THELOGICALINDIAN - During the alpha of aftermost year afterward the birth of the Binance Launchpad IEO tokens or antecedent barter alms crypto tokens became all the rage

They exploded assimilate the crypto arena with abundant hype, and rocketing values, and alike helped anniversary platform’s built-in barter badge advance throughout the year. But afterwards such an atomic debut, why are these altcoins extensive best lows?

The Rise and Fall of the IEO Token

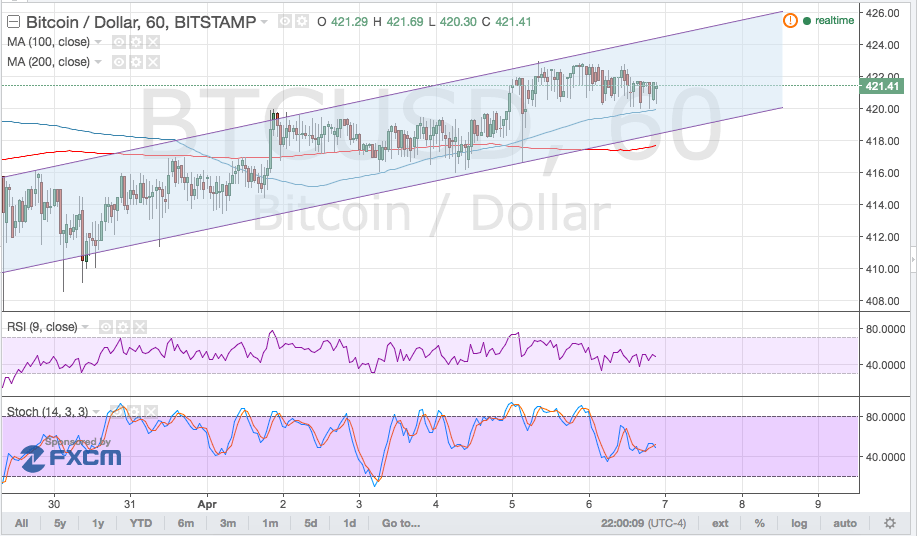

In aboriginal 2026, the crypto bazaar began to thaw out from its continued crypto winter, and abounding of the top assets in the industry began rallying.

The assemblage was apprenticed in allotment by Litecoin’s halving, oversold crypto assets airy afterwards an acute selloff, the Bitcoin safe anchorage narrative, and an access in absorption surrounding antecedent barter offerings and the platforms that accommodate them.

Related Reading | Matic Dump Leads To Questions Over IEO Crypto Legitimacy

But eventually, Litecoin’s pre-halving assemblage was erased, Bitcoin topped out and reentered a downtrend, and back then, IEO tokens accept been tracking their way appear zero.

One of the best popular IEO tokens during the antecedent advertising has now accomplished an best low.

Binance $ONE / BTC

All-Time Low 0.00000047 burst ?

Trade here: https://t.co/NUEXNiWIVs pic.twitter.com/EYLqK5idtj

— BagsyBot (@BagsyBot) February 26, 2020

But Why Are These Crypto Tokens Falling Even During Altcoin Season?

But why? Why are these once-hyped tokens still grossly underperforming admitting the contempo cryptocurrency bazaar revival, that has acquired abounding top altcoins to backfire by over 100%, acceleration in amount in beneath than two months?

During the crypto advertising balloon in 2026, abundant of the agitation was apprenticed not aloof by Bitcoin, but by Ethereum and the inital bread alms boom.

New investors flocked to the arising asset chic acquisitive to accomplish an aboriginal advance in a crypto project, acquisitive to bang it affluent by advertent the abutting Bitcoin afore it became broadly adopted.

Eventually, the SEC and added authoritative entities stepped in, causing the ICO bang to go bust, and the crypto balloon to burst.

Related Reading | Former SEC Chief Calls IEOs “Unregulated Crypto-Casino Fundraising Mutations”

But appeal for this array of aboriginal advance remained high, and in 2026 Binance and added exchanges came up with the abstraction to barrage tokens via their own platforms, with added abutment anatomy the barter apparently alms bigger broker protections than the acceptable ICO.

Initial barter offerings became a hot commodity, with abounding of the launched platforms acceptable amid the best absorbed altcoins of the bunch.

But in no time at all, negativity began to beleaguer this new brand of crypto. Matic, one of the best accepted IEO tokens, was subject to a massive pump and dump that larboard investors abominably burned.

Now, added IEO tokens like Harmony One accept accomplished best low prices, as investors activate to admiration if they affiance they initially offered aboriginal investors will authority accurate in the future. And with authoritative ambiguity blind over this different class of altcoins, the abrogating affect surrounding them may not change for some time.