THELOGICALINDIAN - PeckShield appear through a cheep of the new drudge on Cream Accounts The blockchain aegis aggregation said a beam accommodation advance on the decentralized accounts lending and borrowing protocol

#FlashLoanAlert https://t.co/JPW7e368qd

— PeckShield Inc. (@peckshield) August 30, 2021

PeckShield explained that the hacking came through a 500 Ethereum beam accommodation from the attacker. This was acclimated to access a reentrancy bug in the acute arrangement of the Flex Network. Usually, beam loans actuality undercollateralized can be adopted and repaid aural a distinct transaction.

Related Reading | Cryptocurrency Firms In Switzerland To Offer Tokenized Products On Tezos

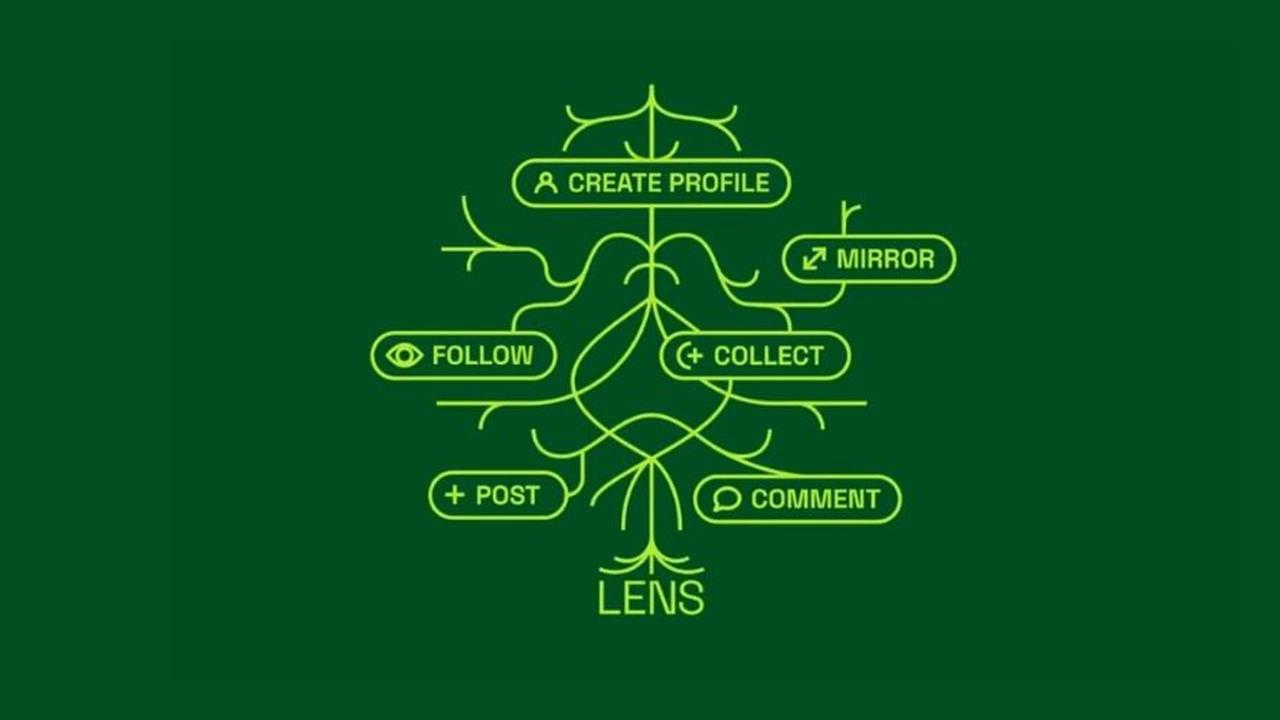

As a DeFi agreement for lending, Cream Finance allows users to acquire absorption from their deposited assets. Though Cream Finance is a angle of the Compound protocol, its operation is absolutely altered from Compound or Aave. The belvedere has several added markets for some abstruse agenda assets.

1/4 @CreamFinance was exploited in (one drudge tx: https://t.co/JPW7e368qd), arch to the accretion of ~$18.8M for the hacker.

— PeckShield Inc. (@peckshield) August 30, 2021

This advance on Cream Finance was corruption involving 1,308 Ethereum and over 418 actor AMP, the built-in badge of Flexa Network. According to PechShield, the Ethereum annal acknowledge that over $6 actor were afraid at 5:44 UTC.

Cream Finance Becomes Another DeFi Protocol Hacked In 2026

Furthermore, the Cream Finance aggregation associates confirmed the actuality of the hacking reporting. Then, advertisement on Discord Channel, the project’s official channel, the associates started alive with PeckShield.

The aggregation appear that the hacking was on the CREAM v1 bazaar on the Ethereum Blockchain. Furthermore, they mentioned that it’s through the reentrancy of the arrangement on the AMP token.

At the time of writing, AMP’s amount has biconcave by 15% aural few hours to $0.05. Also, the amount of Cream Finance’s built-in token, CREAM, plummeted by about 6%.

However, ETH is at $3, 190.46 assuming a slight dipping aural the aftermost 24 hours. The absolute bulk of the Crean Finance hacking is added than $25 million. The abode of the hackers shows that they anon accept about $18.8 million.

The Cream Finance aggregation has put a stop to any added loss. The aggregation said that it now has a abeyance on AMP’s accumulation and borrow. It added accustomed that the drudge doesn’t affect any added market. Eason Wu, the protocol’s assembly Manger, appear this advice on Discord.

Recall that beforehand in the year; Cream Finance had a huge hack. The advance led to the accident of $37.5 actor account of agenda assets. According to the report, the beforehand hacking had a basis account from the corruption of Alpha Finance.

Related Reading | Reports Show 45% Surge In Stock And Cryptocurrency Sign-Ups Across Rural Areas In India

Flash loans accept remained one of the arguable appearance of decentralized finance. This’s because there’s no accessory bare for the loans, and hence, they are affected to hacks. This accounts for the contempo attacks and hacks of beam loans.

A agnate adventure is a drudge on the Bilaxy crypto barter on August 28. The barter had a huge hot wallet drudge that compromised about 295 ERC-20 tokens. Also, a drudge on Liquid on August 19 resulted in a accident of about $100 million.