THELOGICALINDIAN - Investing in altcoins is beneath chancy than Bitcoin during a buck bazaar according to crypto advance firms

New Wave Capital told Yahoo that the altcoins with abate assets accept amazing abiding potential. Bitcoin, according to the San Francisco startup, could accept added accoutrements to backpack during the abutting balderdash run. Traders ability feel assured about overextension their portfolio in assets with the best applied abiding goals in mind. However, the aggregation agreed that Bitcoin is still the best airy asset during a buck market.

“In a buck market, anybody moves abroad from altcoins, and they go aback to what has been commonly added resilient, which is bitcoin,” said CEO Eric Campbell. “They anticipate it’s a safer asset. But aback we appear aback to addition balderdash bazaar in the future, we anticipate bodies will go aback to altcoins.”

New Wave currently appearance a assorted ambit of altcoins in its advance portfolio, including Etherum, XRP, Bitcoin Cash, Civic, and Litecoin. The account gets adjourned every division based on a accident analysis and algorithm.

Strong Use Cases

While Bitcoin assuredly charcoal the baron of cryptos, several altcoin projects accept emerged as alternatives to the aboriginal agenda currency’s abstruse limitation. Ethereum, for instance, serves the purpose of creating and ablution decentralized apps and acute affairs on the top of a accessible blockchain. Monero, at the aforementioned time, offers users with abounding privacy, article that Bitcoin provides but partially.

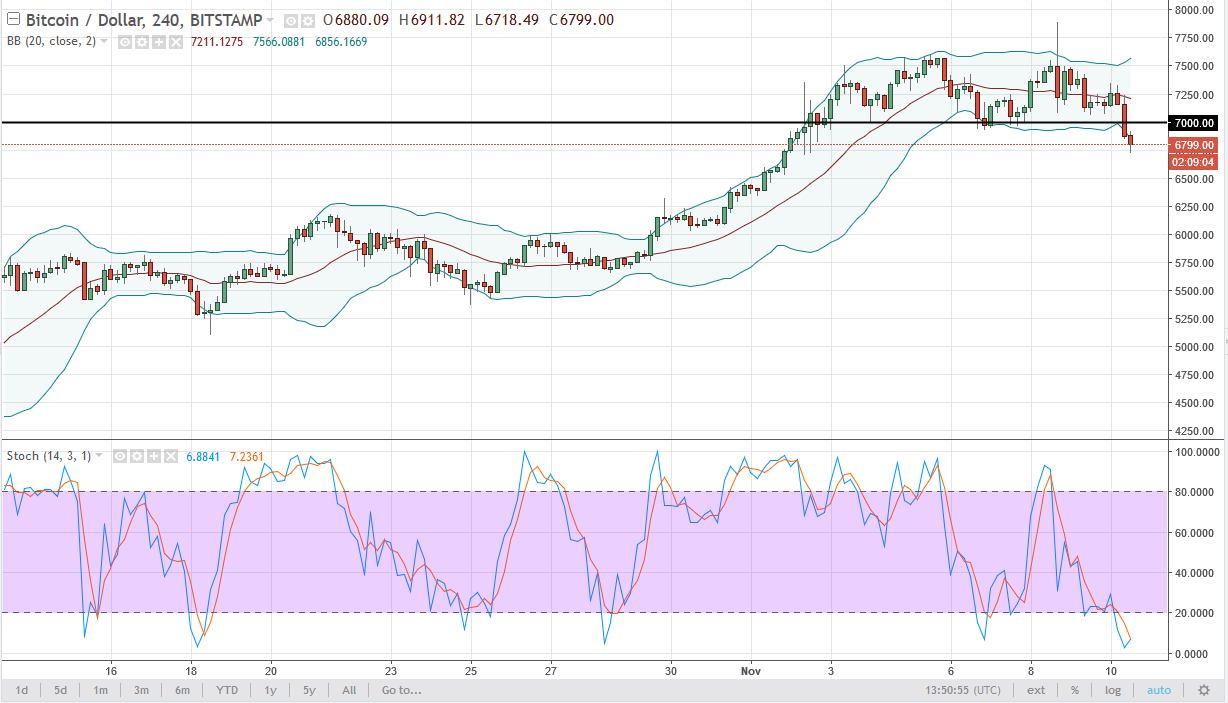

Nevertheless, Bitcoin is amid the least affected cryptocurrencies during this year’s bearish sentiment. The bread has absent 54 percent of its amount compared to its abutting alternatives. Ethereum, again, for instance, has alone 74 percent adjoin the US Dollar this year. XRP is additionally bottomward 78 percent, alongside Bitcoin Cash and Litecoin with their 82 and 78 percent losses, respectively.

