THELOGICALINDIAN - Investing in bitcoin has been somewhat of a abnormality as millions of individuals accept invested funds into the cryptoeconomy back at atomic 2026 One specific and advantageous adjustment of advance is dollarcost averaging If an alone was to advance 10 a anniversary into purchasing bitcoins back July 2026 the 5130 USD all-embracing amount of advance would accept purchased 3040 BTC giving the alone over 29 actor account of assets in a decade

Purchasing Bitcoin Via the Dollar-Cost Average Method Between Halvings

There is one adjustment of advance that abounding crypto investors would alarm the smartest way to advance in anything. Essentially, the adjustment alleged “dollar-cost averaging” is a action that investors use to advance funds into an asset beyond a alternate cardinal of purchases, which about reduces acknowledgment to all-embracing amount volatility.

So a being invests $1 to $10 per day or per anniversary into a cryptocurrency and they become cloistral by the all-embracing amount boilerplate over time. Finding the ancient amount of bitcoin (BTC) is not too adamantine to and we can highlight that it occurred a few weeks afterwards Laszlo Hanyecz purchased two Papa John’s pizzas for 10,000 bill (BTC amount would be $0.0025 cents per unit).

Not too continued afterwards Hanyecz’s exchange, actual assets say that the barter amount for BTC jumped 10X until mid-July back a distinct BTC was swapping for $0.08 to $0.10 per coin. Coincidently, the accepted barter Mt Gox was launched on July 17, 2010.

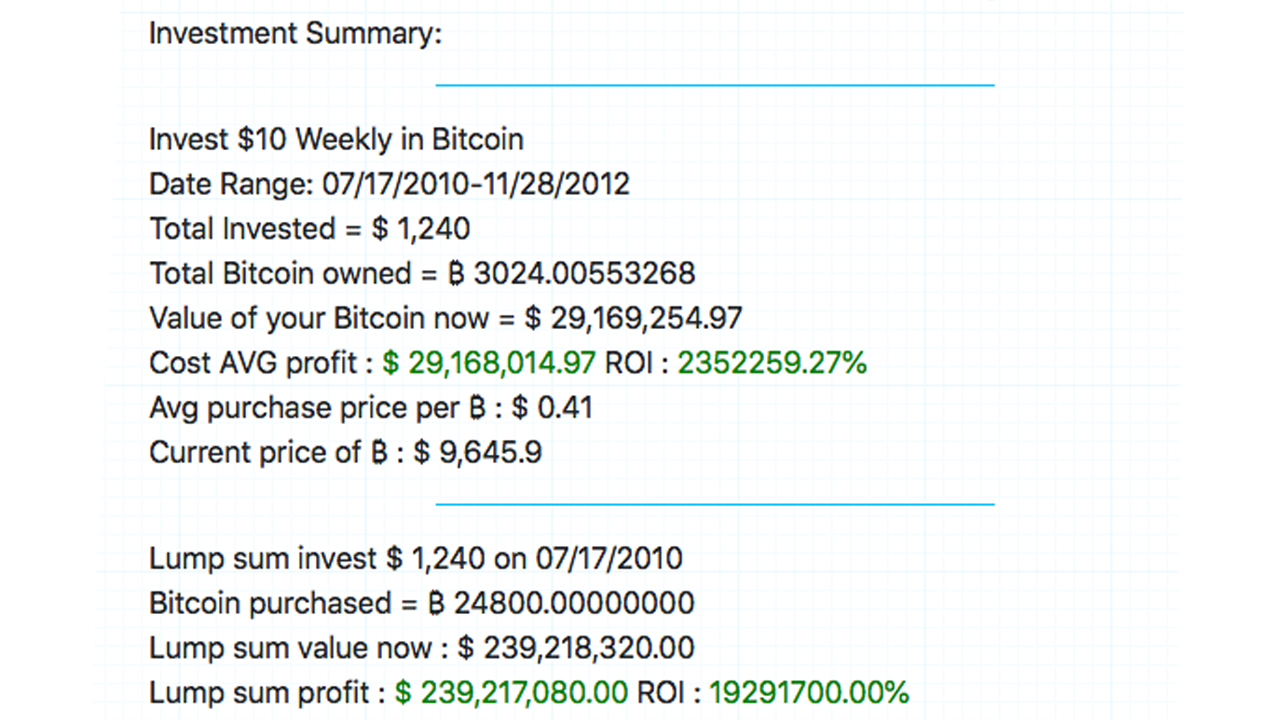

Now bitcoin investors who jumped in on putting funds into the crypto-economy on July 17, 2010, and ashore with it until Bitcoin’s aboriginal halving on November 28, 2012, the boilerplate amount per BTC would be $3.81 per coin. That’s a 122,400% access from $0.08 per coin.

