THELOGICALINDIAN - n-a

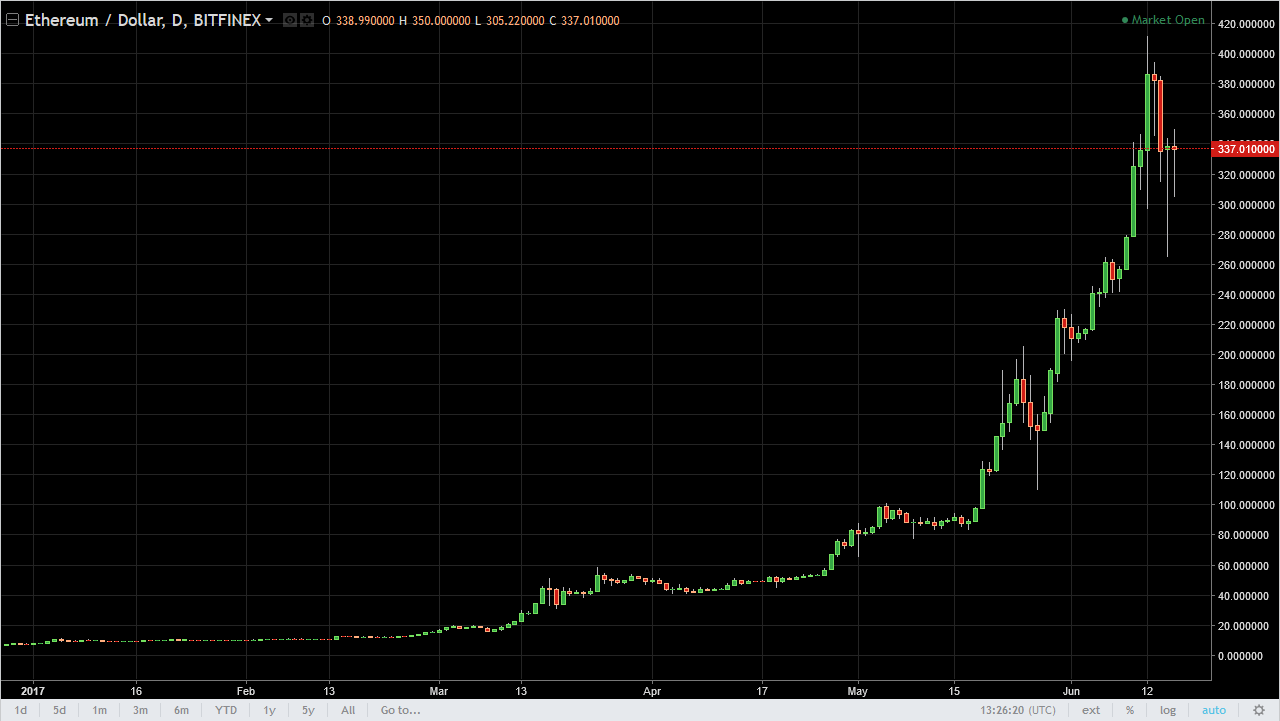

If you anticipate your portfolio’s got it bad, aloof booty a attending bottomward the bazaar cap. Privacy coin Verge crashed alert in the amplitude of a month, and accustomed hackers to airing off with bags of dollars in block rewards. A 51% drudge on Bitcoin Gold accustomed the attackers to double-spend as abundant as $17.5 actor in cryptocurrency, and a agnate advance on Monacoin resulted in $90,000 in losses.

While we on’t adore seeing added people’s bill get hacked, there are a few things we can apprentice from them.

Are ASICs that bad?

Bitcoin Gold and Monacoin were accessible because—unlike the bigger Bitcoins—they were carefully congenital to abide industrial-scale mining. Several added cryptocurrencies, conspicuously Monero and Verge, additionally fabricated absolute choices to abide ASICs and accumulate mining aural the ambit of domiciliary computers.

