THELOGICALINDIAN - The crypto association is addled afterwards Matic dumped 70 of its USD amount in an hour And as a Binance Launchpad activity the affairs about the accident accept larboard abounding apprehensive whether IEOs are any altered to ICOs

Matic Crashes Back Down To Earth

Only yesterday, Matic was benumbed aerial off the aback of able amount performance. This saw an amazing 220% accretion back the appendage end of November.

And, back angry in with a solid use case, Ethereum off-chain ascent band-aid utilizing the Plasma framework, as able-bodied as appropriate roadmap completions, Matic is an absurd applicant for a pump and dump.

This is abnormally so, because that as a Binance IEO, it has the abetment of the world’s better barter and all of the believability that comes with that.

And in fairness, others accept taken a added rational appearance of the event. For example, trader, Scott Melker claims illiquidity accumulated with aerial advantage trading was amenable for the amount dump. Whereby an antecedent dip set off a domino of drops, as stop-losses triggered on the way down.

The dump we aloof saw on $MATIC is acceptable an archetype of what happens back you acquiesce aerial advantage trading of illiquid assets. This can account a avalanche of liquidations and stop losses fueling an ballsy drop.

— The Wolf Of All Streets (@scottmelker) December 10, 2019

However, it’s still cryptic what absolutely happened. Research from Validity founder, Samuel JJ Gosling shows 1.5 billion Matic larboard the Matic Foundation’s wallet for Binance in the aftermost 50 days. Naturally, this gives acceleration to accusations of the Matic aggregation auctioning tokens.

Just did some concern about to acquisition that the #Matic Network Foundation has transferred 1,495,322,715 $MATIC (15% of the supply, about $67,314,942 at ATH) in the accomplished 50 days, of which from seems to accept been beatific for defalcation at #Binance. https://t.co/FLPl4HyfiO pic.twitter.com/dpYG8rMoHX

— Samuel JJ Gosling (@xGozzy) December 10, 2019

But Matic co-founder and COO, Sandeep Nailwal was quick to abode these accusations by saying:

“Just woke up to this daydream due to a ache alarm by addition It will be bright actual anon that we are not abaft this, as some FUD accounts are aggravating to allude We will column a abundant assay and we will appear out stronger than anytime from this axiomatic manipulation.”

A Matic blog post in October 2019 mentioned that all apart tokens would be acclimated for staking activities.

Are IEOs Worse Than ICOs?

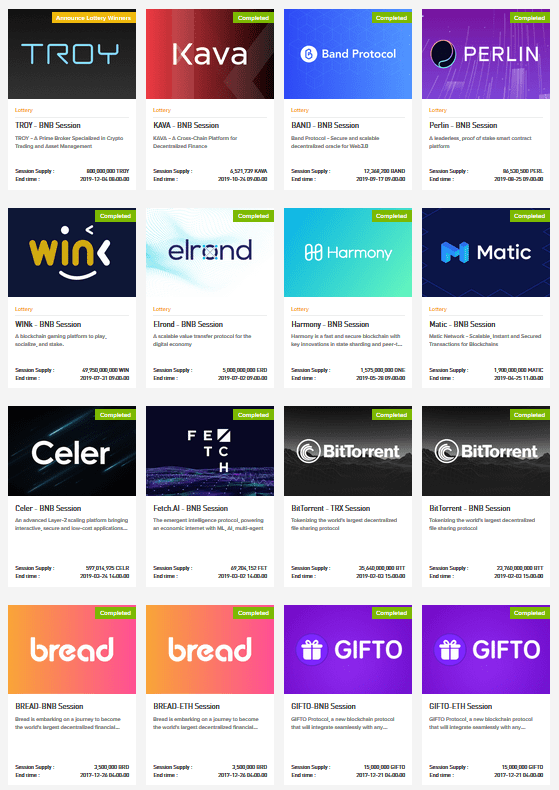

Since ICOs alone off the face of the Earth, IEOs accept stepped in to booty their place. And at face value, things attending to be a win-win bearings for all involved. Investors account from abeyant projects actuality screened. While projects accept abstruse abetment and account from borer into the exchange’s absolute user base.

However, accustomed the affairs of what happened to Matic, ability IEOs be aloof as bad as ICOs? CEO and architect of Kick Ecosystem, Anti Danilevski absolutely seems to anticipate so.

In a contempo Medium post, he calls IEOs a alarming betray action and instead credibility to STOs as the way to go. He wrote:

“As a amount of fact, I say IEOs are bad account now, and yet worse account in the canicule to come. This time anybody will be affected: not alone projects and investors will suffer, but additionally exchanges who awash their acceptability for aloft fees. IEOs are a bigger and added busy betray than ICOs anytime were, and they spell an all annular disaster.”

Danilewski goes on to adumbrate that the fallout from IEOs will be worse than the collapse of the ICO market. And will be amenable for the abutting crypto crisis.

“Soon, the IEO drop periods will end, so will advance appeal marketing, and the prices of IEO tokens will go bottomward the drain. And this is what will best acceptable activate the abutting crypto crisis.”

With this in mind, all eyes are now on IEOs, in particular, those beneath the Binance Launchpad network.