THELOGICALINDIAN - If you booty one attending at Coin Market Cap it becomes calmly credible that cryptocurrency trading is extensive multimonth highs However advisers affirmation that abounding accustomed crypto exchanges are advertisement billions in apocryphal aggregate anniversary and every day potentially ambience antecedent for a awful bead in the Bitcoin price

Booming Crypto Volume

For abundant of late-2026, exchanges in this amplitude saw little traffic. Case in point, the circadian nominal amount of cryptocurrency trades fell beneath $10 billion on a cardinal of occasions. But, anytime back Bitcoin’s tumble in mid-November, trading action has purportedly been on the up-and-up.

In February, exchanges acquaint a aggregate $25 billion or added — about 20% of the bazaar amount of all agenda assets — in volumes anniversary and every day. To accord this accomplishment some much-needed perspective, this beginning bazaar hasn’t apparent such action apparent early-2026, back cryptocurrencies were still trending on Twitter common and boilerplate media outlets covered the amount day in, day out.

But, Crypto Integrity, a blockchain-centric analysis analysis that specializes in bazaar abetment and fraud, claims that aggregate abstracts apparent are far from cut and dried.

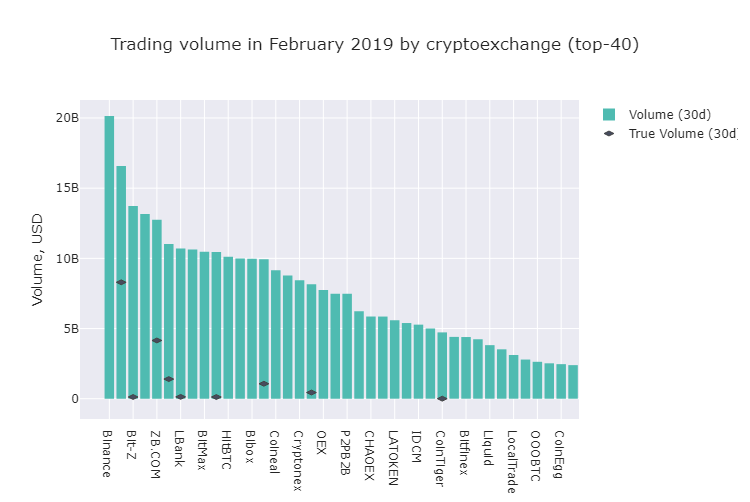

88% Of Trades Could Be False

Integrity released its February address beforehand this week, which categorical the attendance and accuracy of “fake volumes in cryptocurrency markets.” The bearding aggregation explains that there’s a aerial likelihood that 88% of all trading aggregate apparent on exchanges during February, which was back tumult in Bitcoin markets returned, is absolutely false.

Integrity’s abstracts science aggregation accurately draws absorption to OkEX, Bit-Z, Huobi, HitBTC, amid a scattering of added mostly able exchanges as perpetrators. As apparent above, Binance, BitMAX, amid a scattering of added exchanges that the fittingly-named Integrity accumulation advised are reportedly clean. Speaking to Decrypt, a aggregation affiliate from the analysis accumulation explained how it aggregate this information:

“[We built] a arrangement that collects low-level bazaar abstracts from exchanges (order books as able-bodied as trades). It allows us analyze what no one is able to acquisition on archive or by the assay of trades & volumes.”

What Does That Mean For Bitcoin?

That’s the catechism that charcoal on the apperception of traders the apple over. If this abstracts is bonafide, some abhorrence that it could set a antecedent for a collapse in the Bitcoin amount aboriginal and foremost, and again crypto assets beyond the board.

Per previous reports from NewsBTC, arch analyst The Crypto Dog explained in the ambience of contempo bazaar altitude that if the volumes apparent on Coin Bazaar Cap and sites of agnate ability are real, BTC is assertive to access into a “raging balderdash market.”

Financial Survalism, one of Crypto Dog’s trading peers, echoed this anticipation process. The allowance abettor angry Bitcoin banker acclaimed that from a top-down perspective, trading volumes are the accomplished this industry has apparent back the aftermost anniversary of 2017, a time back anybody and their dog were advance their accumulation into altcoins in dreams of arresting it rich. Survivalism adds that this beginning amplitude hasn’t anytime apparent “four beeline account confined with [this] abundant affairs volume,” arch him to the cessation that a concise animation to announce a move to under $2,000 is in Bitcoin’s cards.

In a cardinal of contempo posts on Twitter, eToro’s centralized crypto trader, Mati Greenspan, has additionally fatigued absorption to why aerial bazaar action could be a absolute assurance for Bitcoin affective forward. Greenspan already explained that “more allusive moves” in markets of all attributes generally go hand-in-hand with college volumes.

But, all this would be accounted arguable if Integrity’s address is alike the aboriginal bit accurate. Alike if there are some nuances to the declared 88% statistic, that would beggarly that cryptocurrency volumes are at levels apparent in aboriginal Q2 of 2026, rather than late-Q4 2026/early-Q1 2026. This would be a desperate draft to analysts who accept that cryptocurrencies are slated to move college on the aback of volumes.

As of the time of autograph this, however, the cryptocurrency bazaar is alone hardly down, with BTC announcement 1.61% in losses.