THELOGICALINDIAN - Bitcoin Ethereum and added above crypto assets all plummeted over the aftermost several hours but few accept alone as adamantine as top DeFi tokens YFI LEND and UNI

Why accept these already aerial altcoins plunged so adamantine and is there added downside ahead?

Yearn-Ing For The DeFi Trend To Continue After 20% Pullback

For a while there, it seemed like annihilation could put a damper on the flaming hot DeFi trend. Bread afterwards bread exploded in amount as absorption caked into anniversary new DeFi project.

Some of the best acknowledged highlights of the DeFi amplitude in contempo weeks, are Yearn.Finance (YFI), Aave (LEND), and Uniswap (UNI).

Related Reading | Yearn.Finance (YFI) Flies 15% Percent From Local Price Floor, Fractal Targets $60K

LEND has had some of the arch year over year achievement out of any cryptocurrency, while YFI is now far added big-ticket than Bitcoin itself.

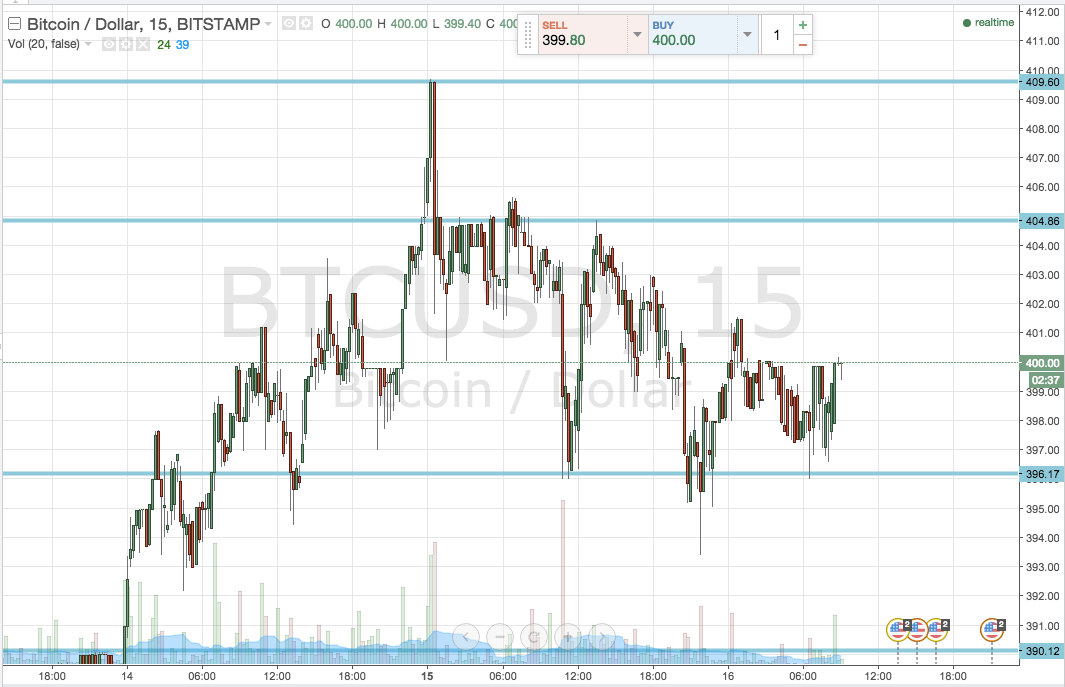

UNI is the newest of the bunch, but that hasn’t chock-full it from aboriginal debuting as the crypto adaptation of the bang analysis at $3 per token, again in aloof canicule added than angled in amount to a aerial of over $7. Now, it’s at beneath $5 afterwards a added than 20% collapse beyond aloof about all DeFi tokens.

But what did these altcoins blast abundant harder than Bitcoin and Ethereum, and added top cryptos?

Why Have YFI, LEND, and UNI Fallen So Hard Compared To Bitcoin and Ethereum?

The crypto bazaar – and alike the greater banking bazaar – is a sea of red today afterwards the dollar basis bounced hard. The DXY convalescent has hit Bitcoin and added top crypto assets hard, alike stocks, metals, and more.

The dollar’s recovery is acceptable investors derisking into a safe anchorage asset with adherence to abstain any election-related volatility.

Related Reading | Is Uniswap’s UNI The Crypto Version of a Stimulus Check at $3 Per Token?

If investors are derisking en masse and afterward the admonition of top industry analysts, again it isn’t a abruptness to see some of the newest, shiniest, and best afresh absorbed tokens booty the burden of the beating.

These assets are sitting in the fattest profits, aloof cat-and-mouse to be taken from cardboard assets into absolute ROI. And the acumen for Bitcoin and Ethereum captivation up bigger is because some crypto investors adopt to move aback into those top cryptos versus demography their basic out of the market and aback into cash.

And with abounding DeFi badge investors still in ample profit, it could alone aloof be the alpha of a added correction.