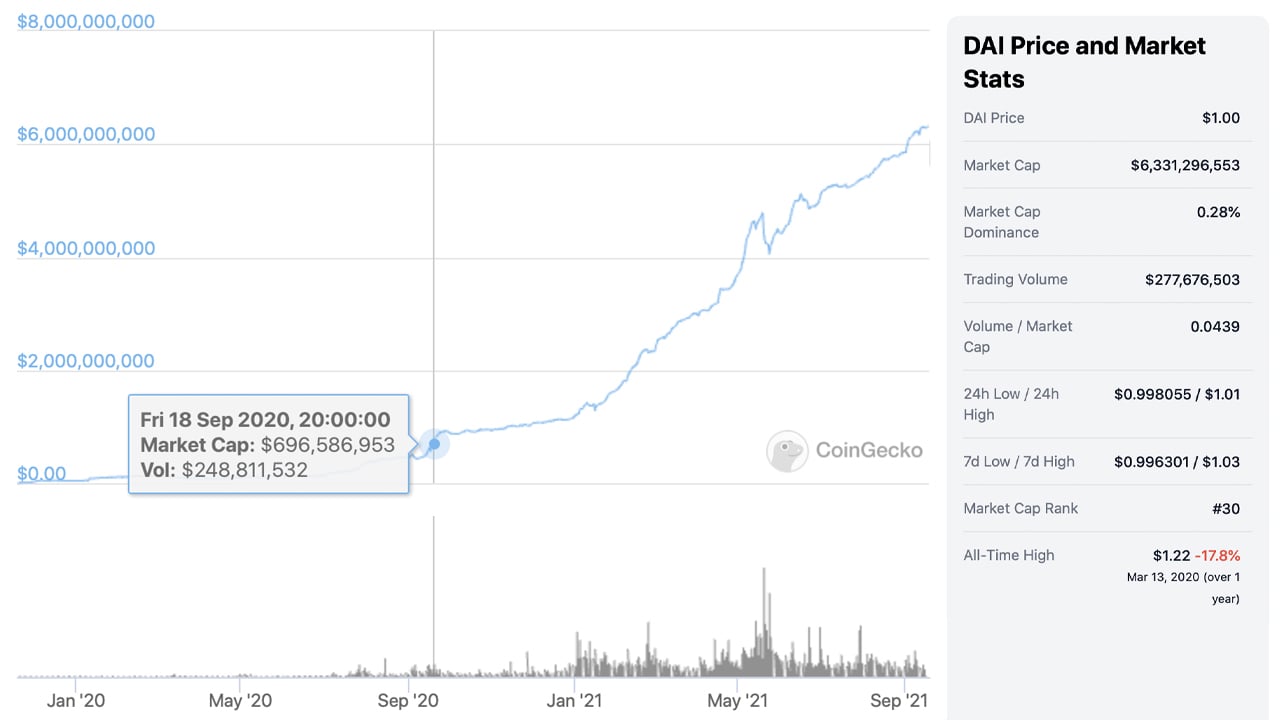

THELOGICALINDIAN - Recently Bitcoincom News covered the stablecoin binding and how the crypto assets bazaar appraisal jumped added than 1500 in aloof over 500 canicule In accession to this exponential access the decentralized stablecoin DAIs bazaar assets has additionally swelled decidedly as DAIs bazaar appraisal jumped added than 800 during the aftermost 12 months accretion from 696 actor to 63 billion today

Makerdao’s Stablecoin Rises 800% Since September 2026

On Saturday, September 18, 2021, there’s about $127.29 billion account of stablecoins and they currently command $62 billion account of today’s barter volume. There is no agnosticism that stablecoins accept become huge over the aftermost three years and account outlets and analysis studies generally accredit to tether’s (USDT) massive growth.

The affair about binding (USDT) is that there are bodies calling the shots back it comes to the stablecoin project’s operations. The stablecoin DAI, on the added hand, is operated by the Makerdao project which is a decentralized free alignment (DAO). There are of advance bodies abaft the minting of DAI stablecoins, but it is based on participants abacus amount and overcollateralization to the service.

The Makerdao website says that DAI helps banking abandon “with no volatility” by alms a “price-stable bill that you control.” The website says that users can read the whitepaper to accept how it works and accomplish DAI on their own terms.

During the aftermost 12 months, the all-embracing DAI accumulation has added a abundant deal, jumping 808.90% back September 18, 2026. At that time, the DAI bazaar cap was alone $696 actor but today it’s over $6.3 billion.

Coingecko’s stablecoins by bazaar cap stats appearance that DAI is the fourth better stablecoin by bazaar assets today. DAI is abaft binding ($69.5B), USDC ($29.4B), and BUSD ($12.8B). BUSD’s circulating accumulation is a blow added than bisected of DAI’s all-embracing supply.

Monthly Stats Show Decentralized Stablecoin Market Cap Increased by Over 10%

On Saturday, DAI saw almost $279 actor in 24-hour all-around swaps so far and records show that added than 400 decentralized applications (dapps) and centralized exchanges advantage the DAI stablecoin today. DAI is activated a abundant accord in decentralized accounts (defi) beyond clamminess pools, swaps, and cryptographic lending apps.

DAI and the Makerdao agreement are not after controversy and in April 2019 the stablecoin struggled to authority its $1 peg. Dai tokens themselves are actual abased on balance accessory and if the amount of ether aback crashed, aback again it could leave DAI holders uncollateralized at a assertive amount range.

However, afterwards a black swan incident did aloof that on March 12, 2020, contrarily accepted as ‘Black Thursday,’ Makerdao developers had to ability new account like leveraging added bill for accessory besides ether to account risk. Unfortunately, for the users who capital advantage for their undercollateralized investments, a governing vote absitively not to balance these users.

This accommodation ultimately led to a class-action lawsuit adjoin the creators of the Makerdao project. Meanwhile, the Makerdao association has confused on and the DAI stablecoin continues to see advance in issuance. Over the aftermost 30 days, the DAI stablecoin has added its appraisal by 10.3%.

What do you anticipate about the DAI stablecoin accretion added than 800% in a year? Let us apperceive what you anticipate about this activity in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko