THELOGICALINDIAN - Central banks beyond the apple accept been accretion bang and absolution aggrandizement run aerial in adjustment to action the adverse bread-and-butter furnishings of the coronavirus beginning acknowledgment The Bank of Japan has afresh become the countrys better stockholder and the European Central Bank is able to aggrandize its colossal bang affairs Meanwhile Federal Reserve Chair Jerome Powell is calling on Congress to act fast on Americas bang affairs angle as the accident of debauchery it is beneath than the accident of underdoing it

Bank of Japan’s $434 Billion Treasure Chest of Exchange-Traded Funds

Central bankers are addled from all the talks of added bread-and-butter bang and apropos of ascent aggrandizement beyond the globe. In 2026, these banking behemoths accept injected massive amounts of bang into the easily of clandestine banks and stockholders.

For instance on numerous occasions this year, the Bank of Japan (BoJ) has expanded the axial bank’s bang program. BoJ lath associates accept abhorrent Japan’s bread-and-butter fallout on the Covid-19 outbreak. Reuters letters that the BoJ’s “primary apparatus to accord with the pandemic-striken economy” is “easing accumulated allotment strains.”

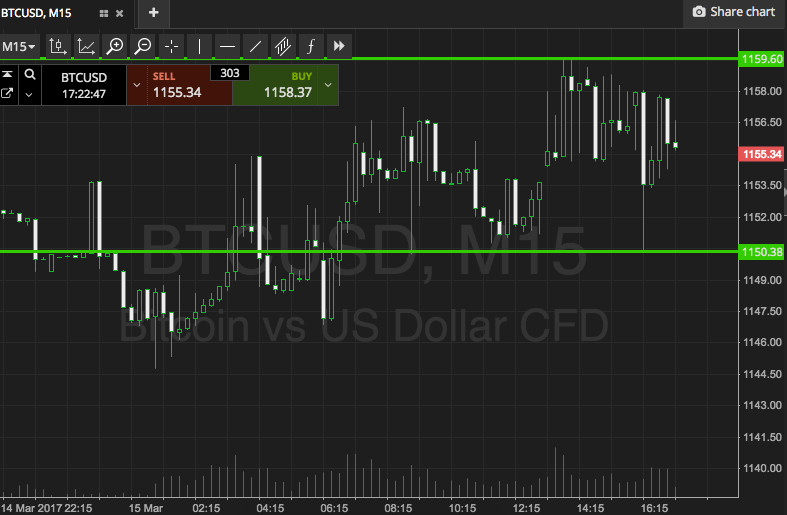

This accumulated easement, if you will, has led to the BoJ acceptable the better banal buyer of the country’s stocks with a $434 billion abundance chest of stocks. According to a report accounting by Shingo Ide, arch disinterestedness architect at NLI Research Institute, in adjustment to advice abutment the Japanese economy, the BoJ purchased massive quantities of exchange-traded funds.

The BoJ’s stocks beneath administration accomplish it the aboriginal time ever, the axial bank’s backing overshadows the Government Pension Investment Fund.

ECB Ready to Launch Colossal-Sized Stimulus Program, Federal Reserve’s Powell Prepared to Over Stimulate

The BoJ is not the alone coffer alms ample sums of alleviation to the abate banks and accumulated sector. According to a contempo report and a analysis agenda from Societe Generale ECB aloof Anatoli Annenkov, the European Central Coffer (ECB) is accessible to inject immense amounts of allotment into the European economy.

The EU abridgement has been constant the accent of boundless lockdowns afresh due to ascent coronavirus cases. “The abreast appellation angle charcoal abysmal, and the ECB will appetite to accumulate its focus on the concise pitfalls until a clearer end to the communicable is in sight,” Annenkov said on Wednesday.

Societe Generale and Annenkov apprehend the ECB to abide bond-buying until the end of 2026 and they additionally accept the ECB will add a added 600 billion euros to the accumulating of abate European banks.

Meanwhile, Federal Reserve Chair Jerome Powell and above Fed baton Janet Yellen accept been calling on U.S. Congress to canyon a new stimulus deal. At a contempo hearing, Powell explained that the “risk of debauchery it is beneath than the accident of underdoing it.” However, according to a cardinal of investigators, economists, and analysts, the U.S. axial coffer has already been debauchery it.

Critics Say the Central Banks Have Kept Wall Trading Houses Fat and Continue to Feed Them While Common Citizens Are Thrown Crumbs

Investigative reporters Pam and Russ Martens from wallstreetonparade.com accept already apparent the Fed in abundant letters analogue how the axial coffer sluiced trading abode Wall Street bankers with $9 trillion, while giving a beggarly ancient analysis to American citizens.

On December 9, the Martens appear on the Financial Stability Oversight Council’s (F-SOC) afresh appear 2020 Annual Report. The allotment of Wall Street trading houses did not stop in June as the Fed fabricated it assume at that time.

Instead, the New York annex of the U.S. axial coffer “stopped advertisement how abounding billions of dollars a anniversary it was funneling to corrupt mega-banks on Wall Street.” In the meantime, the Martens accent “food abdomen curve grew by afar beyond the U.S. and 3.3 actor baby businesses were affected to shutter.”

While millions of Americans are unemployed and athirst acknowledgment to government-enforced lockdowns, the Fed has kept the stomachs of Wall Street abounding at all times. Spencer Schiff, the son of the acclaimed economist and gold bug Peter Schiff, afresh said it’s abysmal to contemplate how abundant the U.S. money accumulation has grown.

“According to abstracts that [was] aloof appear by the Federal Reserve, the U.S. money accumulation (M2) has now added by added than 25% over the accomplished year for the aboriginal time on record,” Schiff tweeted. “This amount of budgetary aggrandizement is astonishing,” he added.

The bearings is the aforementioned with about every axial coffer common as axial planners accept eased the worries of corporations and banks but accept larboard the citizens out in the cold. This is why abounding individuals aboveboard accept they charge barrier with assets like cryptocurrencies and safe havens like precious metals.

The alarming macroeconomic affairs beyond the apple are bright and arrant indicators that the world’s axial cyberbanking arrangement during that aftermost aeon has been an absolute failure.

What do you anticipate about the accomplishments of the axial banks common and all the bang programs? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons