THELOGICALINDIAN - Japans Financial Services Agency FSA will appoint a 2x allowance absolute on crypto trading This will be able from bounce this year

Margin trading is accessible to retail investors, abounding of which are not able traders. As such, it comes with cogent banking risk, and some would altercate that this move is continued overdue.

However, nanny-state policies, such as this, alone highlight how authoritative access can absolute development aural the space. This is because allowance trading and aggregate are acerb correlated, meaning, such a move will accept the aftereffect of abbreviation barter volume.

The Enticement To Get Rich Quick With Crypto Margin Trading Is High

There’s no agnosticism that crypto allowance trading is an adorable hypothesis for traders. Part of the acumen why is due to the massive margins accessible to accustomed people, like you and me.

For example, Binance, the world’s better barter by volume, offers up to 125x allowance – the accomplished accessible in the industry. But it’s not abnormal for advantage exchanges, such as ByBit and BitMex, to action a 100x leverage.

And with the attraction to “get affluent quick”, allowance trading has admiring the absorption of authorities for all the amiss reasons. So abundant so that the UK’s Financial Conduct Authority (FCA) is apery moves by Japanese authorities on the base of crypto-derivatives trading actuality actionable gambling.

The UK’s FCA See Crypto Trading As Gambling

The UK’s banking regulator, the FCA, anticipate crypto-derivative trading is inappropriate for retail investors.

As a result, according to The Economist, the FCA is attractive to ban retail investors from trading crypto-derivatives.

The capital acumen cited comes bottomward the complication of crypto-derivatives, which abounding abecedarian traders abort to accept fully. Therefore advertisement themselves to a greater adventitious of loss.

“Now the Financial Conduct Authority (FCA), a British watchdog, is proposing a absolute ban on affairs crypto-derivatives to retail investors. A appointment concluded on October 3rd. Its accommodation is accepted in aboriginal 2026.”

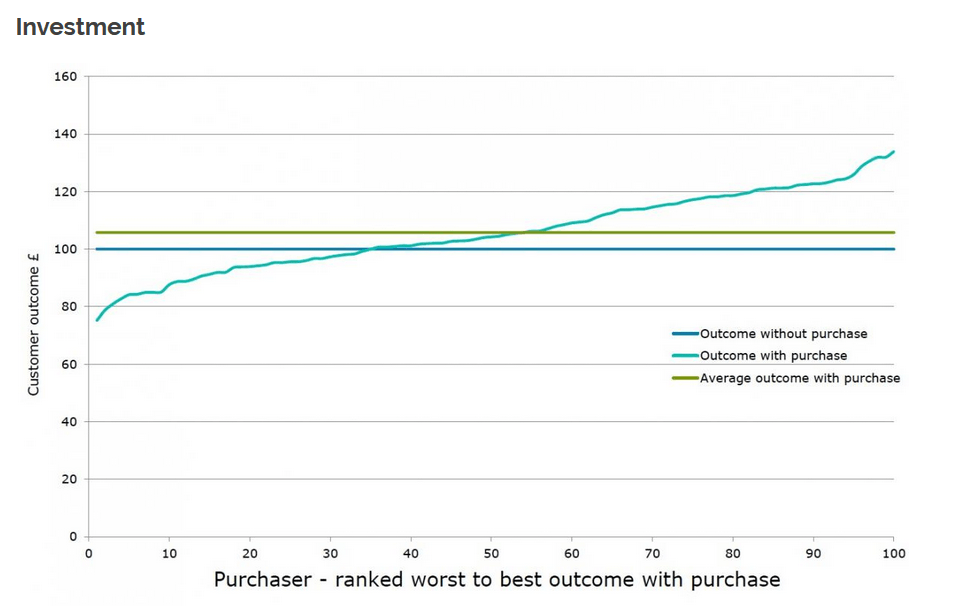

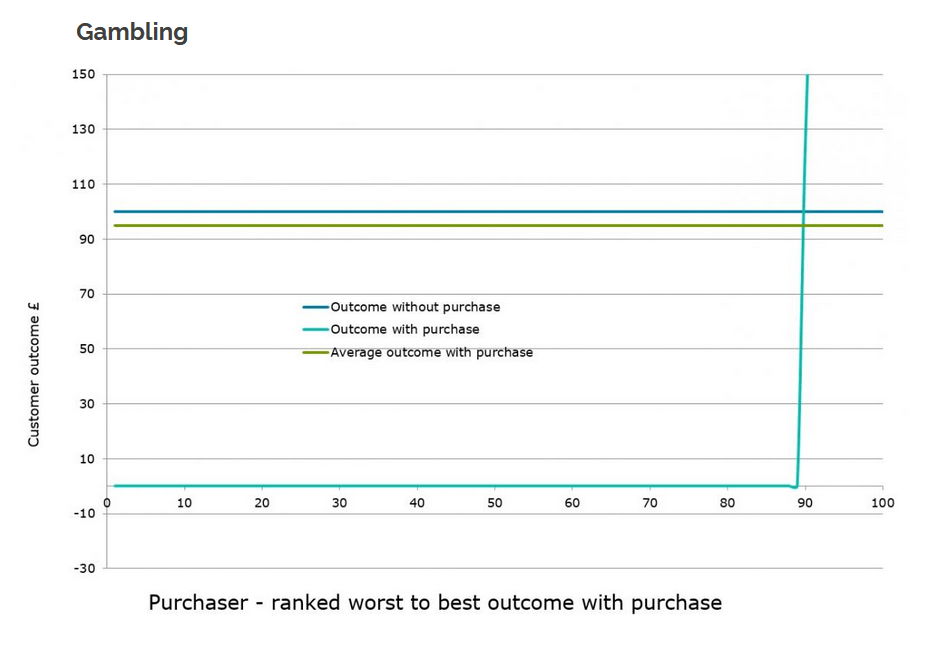

The acumen amid advance and bank is a accomplished one. But the FCA has acutely declared guidelines that advice differentiate amid the two. And what that comes bottomward to is what they accept termed “outcome distributions.”

