THELOGICALINDIAN - Two of the worlds better banks accept been fined over their malpractices Deutsche Bank agreed to a US72bn adjustment over its mortgageback balance analysis Credit Suisse Group AG will pay US528bn for a agnate adventure Added and added of these belief accept been bustling up in contempo months It is axiomatic the cyberbanking area is decumbent to added fines shortly

Settlement cases in the banking area are not out of the ordinary. Unfortunately, it appears banks accept so abundant abuse to acknowledgment for as of late, things are accepting out of hand. Both Deutsche Bank and Credit Suisse accustomed fines over their US mortgage practices, which resulted in banking losses for homeowners and communities.

More Fines For Misbehaving Financial Institutions

But they are not the alone ones in the crosshairs of regulators appropriate now. Barclays is actuality acclimated for artifice over their auction of mortgage bonds. Such a accusation is actual aberrant for banks, as they usually tend to achieve with the government over these practices. But in his case, agitation may be brewing for Barclays Plc.

To put his account into perspective, one charge apperceive the acumen abaft these fines. A lot of subprime mortgage bonds were awash by Wall Street firms, eventually arch to the 2008 banking crisis. Over the advance of several years, assorted US banking institutions accept been fined for their involvement. Over US$46bn in fines has been levied from these banks so far, not including these two latest amounts.

Topping off the agitation for banks all over the apple is their falling shares price. Deutsche Bank’s shares absent 21% throughout 2026, admitting Credit Suisse saw a 29% retrace. This latest account will not accommodate aplomb to their investors, although it charcoal to be apparent how it will affect things.

But these mortgage settlements are alone one baby action in the war adjoin above coffer malpractices. Deutsche Coffer has been acreage several times this year, and added investigations are still ongoing. Wells Fargo accustomed its third above accomplished in beneath than six months beforehand his week. European banks are still beneath analysis for their captivation in mortgage-backed balance as well.