Regardless of their anemic annual performances, these projects serve abiding goals accompanying to blockchain’s affiliation into boilerplate industries. Analysts blow their bullish perspectives about altcoins on a axiological appeal and accumulation theory. Against a bound supply, the appeal for these fractionable amount units is acceptable to go up. XRP, for instance, is proving itself to be a digital bill for cross-border transactions. It is the coin’s basic use case which, aloft added adoption, could crop profits in the continued run.

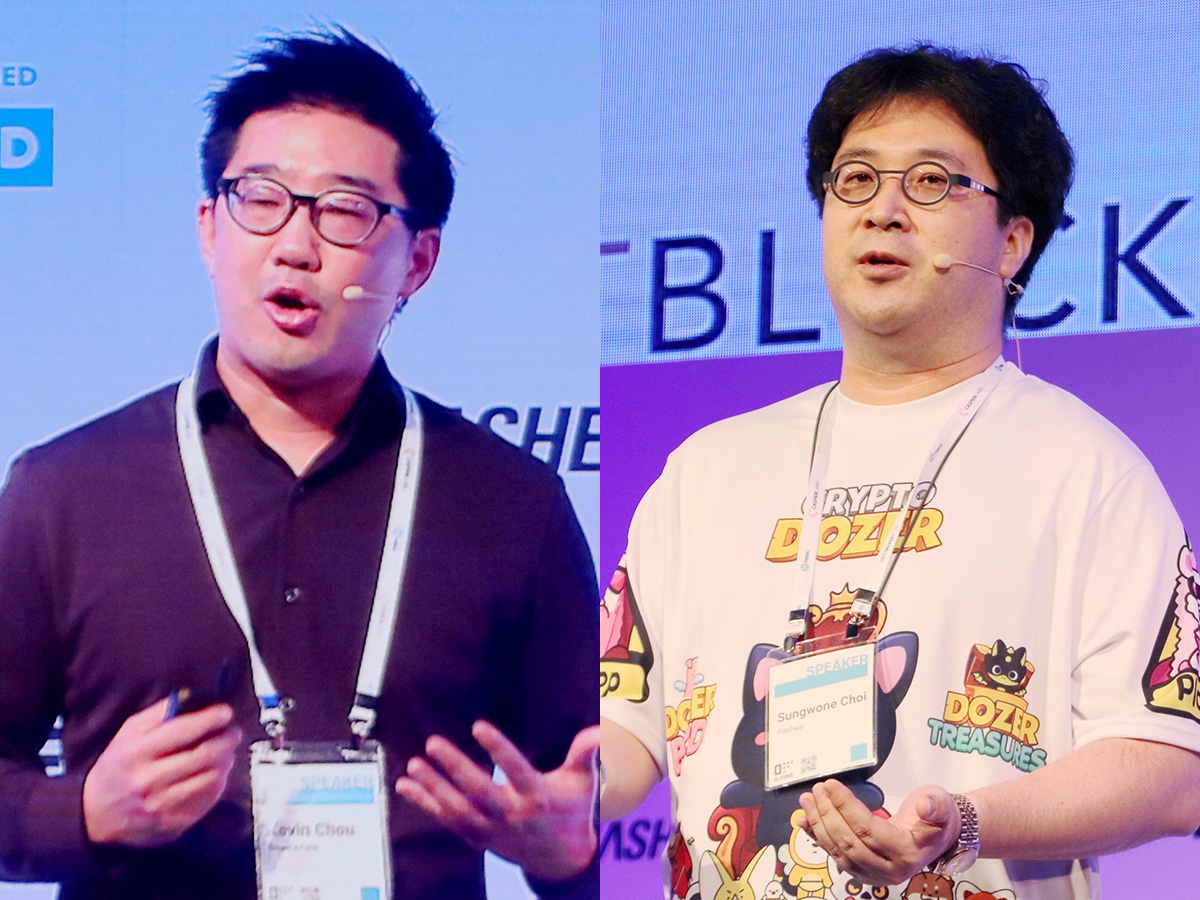

New Wave’s co-founder Albert Cheng thinks it is the prime acumen why their advising close is attractive into added Bitcoin alternatives.

“When a bazaar is bearish, there’s a flight to quality, and that’s bitcoin today,” he told Yahoo. “But our account is advised to drive abiding thinking. And if bodies are captivation their portfolios for a continued time, I anticipate it’s advisable to accept acknowledgment to assorted coins. True archetype accouterment booty a continued time.”