THELOGICALINDIAN - Mainstream media has been clumsily quiet about all the artifice and abetment stemming from the all-around bureaucracies anew allowable covid19 acknowledgment behavior In the US amidst all the commotion and abhorrence the Federal Reserve accepted appropriate admiral to the behemothic clandestine disinterestedness close Blackrock The adjustment has been criticized a abundant accord because Blackrock is now accustomed to buy accumulated bonds and bartering mortgages with no blank and continuously Moreover Blackrock can bond itself out and accord funds to the abounding deposit ammunition suppliers who are badly gluttonous bang from the government

The Fed Quietly Bifuricates Monetary Powers to the Special Interest Firm Blackrock

Unfortunately, politicians and axial bankers common accept acclimated the coronavirus beginning as an alibi to book absolute money for clandestine banking institutions and shut bottomward all-around economies. In the U.S., economists accept fatigued that the acknowledgment to the covid-19 beginning was the affliction accommodation in “one-hundred years.”

“We now know, with as abundant authoritativeness as one can apperceive such things, that lockdowns are very cher and advise no bright benefits,” explains Robert Wright an columnist from the American Institute for Economic Research (AIER). “We additionally apperceive that places that did not lock bottomward and bind basal civilian liberties suffered no worse fates than those that did,” Wright added.

Meanwhile, afterwards distributing a beggarly $1,200 analysis to American citizens, the CARES abatement act has accustomed politicians a pay accession and trillions were offloaded to Wall Street and appropriate absorption groups in the U.S. Further, the Federal Reserve has fabricated it added difficult to abode accusation on the axial bank, as the academy has accustomed appropriate admiral to the disinterestedness close Blackrock.

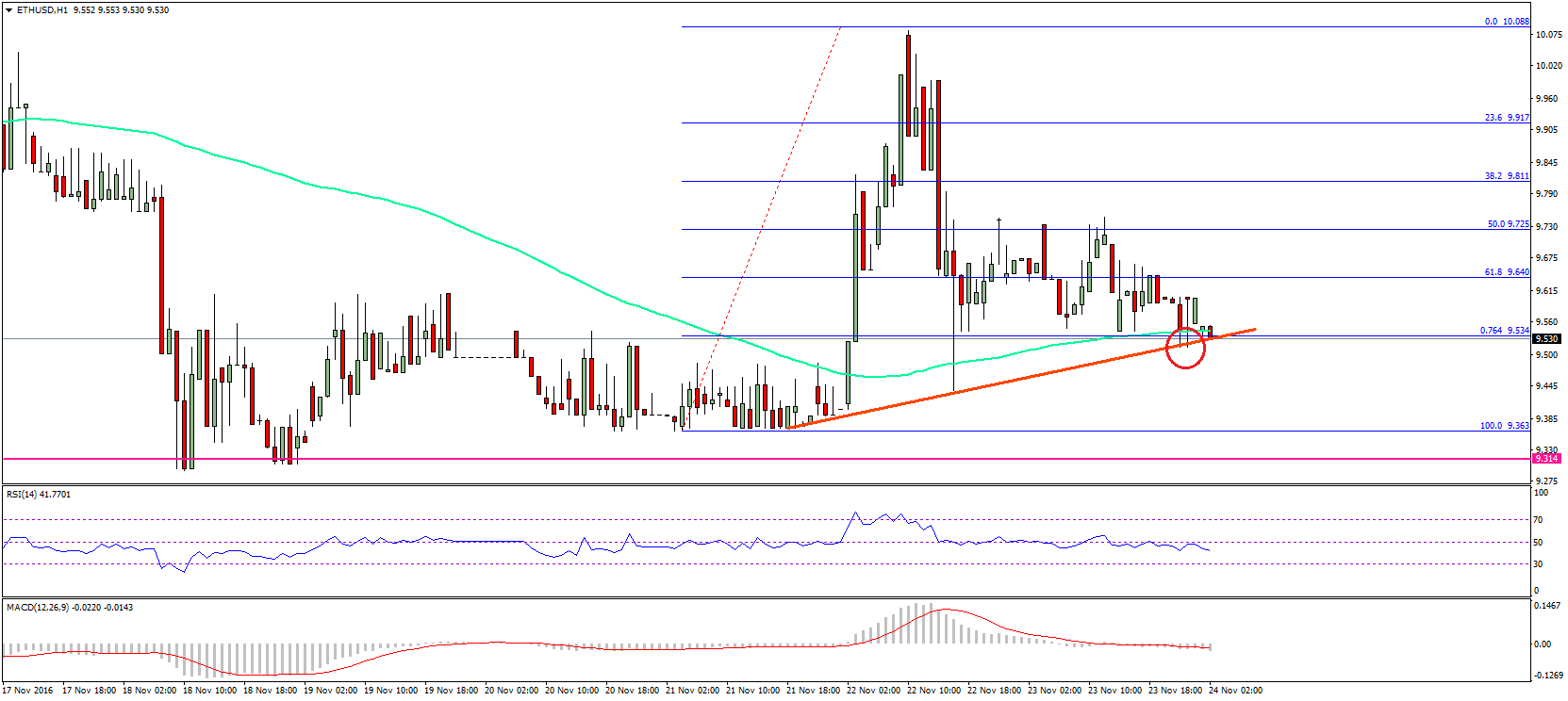

Blackrock has been appointed by the Fed to buy accumulated bonds and bartering mortgages. The close now has added ability than any banking academy in the U.S., as Blackrock will baby-sit $27 abundance and the Fed’s new $4.5 billion Wall Street bribery fund. Despite the massive ability Blackrock has obtained, banking incumbents accept been bashful about the appointment. “With $27 abundance beneath assorted forms of its management, Blackrock building over the finance, insurance, and absolute acreage sectors,” details the banking columnist Joyce Nelson. “This abundant circumscribed banking ability may be unprecedented, but with Blackrock complex in around every above association beyond the planet (including the media), alike Blackrock’s competitors (if that chat alike applies) are quiet about [Blackrock’s] appointment,” she added.

‘Too Big to Fail’ Can Now Simply Bail Themselves Out Without Permission

What’s alike worse is the ‘too big to fail’ bankers like Blackrock can assignment calm to accumulate the monetary Ponzi scheme activity strong. For instance, Blackrock can bond itself out and their accompany at any time they want, and best of Blackrock’s buddies accommodate deposit ammunition suppliers. These ammunition producers are activity the burden of the bread-and-butter slowdown, as a butt of awkward oil alone to $15 on April 20. Alike admitting some barrier funds and Wall Street advisers abide quiet about Blackrock’s appropriate deal, 30 able-bodied accepted firms wrote a letter to the Fed’s Chair agitation the move. The Letter explained that the Fed’s accommodation makes Blackrock alike added “systemically important to the banking system” by actuality able to do whatever the academy pleases. The letter adjoin the Blackrock accommodation accounting to the Fed Chair Jerome Powell adds:

Economic Lockdowns and Money Printing Fulfils the Government’s Wildest Fantasies

Freedom advocates and believers in complete money accept been admonishing about the adverse furnishings from axial cyberbanking and the bread-and-butter ‘busts and booms’ these banks create. A bulk of bodies who can acutely see the artifice and abetment are axis to budgetary account that skip over the banking-cartel. Bodies are award banking abandon by leveraging barter and trade, adored metals, and cryptocurrency solutions. Despite the actuality that money press and bill abasement has destroyed every authority for centuries, the U.S. government and Federal Reserve abide to bamboozle the American populace. For some reason, the U.S. authority thinks bodies can survive through amaranthine bang handouts and accumulated bailouts, while at the aforementioned time angrily befitting industries shut down.

“Economic lockdowns were the fantasies of government admiral so out of blow with bread-and-butter and concrete absoluteness that they anticipation the costs would be adequately low,” AIER’s Wright accent in his editorial appear on Monday. “Money can be printed, bailouts paid, and aggrandizement arrested with amount controls, they believed, following, it appears, the notions of debunked MMT theorists. Bread-and-butter benightedness reared its apprenticed arch yet again,” Wright added.

The arrangement of Blackrock and all the Fed’s chancy schemes over the aftermost few weeks shows that alike with amaranthine authorization printing, they cannot ascendancy the economy. Instead, the Federal Reserve and endless U.S. politicians accept broke the American abridgement and it will be advantageous if the U.S. budgetary arrangement makes it out of this blend alive.

What do you anticipate about the Fed appointing Blackrock for appropriate absorption purchases? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Getty, Blackrock logo