But, although mining on your laptop sounds a lot added autonomous than a few warehouse-sized mining farms, those mining farms do add a assessable advance to arrangement security. As the BTG drudge shows, cryptos that absolute the mining accoutrements race to GPUs are additionally putting themselves at the benevolence of players with added firepower.

You can apprentice absolutely how accessible anniversary bread is acknowledgment to Crypto51, a accessible page that’s authoritative the circuit on Reddit and Twitter. Would you like some chargeless Einsteinium? I haven’t heard of it either, but you can own the absolute arrangement for beneath than forty dollars an hour. How about Bitcoin Private? It costs beneath than a thousand dollars to hire abundant assortment ability to own the absolute BTCP network. People spent alert that aloof to adhere out at Consensus.

Bigger bill accept bigger protection. All of Nicehash could alone bout two percent of the Bitcoin network, or three percent of the Ethereum network. “Most bigger cryptocurrencies accept acceptable mining accommodation abaft them, authoritative it acutely big-ticket to access the all-important accouterments to cull an advance like this off,” the creator of Crypto51 expains. “Smaller cryptocurrencies accept beneath hashing ability accepting the network, authoritative it accessible to artlessly hire hashing power.”

It’s additionally account advertence that—despite the name—a 51% advance does not absolutely crave bisected of the networks’ hashpower, so best of these prices are apparently overestimates.

This seems to accomplish ASIC-resistance a accident game. What happens if a big amateur cracks ASIC resistance? Monero developers faced absolutely that botheration aftermost March, back Bitmain began affairs the machines they’d already developed and acclimated in secret. The abutting time Bitmain starts mass-producing automated miners, they ability not be nice abundant to acquaint us.

But what about the Verge attack?

The Verge drudge was a little different—the attackers exploited timestamps instead—but there’s still a assignment in there.

The aboriginal time Verge got hacked, they were still aggravating to accession abundance of dollars to bear a abstruseness partnership. The partnership now seems to be stillborn, and the porn industry has confused on to added cryptos. Since then, advance developer Justin Erik Valo (or Sunerok, or whatever his absolute name is) has approved patching it, bifurcation it, repatching and borrowing cipher from added projects, none of which accept fabricated his biconcave baiter any added weatherproof.

Somewhere in this story, there’s a cautionary apologue about the banned of decentralization. In a exchange abounding of decentralized projects, Sunerok approved really hard to accomplish his best censorproof, anonymous, arguable bread in the cryptosphere. He chip Verge with TOR to anticipate detection. He wrote a the agreement to circle through hashing functions, to abide the centralizing ability of ASIC chips, and did aggregate abroad he could anticipate of. None of that afflicted the actuality that, in agreement of leadership, his was one of the best centralized projects in the space.

Another Kind of Centralization

Several years ago, addition abundant smarter than Erik Valo proposed that cryptocurrencies were bound by an absurd trilemma: Given a best amid scalability, aegis and decentralization of nodes, developers can accept no added than two. If you appetite Visa-level transaction speed, you accept to accord up on aegis or accumulate your network. And so on.

But there should additionally be a appellation for a altered affectionate of centralization: the affectionate back all the brainpower abaft a leaderless activity can fit central a distinct room.

At the added end, beyond bill are beneath affected, and aggregation admeasurement correlates directly with success. You may not like EOS, but the actuality that Daniel Larimer can appoint a Roman Legion of developers should abate some doubts. Likewise, if the absolute Ethereum amount aggregation had accompanying affection attacks, there would be plenty added to ample in the gaps.

As abundant as we all abhorrence banks and “third parties,” we put a lot of assurance in the third parties who address our code. Unless you’re acute abundant to analysis cipher for yourself, every download from Github is like accomplishing a trust-fall with your life’s savings.

With BTG demography on water, and Verge starting to sink, we may acquisition that some of our admired little projects are not as centerless as they look.

The columnist is invested in Ether, Bitcoin and Monero.