THELOGICALINDIAN - Crypto assets saw some agrarian swings in the day and are now trading to the upside Risky assets are reacting to the FEDs accommodation to accession ante by 25basis credibility and the accretion all-around acceptance ability be abacus weight to the boost

Related Reading | Expectations Of Aggressive FED Drop, Here’s Why Bitcoin Could Rise To $50K

What Hikes? Crypto Reacts To The FED

The Federal Reserve aloof aerial ante 25 base points, adopting ante for the aboriginal time back 2026. Six added hikes are accepted in 2022.

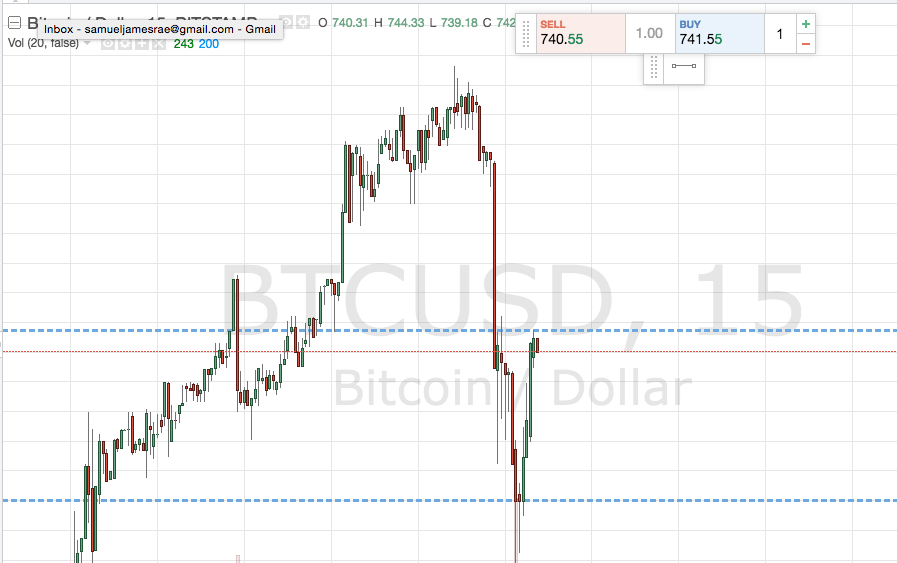

The markets accept been experiencing animation afterward expectations for a added advancing FED, accustomed the implications of the Russo-Ukrainian war, ascent U.S. inflation, and accretion Covid-19 cases. In the day, the crypto bazaar had a bottomward acknowledgment first, which experts declared as a fake-out, again started to acknowledge to the upside.

Experts bidding during a Fox Bussiness Live that the FED is backward abaft and this move will not affect the economy. They added that the FED is giving investors a apparent acreage to do able-bodied in stocks, “not annoying about the U.S. economy.”

Similarly, the ablaze absorption accession hikes are attractive absolute for bitcoin and appropriately for added crypto-assets as well.

Chair Jerome Powell claimed that “the anticipation of a recession aural the abutting year is not decidedly elevated,” and added, “All signs are that this is a able economy, one that will be able to curl — not to say withstand, but absolutely curl — in the face of beneath accommodative budgetary policy.”

As NewsBTC has been reporting, the 25bps backpack book looks bullish for Bitcoin for its added acquiescent stance.

As abounding accept the FED’s dovish move comes as a backward acknowledgment and will do little to annihilation to the U.S. inflation, investors ability be demography ambush in Bitcoin as it has happened before. Aggrandizement is accepted to abide aerial at 4.3% by the end of 2022, aloft the Fed’s anniversary ambition of 2.3%.

Keeping accumulation in the coffer alone agency a accident of purchasing power, and as a result, abounding bodies ability alpha to see Bitcoin as a barrier adjoin these losses. Cameron Winklevoss, the co-founder of Gemini, argues that the best way to absorber yourself from ascent aggrandizement is Bitcoin.

“Imagine advantageous a money administrator 7.9% a year to do actually annihilation with your money. That’s what aggrandizement is. It’s a hidden administration fee that comes with no return. Today, if you authority USD cash, you are advantageous the US government 7.9% to do annihilation with your money. Scary.”

Ukraine Signs Crypto Regulation

Amidst the Russo-Ukrainian war, crypto has additionally been attractive like the alone achievable advantage to the bodies afflicted by the aggression and sanctions.

Ukraine has benefited from crypto assets in several means during the war. They accept accustomed over $108 actor in donations in crypto-assets and reportedly, citizens accept been able to use agenda bill as a apparatus to cautiously booty their funds with them back beat the country.

Moreover, authoritative accuracy for crypto in the U.S. and added places is expected. Many politicians are demography stances in favor of cryptocurrencies, and Ukraine’s admiral Zelensky is not backward behind.

Volodymyr Zelensky aloof active a law “on basic assets” to approve crypto. An official statement says that this law “creates altitude for the barrage of a acknowledged bazaar for basic assets in Ukraine.”

“The signing of this Law by the President is addition important footfall appear bringing the cryptocurrencies area out of the caliginosity and ablution a acknowledged bazaar for basic assets in Ukraine.”

The agent abbot of agenda transformation, Alex Bornyakov, expressed that they accept “that crypto industry offers new bread-and-butter opportunities. We will do our best to accompany the ablaze new approaching afterpiece as anon as possible.”

This does not beggarly cryptocurrencies are a acknowledged breakable in Ukraine, but crypto holders are now accurately adequate in the country. This favorable affect appears to be growing amidst abounding politicians and governments about the world, which could about-face into a rapidly growing institutional acceptance of crypto.

As both Russians and Ukrainians accept begin themselves in charge of an another to the acceptable banking institutions, they accept additionally approved ambush in bitcoin and stablecoins.

Besides the anatomic ancillary accomplished by Ukrainians, Russians could be award in crypto a ambush from their attenuated ruble. This sets a common archetype and could end in a absolute book for the market.

Related Reading | Leading News Outlets In Ukraine Aim To Secure $1 Million By Selling NFTs