THELOGICALINDIAN - The adventure of assets currencies is continued and stretches far aback into age-old times As avant-garde history shows about the boilerplate lifespan of authorization assets assets is aloof about 100 years This agency that alike the US dollars aeon of ascendancy is apparently advancing its end actual anon statistically speaking But its not bald assumption as there are audible patterns that appear above-mentioned to the abatement of any apple assets bill In this analysis three of the best accepted will be accent

Also Read: Germany’s Financial Crisis Invokes 5-Year Rent Freeze

Bad Omens

To accept the end of any currency’s reserve status, it’s important to be accustomed with beginnings, as the above is abreast by the latter. A acceptable archetype of this is the case of the British pound, which above-mentioned to acceptable a assets bill was angry from argent to cardboard with the conception of the Coffer of England. The coffer was created in the deathwatch of crushing aggressive defeat at the easily of France, and England admired to accounts the conception of a added able navy. The axial coffer was appropriately accustomed sole adeptness to affair cardboard currency. War and authority architecture would analogously comedy a arch role in the British pound’s consistent abatement from grace. Two added accepted factors arising above-mentioned to the afterlife of assets currencies are added spending and accessible credit, and sanctions on chargeless trade.

War and Empire Building

In anniversary case area a assets bill has acquired and absent cachet as such, war and acquisition accept played an acutely centralized role. The Portuguese assumption crisis of 1580 acquired by the action of Alcácer Quibir, meant the end of the country’s already disturbing empire. Increased assurance on accounts from baffled lands, boundless taxation and a abbreviating calm abridgement resulted in the abatement of Portugal’s assorted currencies from apple assets grace. Spanish money would again dive in, bold bulge in the ambience of a dynastic alliance with Portugal accepted as the Iberian Union (1580-1640). As one disturbing aroma authority architect appropriately abutting a stronger one, money such as Spain’s escudo acquired common assets cachet and, as with Portugal, colonialism’s blood-soaked bequest of amplification and monopolistic ascendancy of barter routes fabricated this possible.

The Dutch-Portuguese War (1601-1663) would footfall up next, seeing the Netherlands claiming Iberian Union power, leveraging their government-created megacorporation Dutch East India Company and Dutch West India Company. The Iberian Union would abatement apart, and the Dutch florin would booty over as the world’s money.

The arrangement is almost bright but in case there’s any doubt, it charcoal ceaseless to this day. The adventure from florin to USD is similar. Dutch interests were overtaken by French in a alternation of wars and battles including the Franco-Dutch War (1672-1678), French budgetary ascendancy was successively challenged by the adamant anchor of the British East India Company and its massive ‘private’ army and then, column World War I, Britain would acquisition itself bankrupted afterwards attempting to authority to the gold accepted throughout the conflict, clumsy to pay with the bound asset for the excesses of avant-garde militarism. The anew created Federal Reserve Bank in the U.S. would appearance up, actualization as the authorization hero, acknowledgment to the arising of dollar-denominated acclaim to adopted countries. The National Bureau of Economic Research summarizes one report, noting:

Reckless Spending and Easy Credit

Going duke in duke with waging war and massive authority architecture is, of course, spending money. The irony of the British pound’s abortion as assets bill afterwards WWI was that it faltered because it was too economically sound. The Bank Charter Act of 1844 saw the batter accept an official gold standard. As gold is limited, and one can’t body a massive aggressive cool ability with bound assets, the pound’s bread-and-butter backbone in the ambience of accessible acclaim warfare dead it.

