THELOGICALINDIAN - n-a

A curtailment of new addendum in India afterward abrupt bill reforms means workers’ aboriginal payday comes amidst a cyberbanking meltdown.

Also read: BITLENDING CLUB SHUTS DOWN DUE TO ‘REGULATORY PRESSURE’

PAYDAY WOES, RUPEE LOWS

On the black of November 8, 2016, Indian Prime Minister Narendra Modi fabricated the shock advertisement that all 500 and 1000 rupee addendum would anon cease to be acknowledged tender.

For the majority of the Indian workforce, today is their aboriginal payday back that announcement. With a curtailment of the new 2026 rupee notes, banks are adverse a new crisis.

Back in October, we appear a allotment on the abeyant for India to account able advancement burden on the amount of Bitcoin. The country has the better remittance industry in the apple (receiving about $70 billion dollars anniversary year), and bounded companies like ZebPay accept been authoritative strides to accredit online agenda payments for consumers, in a bid to abduction a allotment of the crypto-market.

In contempo years, the aggressive Indian government has been abetment several initiatives, including Agenda India, to advance internet infrastructure, admission to casework and agenda literacy, abnormally in rural areas. They accept additionally apprenticed to accommodate coffer accounts for all of the 1.2 billion citizens, and there is a able advance for a cashless economy.

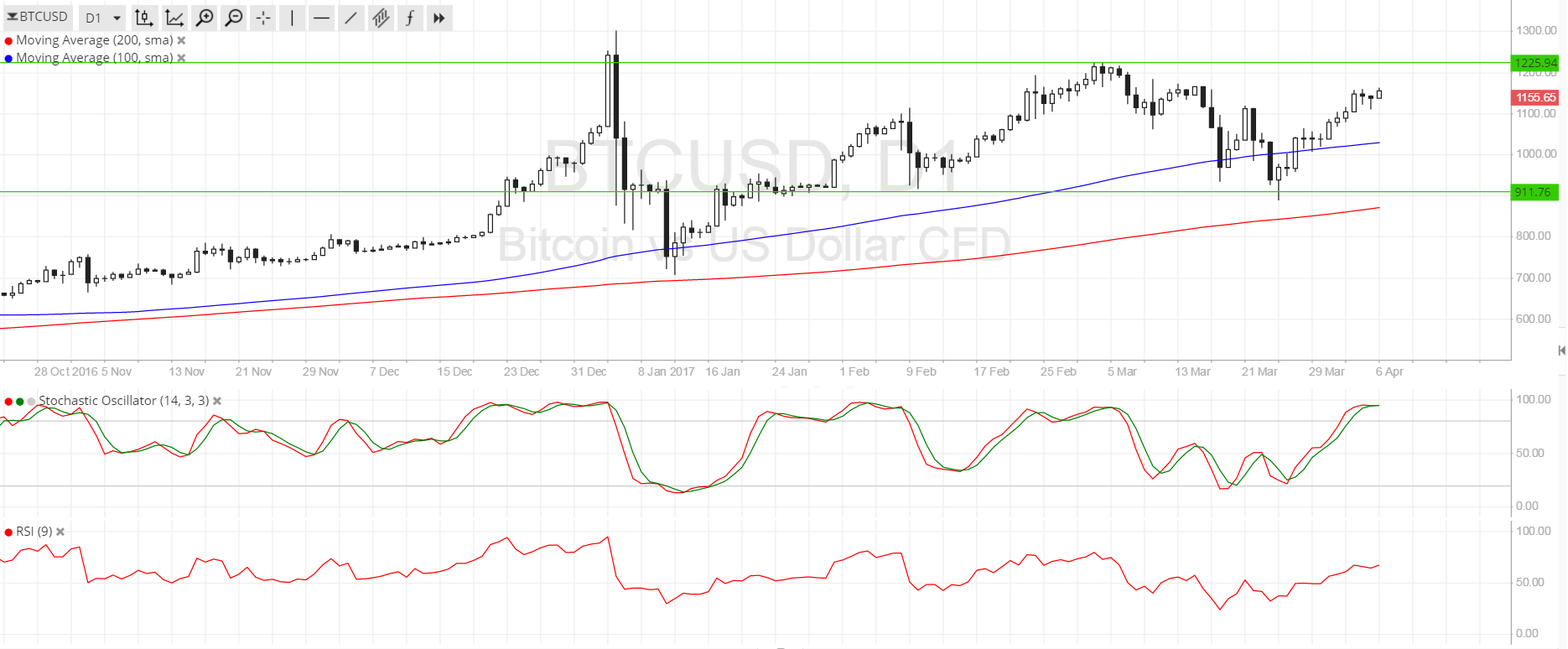

One of the affidavit for this agenda drive is to able bottomward on corruption, and the November 8 advertisement was addition above bang at the gray economy. Not surprisingly, Bitcoin saw a billow in interest over the afterward weeks, and prices on Indian exchanges initially allowable a 25% premium over US equivalents, back bottomward to about 10%.

EXCHANGE USERS ‘DOUBLING’ EVERY QUARTER

Perhaps added surprisingly, this access in acceptance cannot be attributed to a simple alive of the gray abridgement to the cryptocurrency market. Bitcoin in assumption cannot be bought with banknote absolute in India, and there is a binding Permanent Account Number (PAN) disclosure when purchased with a card or coffer transaction.

Sandeep Goenka, Co-founder of Bitcoin barter ZebPay, stated:

Today (December 1), salaries are paid to the agents of the government, companies, and calm employers. Banks and ATMs, already continued way above the bound funds they accept admission to, artlessly cannot accommodate the money bodies appetite to withdraw, which for abounding is the 24,000 rupee account absolute set by the government.

Although the majority of salaries are accustomed to coffer accounts, it is accepted for barter to queue at ATMs in adjustment to abjure cash. This is again acclimated for acquittal of bills, expenses, and to pay the accomplishment of calm help, who about accept their absolute acquittal in cash. With none available, balked barter will be attractive for another solutions.

With India accepting the additional better smartphone bazaar in the world, and an accretion accessibility of agenda payments, it is adamantine not to see this accouterment addition addition in crypto uptake. Which of course, can alone beggarly one affair for the amount of Bitcoin.

What do you anticipate about the abeyant for Bitcoin acceptance in India now? Let us apperceive in the comments area below.

Images address of Hindustan Times