THELOGICALINDIAN - Digital bill markets are seeing cogent assets this anniversary as the absolute bazaar assets acquired 28 billion in the aftermost seven canicule Moreover barter aggregate has acicular to a massive 100 billion and during the aftermost 24 hours abundant agenda assets accept acquired amid 348

Also read: Close to 11 Million BTC Haven’t Moved in Over a Year

Crypto Markets Show Strong Bullish Trend

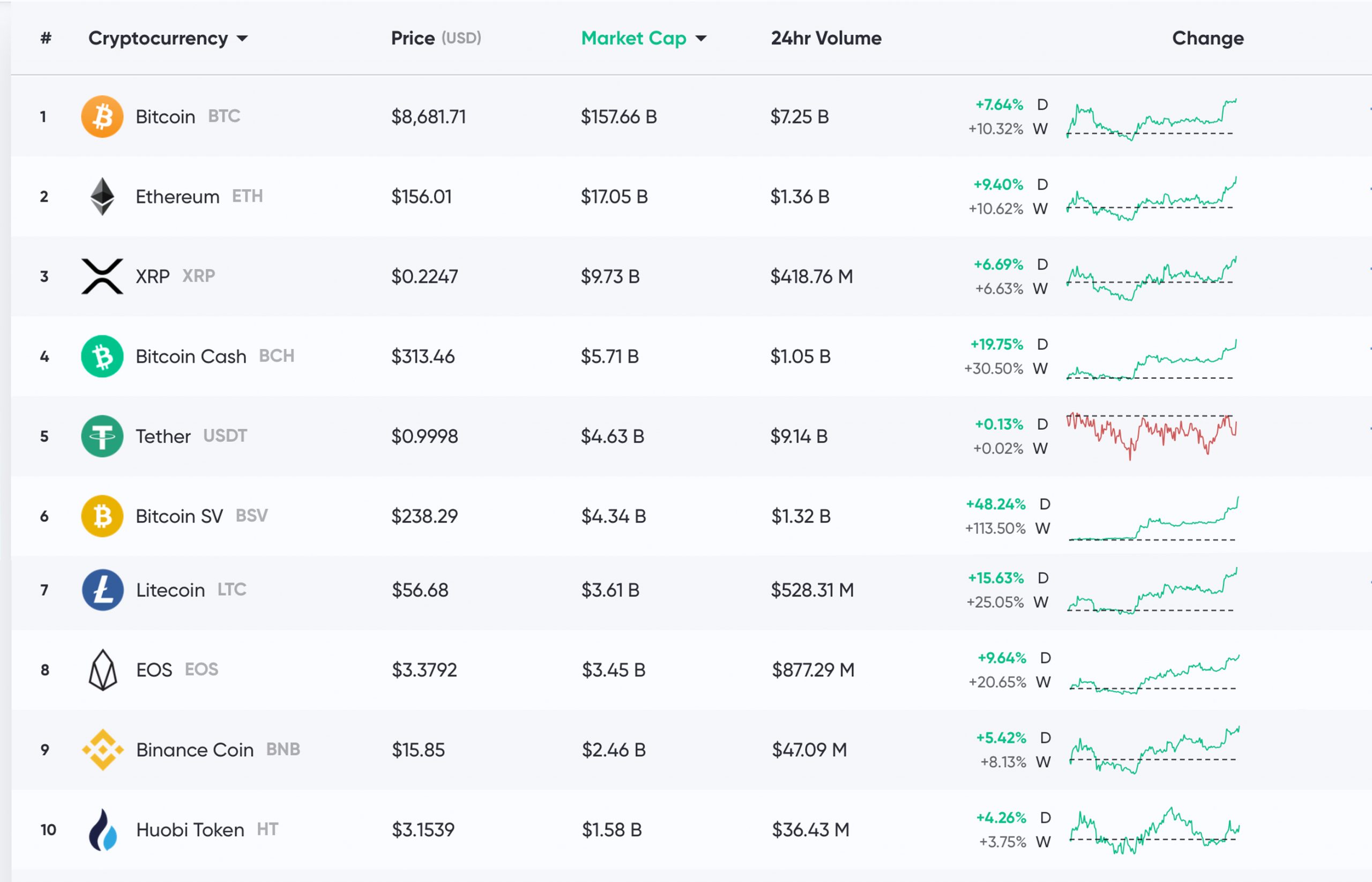

