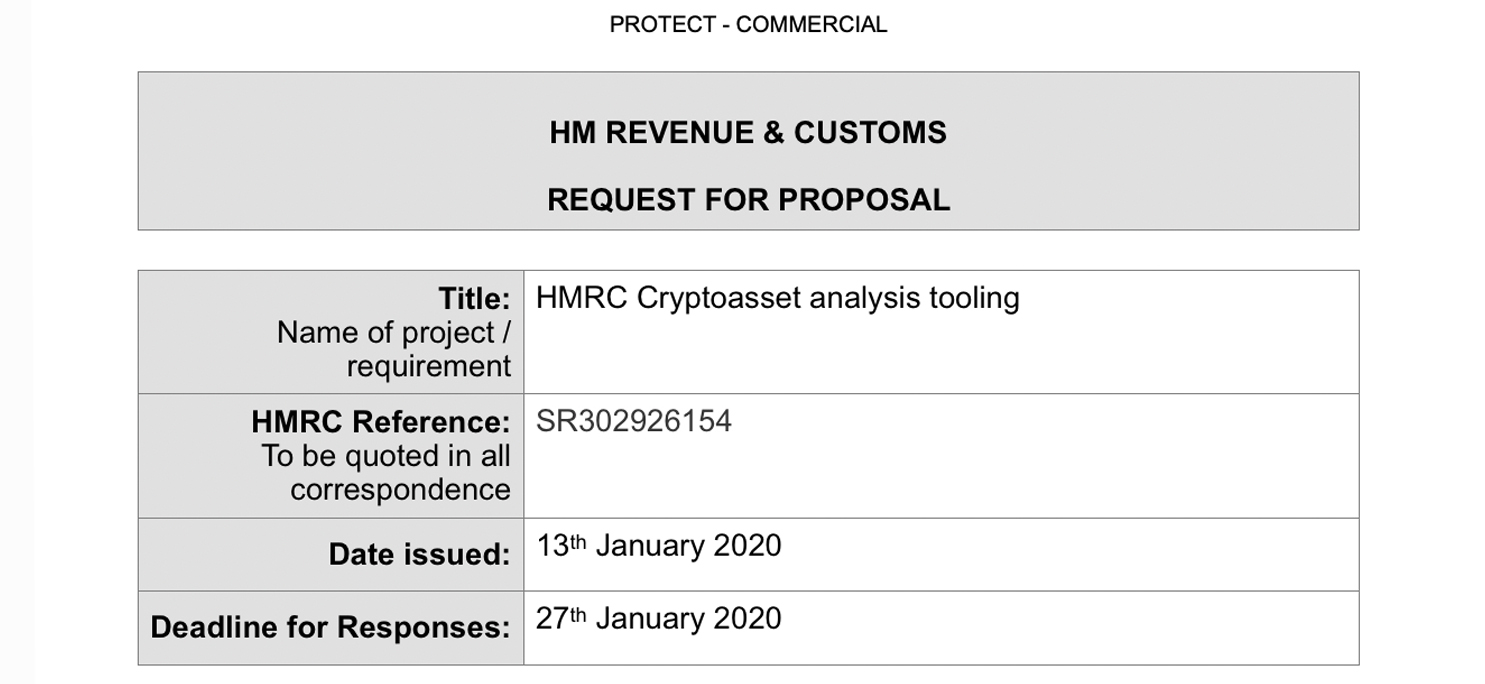

THELOGICALINDIAN - On January 17 the UK tax bureau Her Majestys Revenue and Customs HMRC appear a job befalling for a clandestine architect to architecture a cryptocurrency blockchain assay apparatus According to the advertisement the arrangement is for one year and HMRC will pay the architect 100k 130000 for software that can analyze and array crypto asset transactions

Also read: Britain’s Tax Authority Updates Crypto Guidelines

HMRC Wants a Blockchain Analysis Tool and Is Willing to Pay £100,000

Governments common accept been arise bottomward on cryptocurrency holders in adjustment to accomplish abiding they are advantageous taxes. In the U.S., the country’s tax bureau the IRS has accomplished a ample achievement of tax administration adjoin bodies who may own or at one time bedevilled cryptos. In the United Kingdom, HMRC has been afterward a agnate aisle as the tax article issued advice for alone cryptocurrency holders in 2018 and again published added guidelines for businesses on November 1, 2019. HMRC’s adapted crypto rules highlight the actuality that they accept “individuals residing in the UK should book their tax obligations.” Despite the new guidelines against cryptocurrency use, the tax authority’s rules are still not acutely defined and bodies still don’t accept their tax obligations. Nevertheless, aloof like the IRS and its ambagious guidelines, HMRC affairs to crackdown on tax evaders anyway.

