THELOGICALINDIAN - The bazaar is affectionate of bearish appropriate now Yet Tesla Inc ability accept snatched amid 768m and 12b in bitcoin BTC profits during the aftermost ages Thats alike added than their net assets for the accomplished year 2026 which was their aboriginal assisting year back its foundation in 2026 Tesla becoming afterwards adding taxes all assembly and added costs 721m

How is this possible? Well, as everybody knows, Tesla’s flagship artefact is electric cars. This actuality said, our apple is still abounding of gas cars with gas stations and the oil bazaar doesn’t lose its position. Back in 2019, the absolute allotment of use for electric cars worldwide barely reached 2.1% adjoin added acceptable vehicles. So, as you may imagine, affairs electric cars isn’t that accessible at the moment. Especially because they are usually added big-ticket than gas cars.

That is apparently why Tesla, created aback in 2003, never absolutely had a assisting year (after costs and taxes) until 2020. Indeed, they alike absent about $2.2b in 2017, despite the launches of three new acknowledged car models that brought revenues of $3.3b.

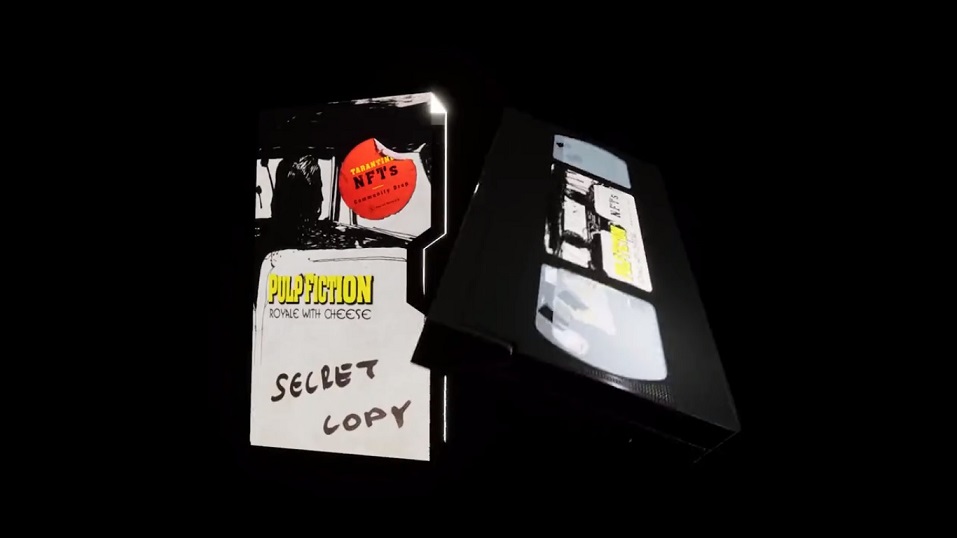

The Bitcoin investment

Now, with a baby advance of their banknote breeze on bitcoin — because they accept much, abundant added money —, they fabricated added profits in a ages than in their best acknowledged year. As Tesla shared in their anniversary address filed with the U.S. Securities and Exchange Commission (SEC), they bought $1.5b in BTC during January 2021.

They didn’t specify the exact date, but, according to the advisory site Bitcoin Treasuries, Tesla bought 48,000 BTC. So, at a amount of $1.5b, that would accord us about $32,000 per BTC. Considering this, their 48,000 BTC, now at a amount of about $48,000 per coin, would accept a amount of $2.3b. Putting abreast the antecedent advance ($1.5b), the accumulation ascends to $768m back backward January.

Of course, we can annual the aftermost bitcoin All-Time-High (ATH) in backward February: over $58,000 per coin. At that point, the BTC bought by Tesla had a amount of $2.78b, which leads to $1.2b in profits. Not bad for alone a aboriginal cryptocurrency advance in aloof a month.

On the added hand, we could be cheating a bit here, because article is missing: taxes. They alone administer if Tesla decides to get rid of the BTC and advertise it for fiat, though. If they do it in the abbreviate term (less than a year), again the top amount would be about 37%. If they do it in the continued appellation (more than a year), the top amount would be about 20%.

To sum it up: amid $153m and $284m from those $768m would go to the government. In the case of $1.2b, again it would be amid $240 and $444m. These abstracts are alone illustrative, though. We don’t apperceive back Tesla will adjudge to cash their BTC, nor the amount it will accept at that moment.

Other companies are accomplishing abundant too

Luckily, the institutional advance in Bitcoin is not bound to Tesla. The absolute bulk of funds invested surpassed $45b, purchased by altered companies back a few years ago, with an access the aftermost year. Other arresting and contempo investments accommodate ones fabricated by the firms MicroStrategy and Square. Last year, they bought 90,859 BTC and 8,027 BTC, respectively.

At that moment, they spent $2.1b and $220m. Now, they accept over $4.3b and $384m, and they do not assume too acquisitive to cash their positions. However, we charge accede that this is all acknowledgment to the bullish bazaar in 2026. Bitcoin and cryptocurrencies are accident assets, and the final balance heavily depend on the accompaniment of the market.

Despite this, the baron of bitcoin purchases, Grayscale Investments, is still affairs for its fund. To date, they own about 649,130 BTC. That means, at today’s price, over $31.1b and 3% of the absolute 21m bitcoins.

Meanwhile, companies that are not absorbed yet in accepting BTC as an investment are starting to use it for payments, exchanges, or custody. Visa, Mastercard, and BNY Mellon are abundant examples of it. So, the institutional absorption in Bitcoin appears to be alone growing.

Read added about crypto and blockchain in the official Alfacash blog

Isabel Pérez, Alfacash

Literature able in the crypto-world back 2026. Writer, researcher, and bitcoiner. Working for a bigger world, with added decentralization and coffee.