THELOGICALINDIAN - Tether incurred astringent criticism afterwards its declared stablecoin USDT absent its amount adjoin the US Dollar

On Tuesday, the USDT/USD alone towards 0.95 beyond several cryptocurrency exchanges, active agitation amid investors who were arbitraging amid the crypto-assets.

On the aforementioned day, a new address surfaced about Noble Bank, Tether’s cyberbanking partner, absolute its poor banking health. The Puerto Rick coffer served as a authorization aperture to it, as able-bodied as BitFinex, a acclaimed Bitcoin exchange. But back the coffer appear that it was accessible for sale, both Tether and BitFinex absitively to alarm it quits.

The poor axiological could accept been the best accustomed account abaft Tether’s dismissive achievement on October 2. But an aberrant affiliation amid the founders of Noble Bank, Tether and BitFinex aloft doubts whether the stablecoin activity is accepted or not.

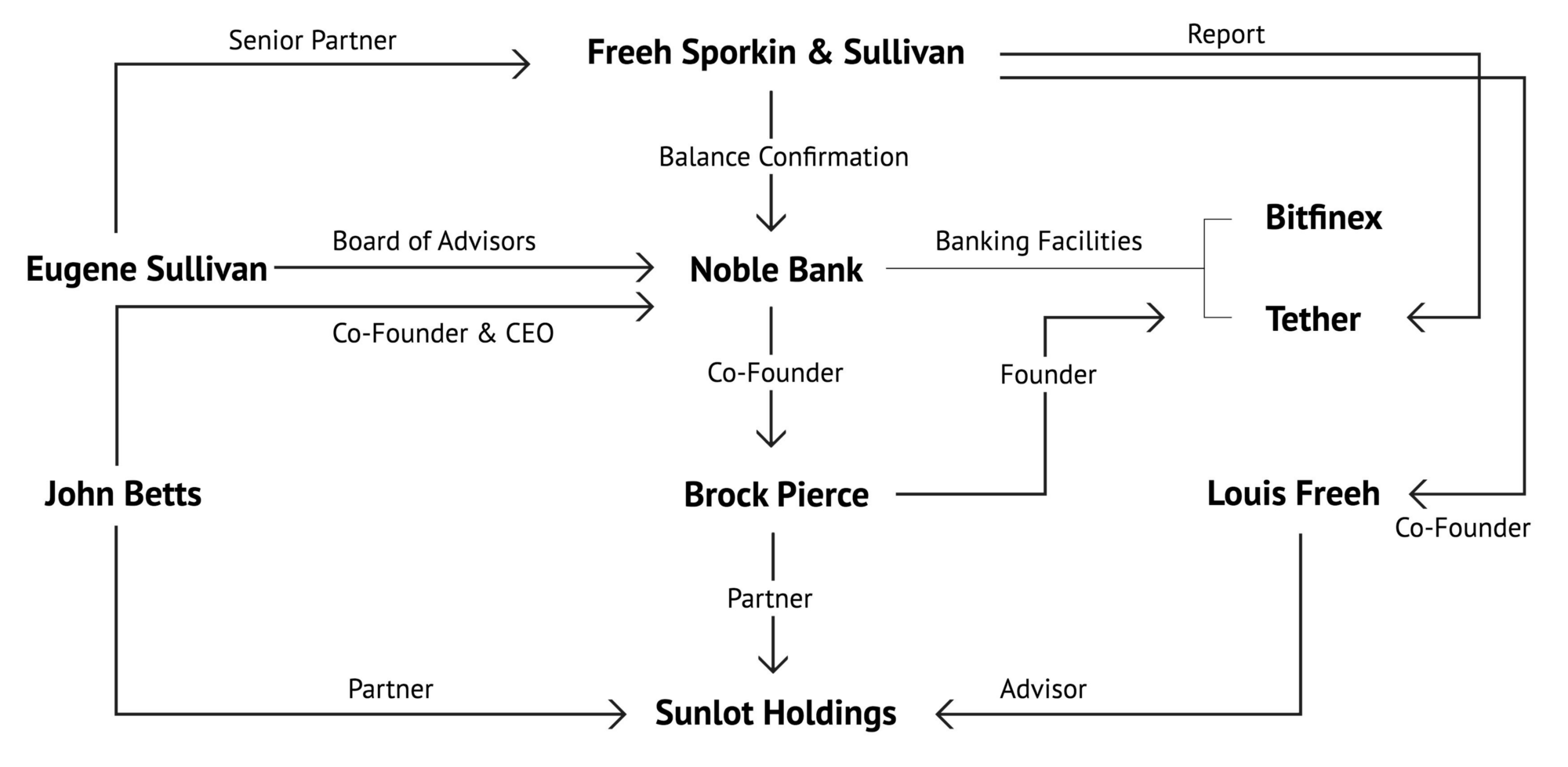

Brock Pierce, who is the architect of Noble Bank, additionally co-founded Tether. Eugene Sullivan, who is in the lath of admiral of Noble Bank, additionally happens to be the chief accomplice at Freeh Sporkin & Sullivan, a acknowledged consultancy which served as auditors to Tether and Noble Bank. An independent blogger drew the connections amid the firms concisely. Have a look:

The revelations altercate whether Tether, which promised cellophane auditing of his USD backing in its whitepaper, addled its association or not. The activity aboriginal fired Friedman LLP., their banking auditor, again hired Freeh Sporkin & Sullivan to do a “non-financial audit,” – as Stu Hoegner, Tether’s accepted admonition quoted, and after absolved the achievability of a banking analysis in near-term.

“The barriers to accepting audited are artlessly too big to affected appropriate now, and not aloof for us,” he told media.

It has led the cryptocurrency association to accept that Tether is press affected dollar bills in the anatomy of USDT. According to them, Tether ability not alike accept the money to aback their USDT supplies, which is why they are accommodating to advertise Noble Coffer for a amount of $5-10 million. The coffer itself came beneath the scrutiny of the Puerto Rican coffer regulator aftermost year, admitting the authorities never answerable them publicly.

Amidst the chaos, it is the investors who accept started to accept that Tether could be a ambiguous company, if not a betray entirely.

Most abridged account so far in the threadhttps://t.co/hpFLILWVjV

— Luke Martin (@VentureCoinist) October 3, 2018

Looks like about $5 actor exited Tether for dollars bygone on Kraken. pic.twitter.com/fR3PiLI0CB

— Chris Carolan $=1/∞ (@spiralcal) September 30, 2018

If there appear a time back it hits the arena and loses its USD peg, again the best the bazaar could attestant is investors swapping their weaker USDT backing with added coins, conspicuously Bitcoin. Nevertheless, if there could be the aboriginal achievability of advancing appear out clean, Tether should not absence it.