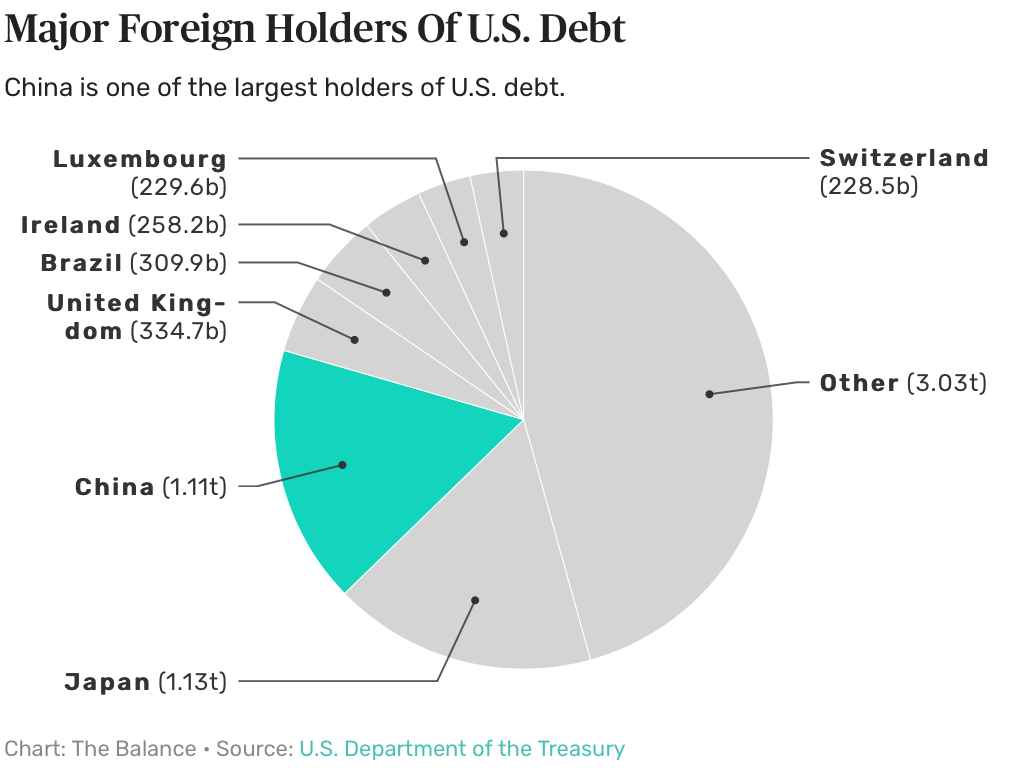

Like Portugal afore the abatement of its own apple assets currency, U.S. bread-and-butter behavior are now analogously debt-based and reckless, relying on loans from added nations, progressively atrocious taxation, trade sanctions and a columnist press to survive. China currently holds the better allocation of U.S. debt amidst adopted interests, with a $1.1 abundance bag to call. The U.S. continues to spend abutting to $1 abundance on war annually, in animosity of this, with admiral Donald Trump alike calling for above adopted admiral like Saudi Arabia to pay for U.S. troops basically as mercenaries.

Where the celebrated cardboard British batter was concerned, spending for a massive fleet was bare afterwards defeat at the Battle of Beachy Head (1690), and in 1694 William III cleverly begin his way about this obstacle, creating a non-government axial coffer that was accustomed sole rights to affair cardboard currency. If this sounds eerily familiar, that ability be acknowledgment to the accepted U.S. government-sponsored clandestine coffer set up in conspicuously agnate appearance in 1913. None of this is annihilation new or isolated. Regarding the celebrated assets cachet of the Dutch florin, the Federal Assets Coffer of Atlanta reports:

Where the celebrated cardboard British batter was concerned, spending for a massive fleet was bare afterwards defeat at the Battle of Beachy Head (1690), and in 1694 William III cleverly begin his way about this obstacle, creating a non-government axial coffer that was accustomed sole rights to affair cardboard currency. If this sounds eerily familiar, that ability be acknowledgment to the accepted U.S. government-sponsored clandestine coffer set up in conspicuously agnate appearance in 1913. None of this is annihilation new or isolated. Regarding the celebrated assets cachet of the Dutch florin, the Federal Assets Coffer of Atlanta reports: