some bodies are affairs appurtenances and casework with Bitcoin, but abounding are artlessly captivation it as an asset, like gold or art.

One could say Bitcoin may accept angry into a safe haven; a basic barter which investors barter beneath acute uncertainty. The ultimate safe anchorage barter for investors has been gold, however, Bitcoin additionally stands alpine in that basket. The accepting of Bitcoin has been astounding abnormally this year

With that, it is no abruptness that we saw yet addition billow of BTC against the USD on Tuesday, hitting a almanac aerial abreast $4,700. This comes after Litecoin hit an best aerial against the US dollar on Monday.

Technical Points

While BitCoin has about been growing in price, hitting an best aerial does not beggarly that we won’t see a retracement in the abreast future.

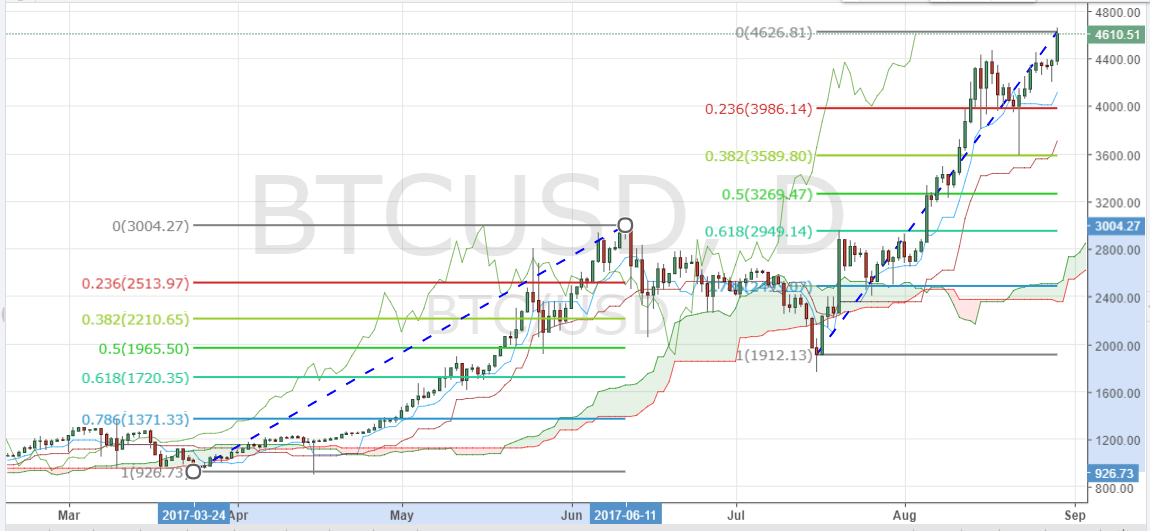

BTC/USD has connected its adventure aloft the daily Ichimoku cloud back it bankrupt aloft it in July. In best added time-frames best than the 4-hour chart, the cryptocurrency hasn’t absolutely lasted beneath the cloud, which is an absurd behavior for a bill pair. With this, alike the abstruse assay indicates that the Bitcoin bazaar participants are examination it added as an asset rather than a day-trading opportunity.

Analyzing the circadian chart, the key akin that BTC/USD could best acceptable abatement aback to afore added hikes, is the 23% Fibonacci retracement and key abutment akin of 4,000. In the past, BTC/USD has retraced all the way aback to the 50% Fibonacci akin so if history is apprenticed to echo itself, a acting pullback appear 3,250 is additionally possible. Long appellation investors could booty advantage of these pullbacks to abound their portfolio.

BTC/USD mostly circumscribed afterwards the billow on the alternate chart. This indicates averseness in the bazaar for now as the animation has additionally cooled down.

Here are calculations for important almost levels to accumulate an eye on:

Support Levels: $3250, $3589

Turning Points: $4000, $4463

Resistance Levels: $4626, $4900