“The outcomes distributions for these basal articles can be apparently modelled assuming the outcomes for 100 archetypal consumers who absorb £100 on anniversary artefact and comparing it to addition 100 bodies who don’t buy the artefact and artlessly accumulate their banknote beneath the mattress.”

Exchange Volume Will Suffer

All the same, abounding would account authoritative limitations on crypto trading as overkill. While the FCA and FSA would altercate that they are attention investors, the actuality charcoal that bodies should accept the appropriate to choose.

Indeed, by arty a cap on leverage, or endlessly retail investors trading crypto-derivatives, the aftereffect will alone arrest advance aural the crypto sector.

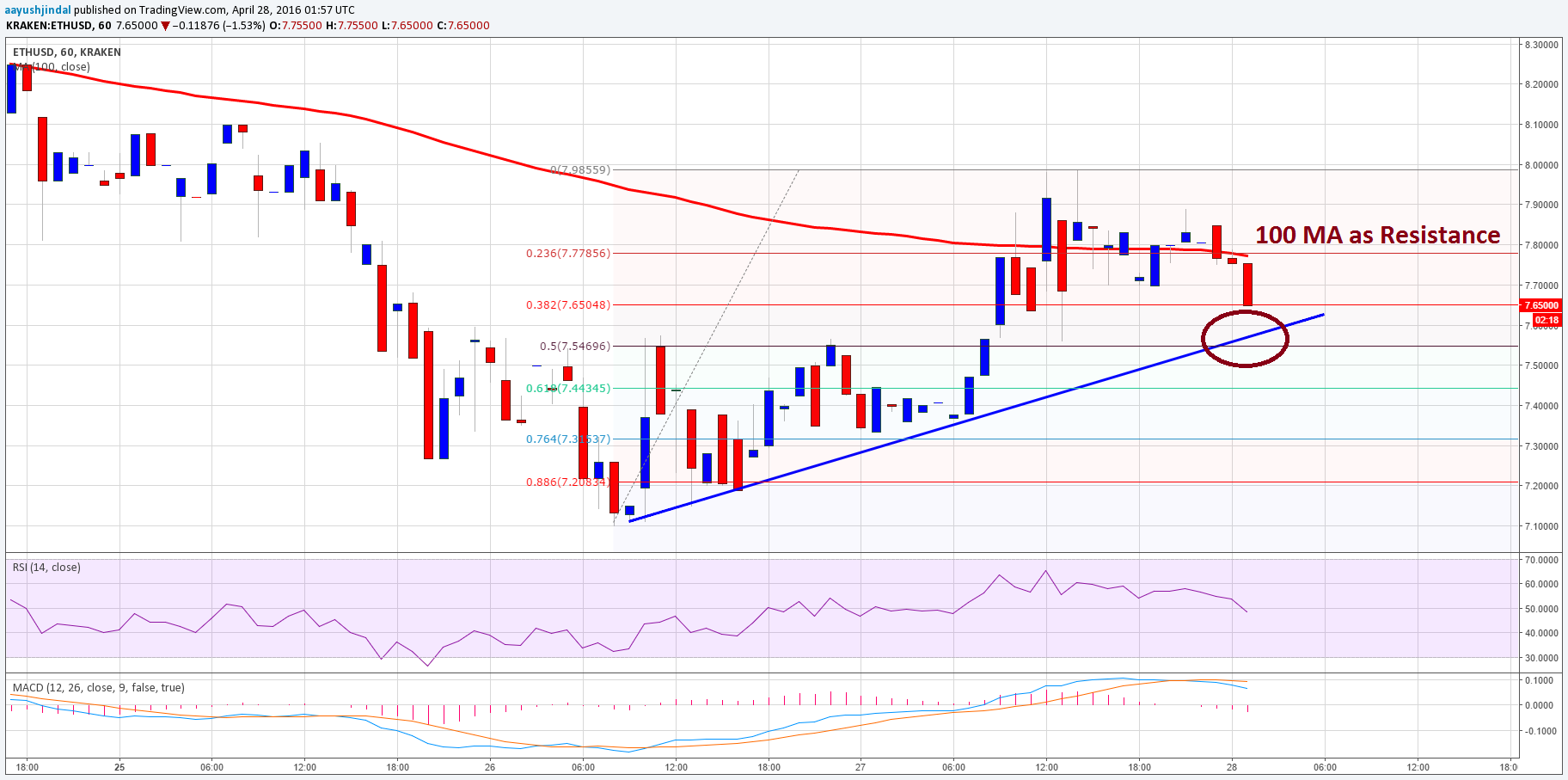

Japan’s better exchange, BitFlyer actioned a 4x allowance absolute as allotment of a gentleman’s acceding with the FSA. Average volumes nose-dived as a result.

Volumes are mostly a action of advantage – see what Bitflyer's did aftermost year back the FSA bargain max advantage from 15x to 4x on the 28th of May pic.twitter.com/eGa9VCFiKx

— skew (@skewdotcom) January 13, 2020

And there is a absolute abhorrence that a 2x absolute artifice would cut volumes further. Might this be the afterlife bell to an industry already disturbing to exhausted the bears?

Images from Shutterstock