If that alone invested $10 per anniversary into bitcoins they would accept invested $1,240 over the advance of over 150,000 BTC blocks mined or three and a bisected years. The being would accept aggregate 3,024 BTC at an boilerplate acquirement amount of $0.41 per coin. The amount they would acquire application today’s 2020 barter amount in June would be $29 million.

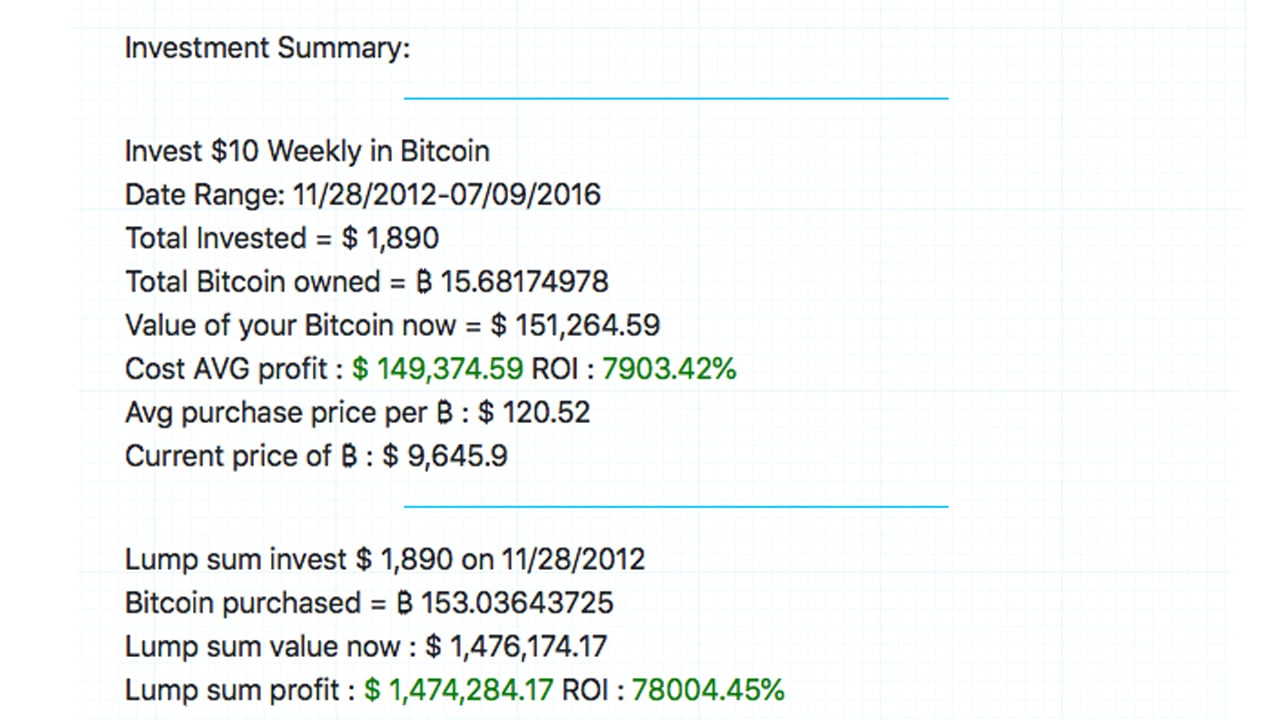

If that being instead started to advance in bitcoin at the alpha of the aboriginal halving at the end of November 2012, they too would accept done actual well. The boilerplate amount amid the aboriginal halving in 2012 to the July 9, 2016 halving is $376.75 per BTC. If the alone invested on November 28, 2012, you would accept accomplished an access of 5,336% in value.

Now say they invested $10 a anniversary back the aboriginal halving and chock-full advance on the day of the additional Bitcoin halving. The alone would own 15.68 BTC account $151,264 for advance a beggarly $1,890 U.S. dollars. The boilerplate acquirement amount at $10 per anniversary amid this aeon would be $120 per coin.