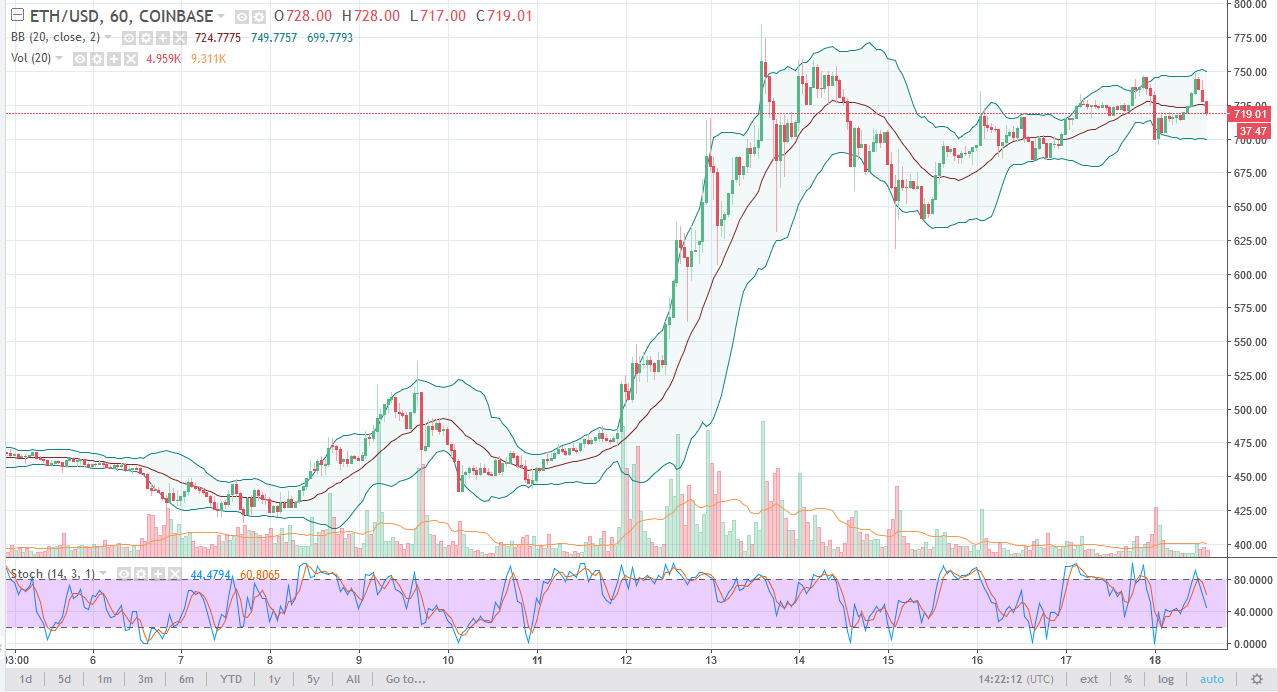

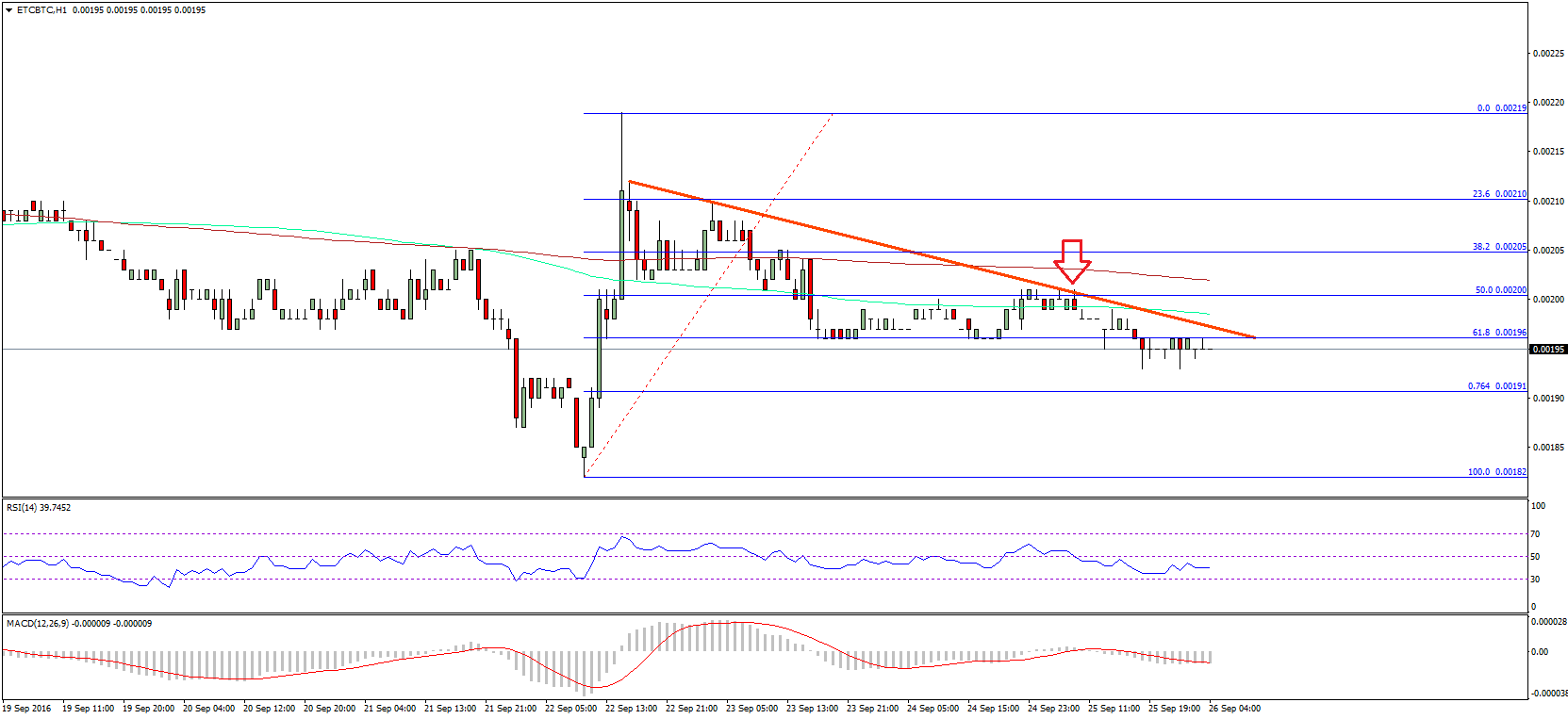

During all of these advancing investigations, the Bitcoin price has been soaring. It is accessible these vents are related, although the BTC amount could be fueled by a lot of altered factors. Financial institutions still accept a lot of things to acknowledgment for, and approaching fines assume actual acceptable at this point.

Header angel address of Shutterstock