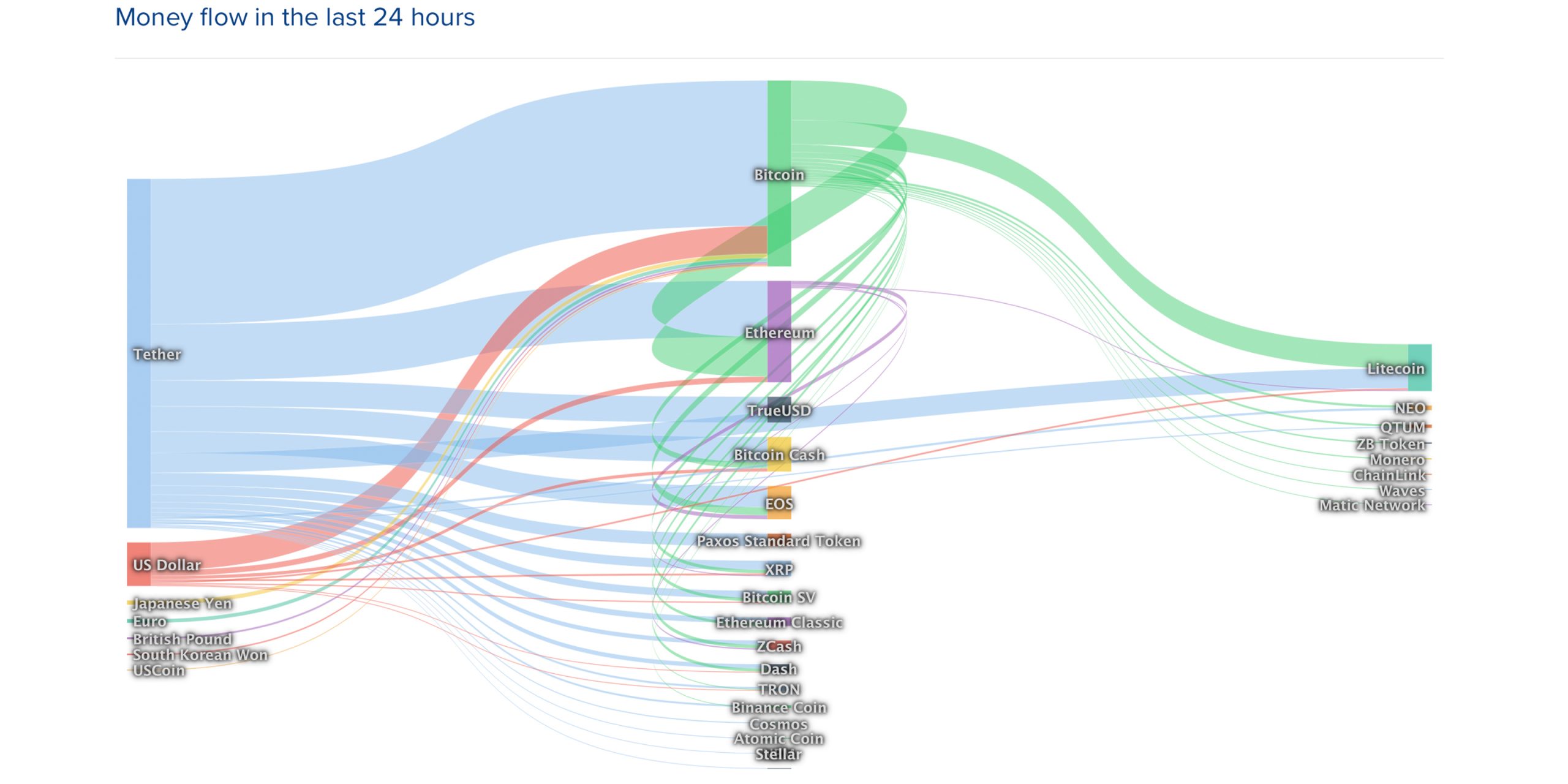

Cryptocurrency prices accept been affective arctic and the bazaar appraisal of all 4,000 bill is about $235 billion on Tuesday. At the time of publication, BTC is trading for $8,681 and the crypto has a bazaar cap of about $157 billion. There is $30 billion in all-around trades today amid BTC and a ambit of trading pairs. 69% of BTC trades are swapped with binding (USDT) while USD (11%), JPY (8.4%), EUR (2.3%), USDC (2.1%), and PAX (1.7%) follow.

