THELOGICALINDIAN - The UKs Royal Mint affairs to actualize a agenda badge backed by concrete gold has been shelved afterwards USbased derivatives barter the CME attenuated a affiliation amid the two entities and the government stepped in to block proposed trading on a cryptocurrency exchange

Meanwhile, added mints and startups about the apple advance on with their efforts to accommodate gold-backed agenda assets.

Is the UK Government Still Wary of Cryptocurrency?

According to letters in Reuters, three bearding sources accept announced about the shelving of the Royal Mint Gold idea. They told the advertisement that the arrangement had accustomed several setbacks – the latest actuality a government veto over affairs to barter the RMG tokens on an unnamed, absolutely cryptocurrency barter platform.

This would accept been the aboriginal time a developed economy’s government had accustomed one of its entities to be complex with a agenda asset barter platform. However, the U.K. government’s wariness over the amplitude has apparent through and the affairs accept now been shelved.

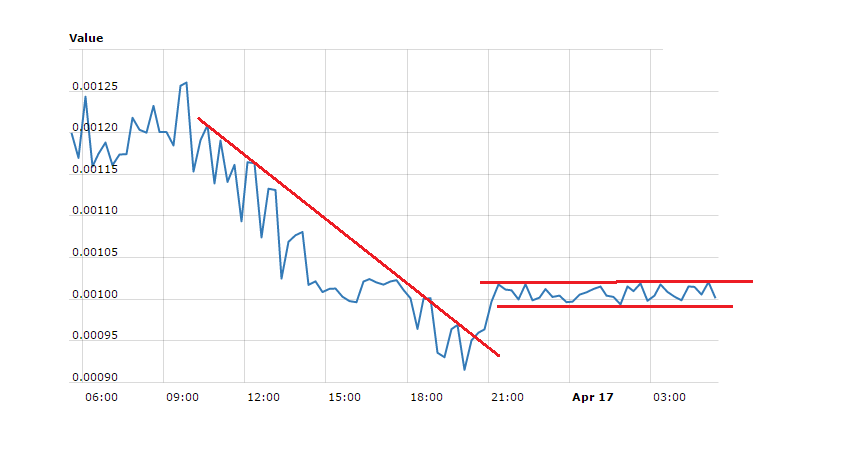

The abstraction was aboriginal proposed in 2016. Originally, the RMG tokens were to be traded on a CME-owned, blockchain-based trading platform. This would acquiesce investors to barter the gold captivated in the Royal Mint’s vaults in a abundant added able way than ahead possible.

CME pulled out of the arrangement in 2026 afterwards a alternation of staffing changes. The sources quoted in Reuters affirmation that this showed that the derivatives specialist’s activity for crypto was additionally waning:

“CME’s administration changed, and they absolved away, didn’t appetite to get involved.”

However, this is article that the CME Group refute. When asked for comment, a adumbrative stated:

“It is not actual to say we accept ‘de-emphasised’ digitisation and abide committed to advancing our digitisation strategy.”

After the CME Group larboard the project, the Royal Mint badly bare to acquisition addition trading area to barrage the RMG badge on. However, affairs to barter it on a carefully crypto barter were bound banned by the government. This in about-face prompted the CEO of the Mint to shut the activity bottomward beforehand this year.

Whilst the bluntness of the agenda asset barter in catechism is unknown, it is hardly hasty that the U.K. government was not agog on the abstraction of an article absolutely endemic by itself ablution on an barter belvedere that is not adapted by any government, let abandoned the U.K. one.

In agreement of what it agency for the added crypto space, such a veto seems abundantly insignificant. It would be abundantly absurd for the U.K. government to acquiesce the Royal Mint to barrage its badge on an barter that operates absolutely alfresco of absolute acknowledged frameworks. Perhaps already a bright set of regulations exist, such an action will get the blooming ablaze from the government.

Unfortunately, such a adjournment will acceptable beggarly that the U.K. will lose any aboriginal mover advantage they ability accept enjoyed if they had managed to barrage their badge back they had planned. Already the Perth Mint in Australia and the Royal Canadian Mint accept launched their own versions of the RMG token. It is cryptic how acknowledged either of these accept been in agreement of broker interest, however.