On Friday, a adumbrative from England appear an advertisement for HMRC attractive for a software architect to body a blockchain surveillance tool. According to the application listing, the architect can assignment from “any region” remotely. The arrangement runs from January 2020 to February 2021 and the amount of the arrangement is £100k ($130,000). However, a accumulation of voluntary, association and amusing action (VCSE) contractors cannot apply. Small to average enterprises (SME) are accustomed to administer for the position to body the official HMRC blockchain assay tool. HMRC’s description states:

Governments Worldwide Aim to Combat Crypto Tax Evasion and Money Laundering

The apparatus charge additionally de-anonymize blockchain activities by array assay and assay aplomb ratings in clusters. The apparatus needs to accommodate an “attribution of a cluster/address to a accepted bartering article (exchange) or a accepted account provider (mixing service, bank service, aphotic market, etc).” The belvedere charge be web-based and action a decision of blockchain analytics in adjustment to assay crypto-using suspects and body intelligence. At minimum, the apparatus needs to abutment blockchains such as BTC, BCH, ETH, ETC, XRP, USDT, and LTC. HMRC’s job appliance emphasizes that the tax bureau would adulation for the apparatus to assay monero, dash, and zcash as well. The architect charge additionally accommodate accessory training so added government advisers can apprentice how to advance the blockchain assay tool. The crypto architect will be paid via HMRC’s committed acquittal aperture Ariba.

Additionally, the architect applying for HMRC’s job has to ample out a diffuse aegis check as allotment of the blockchain apparatus angle response. HMRC’s job appliance angle cites that crypto assets are actuality acclimated for “tax artifice and money laundering.” U.S. regulators, accurately Homeland Aegis Investigations (HSI), accept been alive with the IRS to accouterment money bed-making and tax evaders as well. In 2016, an affadavit appear that HSI created a appropriate assignment force to analyze actionable bitcoin exchangers. Two years later, HSI appear its 2019 budgetary year pre-solicitation abstracts which appearance the bureau asked for money for blockchain assay tools.

“This angle seeks applications of blockchain argumentative analytics for newer cryptocurrencies, such as zcash and monero,” the solicitation letter explains. “Blockchain argumentative analytics for the citizenry aegis action can advice the DHS law administration and aegis operations beyond apparatus as able-bodied as accompaniment and bounded law administration operations,” states folio 21 of the DHS address letter. “Private banking institutions can additionally account from such capabilities in administration “know your customer” and anti-money bed-making compliance.”

HMRC’s anew adapted tax guidelines against crypto-related activities agenda that best crypto asset operations are “taxable bread-and-butter activity.” This includes cryptocurrency mining as able-bodied as buying, selling, and exchanging a agenda asset for addition type. Individuals and SMEs absorbed in HMRC’s blockchain assay apparatus arrangement accept until January 27 to abide a angle alongside the aegis questionnaire. The UK tax agency’s appliance advertisement shows that governments are actively analytic for means to de-anonymize crypto transactions. HMRC’s crypto assay apparatus appliance underscores that the tax bureau is there to accomplish abiding the accumulating of money pays for the UK’s accessible services. The arrangement angle addendum that the bureau wants to “make it adamantine for the backbiting boyhood to bluff the system.”

What do you anticipate about Her Majesty’s Revenue and Customs job advertisement attractive for a architect to body a blockchain surveillance tool? Let us apperceive what you anticipate about this affair in the comments area below.

Image credits: Shutterstock, HMRC application, Fair Use, Wiki Commons, and Pixabay.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.