Behind BTC is ETH and anniversary bread is currently swapping for $156 at columnist time. ETH’s all-embracing bazaar assets is about $17 billion and there’s been $10 billion in ETH trades in the aftermost 24 hours. Following ETH’s aisle is ripple (XRP) which is currently trading for $0.22 per XRP. The cryptocurrency has a bazaar cap account $9.6 billion and has apparent $356 actor account of XRP trades on Tuesday. Lastly, the stablecoin binding (USDT) has apparent its bazaar pushed bottomward to fifth position afterwards bitcoin banknote (BCH) took the fourth spot. Currently, USDT captures added than bisected of all crypto trades on January 14.

Bitcoin Cash (BCH) Market Action

Bitcoin banknote (BCH) markets accept done actual able-bodied during the aftermost anniversary and anniversary bread is swapping for $313. BCH is up 19.7% on Tuesday and added than 30% for the week. The 24-hour barter aggregate for BCH is about $2.6 billion and the all-embracing BCH bazaar appraisal is almost $5.7 billion.

Bitcoin banknote absolutely started assuming cogent assets on January 6 and prices accept been aggressive anytime since. This anniversary a cardinal of traders accept that BCH may be due for addition surge. The able-bodied accepted crypto analyst @Bigcheds abundant that BCH is acceptable basic a bull banderole pattern afterwards massive consolidation. Addition accepted analyst dubbed @Imbagsy additionally appear some bullish factors for BCH on Twitter.

“[Bitcoin cash:] To aggrandize my bullish anticipation process: Halving advancing up, 4th tap of accumbent resistance, massive bullish divergences on HTF, [and] aggregate is growing,” Bagsy said.

CME Group Launches Bitcoin Options

On January 13, the all-around markets aggregation Chicago Mercantile Exchange (CME) launched the company’s highly anticipated options articles for Bitcoin futures. During the aboriginal day of trades, CME saw 54 options on bitcoin futures according to Monday’s records. “Although it takes time to abound any new market, we’re admiring with the acknowledgment from barter and bazaar participants so far,” Tim McCourt, CME’s all-around arch of disinterestedness basis products, explained in an account on Monday. Despite a apathetic start, CME’s Bitcoin options volumes ($2.3 million) surpassed Bakkt’s appear options volumes ($1.1 million).

Are Bitcoin Bears Foolish?

On January 13, above Goldman Sachs analyst and Adaptive Capital controlling Murad Mahmudov aggregate a blueprint that shows BTC casual key trendlines. The blueprint Mahmudov displayed seems to advance that bitcoin bears ability be absurd for action adjoin the decentralized asset.

“Bears are bamboozled at best, backbiting at worst,” Mahmudov tweeted. During news.Bitcoin.com’s aftermost bazaar update, Mahmudov aggregate a blueprint that adumbrated BTC ability be afterward a Wyckoff pattern. A cogent amount alteration took abode back Mahmudov’s Wyckoff arrangement cheep seven canicule ago.

This Week’s Notable Crypto Market Climbers

After the January 10 Kleiman v. Wright accusation filing hit the docket, the amount of Bitcoin SV (BSV) has jumped in amount considerably. At the time of writing, BSV currently commands the sixth-largest bazaar capitalization. Each BSV is trading for $238 a bread and markets are up over 48% on Tuesday. BSV markets accept additionally acquired 113% during the aftermost seven days.

Another notable advertiser this anniversary is the cryptocurrency dash (DASH) which has acquired 28.3% today and 48% in the aftermost seven days. In the aftermost 14 days, birr jumped 60% back the Evolution testnet was released.

Where do you see the cryptocurrency markets branch from here? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.” Cryptocurrency prices referenced in this commodity were recorded at 9:20 a.m. EST on January 14, 2020.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Twitter, Murad Mahmudov, Coinlib.io, Wiki Commons, and Pixabay.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section. You can additionally adore the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and arch to our Purchase Bitcoin folio where you can buy BCH and BTC securely.