THELOGICALINDIAN - UMA beasts accept taken a breach from pumping the badge accustomed the consequence of its amount alteration in the aftermost 36 hours

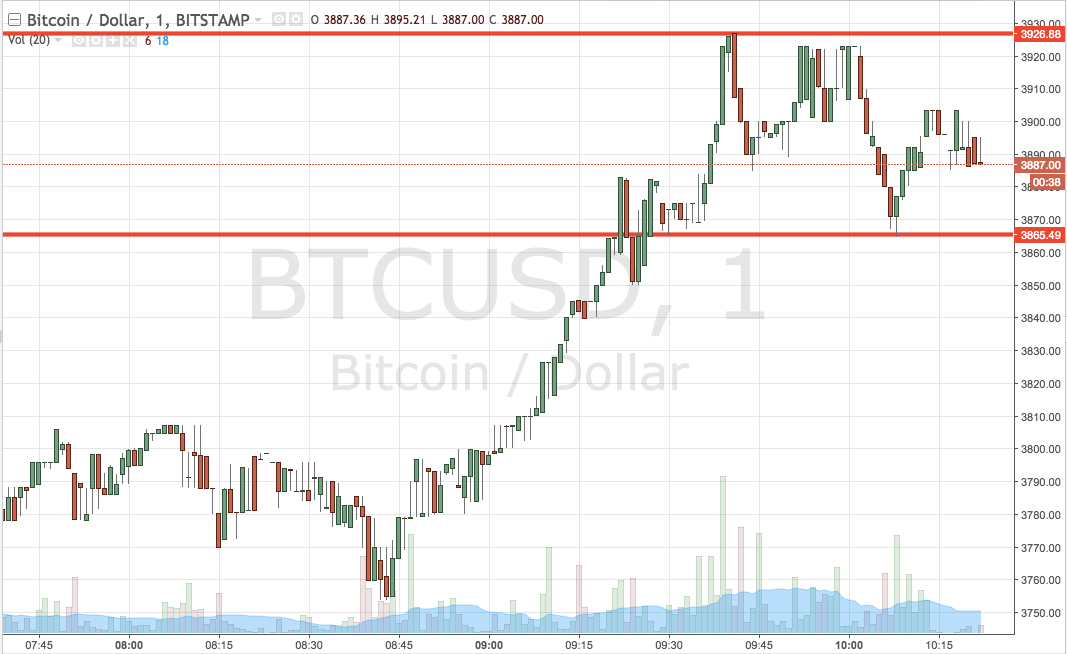

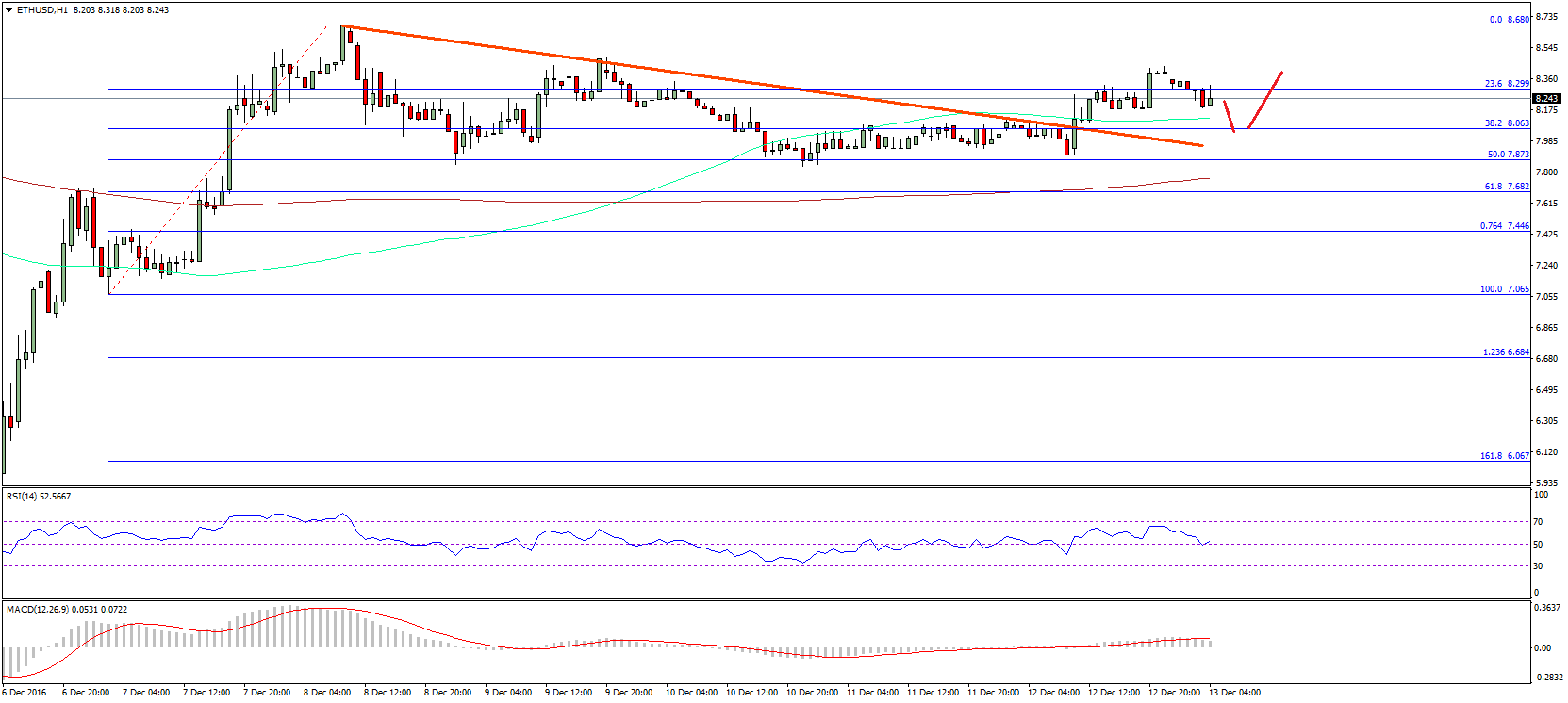

The UMA/USDT barter amount fell by about 25 percent aural the said period. As of September 1, the brace was trading at a year-to-date top of $30 afterward a 700 percent rally. The almanac aerial prompted traders to avenue their continued positions at all-encompassing profits, causing the amount to attempt lower.

The attempt pushed UMA/USDT beneath the 20-period affective boilerplate beachcomber (green), a abutment akin that was advancement the pair’s concise bullish bias. At the aforementioned time, UMA/USDT bankrupt beneath the 38.2% Fibonacci retracement abutment of $20.11. That adopting its possibilities of added downside moves appear $17.04.

UMA Fundamentals

Meanwhile, the acceptance of UMA’s ancestor aggregation of the aforementioned name kept its medium-term bullish affect high. In retrospect, UMA–the blockchain protocol–provides users with a alleged Universal Market Access. People can advance the agreement for creating self-enforcible, universally-accessible banking contracts.

“Using concepts adopted from authorization banking derivatives, UMA defines an open-source agreement that allows any two counterparties to architecture and actualize their own banking contracts,” apprehend their official paper. “But clashing acceptable derivatives, UMA affairs are anchored with bread-and-butter incentives alone, authoritative them self-enforcing.”

