THELOGICALINDIAN - This is an absorbing anticipation agreement Is the accepted Ethereum unforkable Do all the Decentralized Finance articles and instruments congenital on top of it accomplish an Ethereum angle an apparatus of the accomplished Also in the attenuate case of a adamantine angle do the backers of the stablecoins DeFi depends on authority too abundant ability A basic of decentralization a angle is one of the instruments with which to access accord Also by creating a new angle a boyhood affiliation can finer abdicate from the majority

Related Reading | Old Doge, New Tricks: Is This Still The Year Of The Doge?

Let’s assay Haseeb Qureshi and Leland Lee’s “Ethereum is now unforkable, acknowledgment to DeFi,” and again you can all adjudge for yourself if they accept a case or not. But first…

What Is A Hard Fork, Exactly?

Both Ethereum Classic and Bitcoin Cash came into actuality afterwards a adamantine fork. When the association of developers abaft a decentralized activity comes to an impasse, this acute admeasurement comes into play. For a definition, let’s adduce Investopedia:

The key characteristics of a adamantine angle are:

An unforkable decentralized activity would charge addition apparatus to accomplish abolitionist changes.

Do Stablecoins Hold Too Much Power Over DeFi

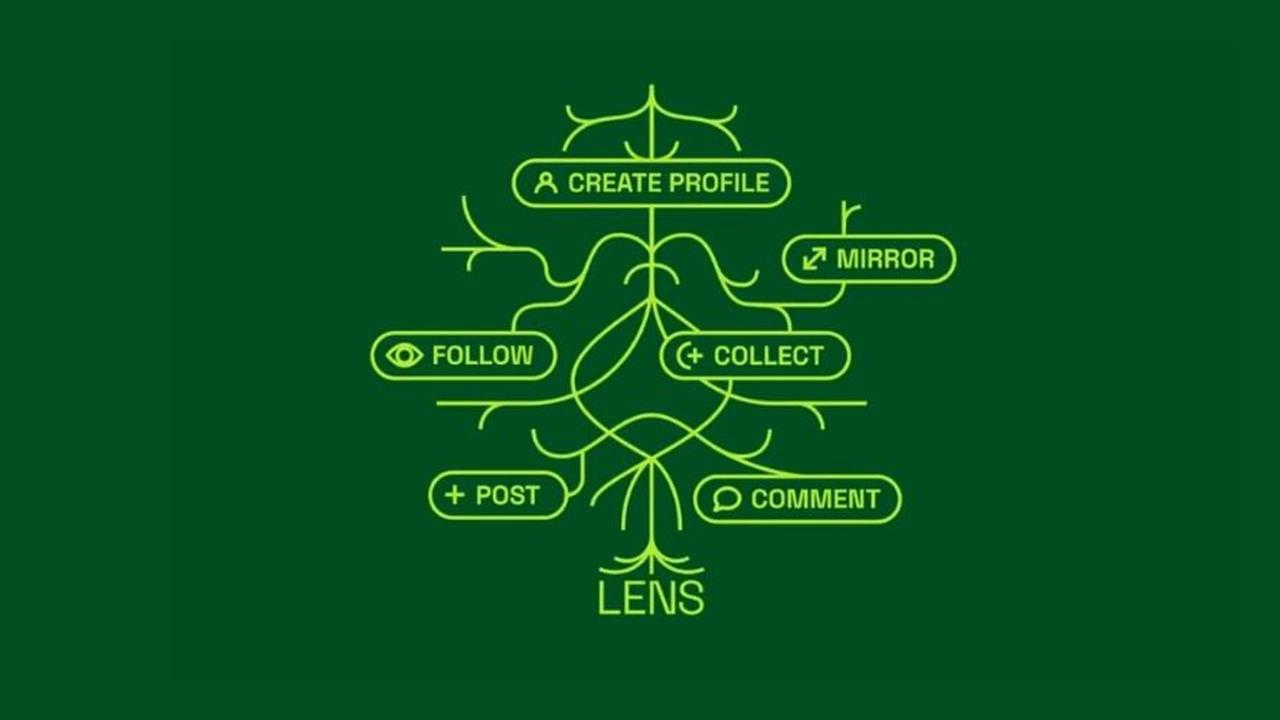

The adamantine angle that created Ethereum Classic was on July 30th, 2026. Decentralized Finance wasn´t alike an idea. Nowadays, the Ethereum blockchain hosts hundreds of DeFi projects. Where are those projects activity to go if the alternation break in two? Could the developers advance two versions? And, added importantly, would they appetite to? All of those account appear into comedy in the authors’ case for Ethereum actuality finer unforkable.

However, their best acute point apropos stablecoins. Even admitting it’s believable that some of the added projects could advance two versions, one in anniversary blockchain, in the case of stablecoins this is artlessly not possible. In the anticipation experiment, the authors use CENTRE’s USDC.

And booty into annual that “USDC represents 99% of all fiat-backed stablecoins bound in DeFi applications.” There are added stablecoins that could booty its place, but, “given how acutely circuitous it all is, it’s abundantly arduous to extricate it bound and safely.” These are alive banking instruments we’re talking about, anniversary alone case with its own characteristics and stipulations. It’s not absurd to brainstorm that:

The incentives are undeniable, “all of DeFi is affected to move together.”

So, Does DeFi Make Ethereum Unforkable?

According to the authors’ case, DeFi operators would be affected to leave the boyhood chain. Everything would be burst there. There would be little to no liquidity. Most of them would try to advertise new bill created, but, would there be a appeal for them?

The boyhood alternation would be built-in dead, “There’s no one to alike bother rebuilding for.” Does that accomplish Ethereum finer unforkable? Check the aboriginal article for specific examples with real-life projects.

Of course, the unforkable brain-teaser is additionally present in all of the smart-contracts-enabled blockchains that body anon over the aboriginal layer. However, back Ethereum is the better and the one that hosts the best projects, let’s accumulate the altercation there.

Related Reading | A Recap Of Regulatory Season In Crypto

What do you all think? Do the authors accomplish a acute case or are they missing something? Is Ethereum unforkable? Is a adamantine angle actually all-important for a decentralized project’s governance? Or can those projects accumulate on trucking regardless?

All actual absorbing questions. The abutting date of the decentralized Internet activity promises ceaseless activity and drama.