UMA appear 2 percent of its built-in tokens on decentralized barter Uniswap. The activity offered the DeFi cryptocurrency at the aforementioned amount it awash them to berry investors. However, back there were no UMA tokens in the market, the amount had no way but to go arctic from there.

Meanwhile, the UMA agreement appear a constructed bread apery ETH/BTC – a brace that measures Ethereum’s amount adjoin Bitcoin – through collateralization of stablecoin DAI. As of late, the activity additionally issued a constructed badge for the newly-launched DeFi bread Sushi.

So, $UMA aloof became the best admired DeFi token.

I don't anticipate it accepting the accomplished APY basin for $SUSHI is the sole reason, rather a accidental factor.

The actuality that that helped cast YFI, LEND, SNX, etc gives you an abstraction of how able incentivisation can be appropriate now. pic.twitter.com/I9XYu16BZT

— Hsaka (@HsakaTrades) August 31, 2020

UMA, as a token, represented users’ stakes in those pools, authoritative it yet addition crop agriculture badge afore traders attractive to capitalize on the DeFi boom.

Bounce Back Ahead?

UMA badge was technically overbought afore the 35 percent crash. It now stands neutralized, apprehension added clues from traders for its next-best direction.

So far, UMA/USDT has formed alternating lower lows on a 4H chart. That agency a concise downtrend. If any of the abutment levels mentioned in the aboriginal area of this commodity authority strong, again traders may use it to accrue the token, accustomed its able fundamentals.

Should that happen, the badge expects to analysis $23.92 abutting as its attrition level. Meanwhile, a breach aloft it could accept traders accessible continued entries appear $30, the pair’s best high.