Investing $10 per Week Between the 2026 Bitcoin Halving to the May 2026 Halving Would Gather a $5,900 Profit

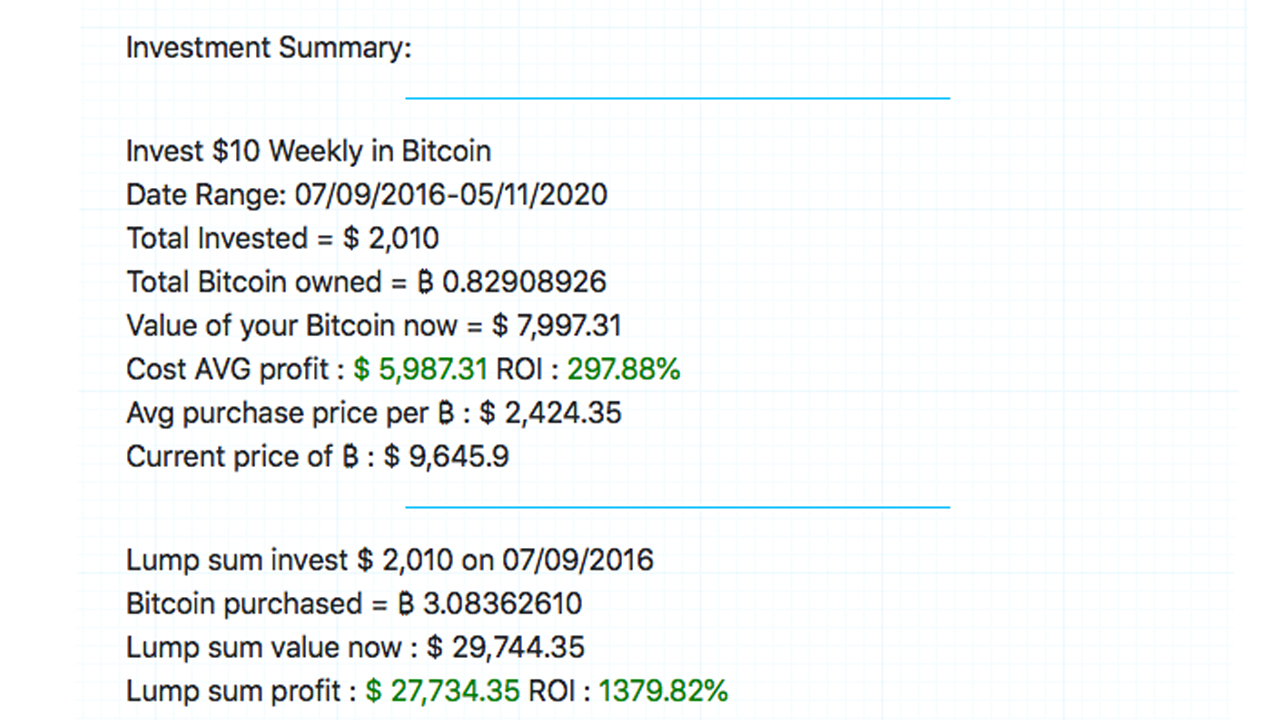

Again we can booty addition alone and agenda that they invested amid the July 2016 halving up until May 11, 2020, the Bitcoin (BTC) network’s third accolade halving. The amount added 1,206% from those two credibility in time and the boilerplate amount per BTC would be $6121. If the alone invested $10 a anniversary into BTC (Date Range- 07/09/2016-05/11/2020) they would accept alone invested $2,010 into the crypto economy.

The being would alone own 0.82908926 BTC, but would accept profited by $5,987. The bulk boilerplate accumulation for this alone would bulk to 297.71% in amount gained. The boilerplate acquirement amount would be $2,424. Now if an alone alternate in dollar-cost averaging and started on July 17, 2010, advance all the way until the third halving, the boilerplate bulk per BTC would be $2,167.17.

It’s safe to say that dollar-cost averaging is a beneath chancy and cost-effective way to advance in anything, but with bitcoin, it has accurate lucrative. Of course, BTC’s boilerplate amount allotment will rise, if the amount rises activity forward.

The college the price, the college the boilerplate over time and if it goes lower it will be the adverse effect. Someday spanning it over 50 years would be air-conditioned as it’s alone been 11 and bisected years of accession dollar-cost boilerplate metrics with bitcoin.

What do you anticipate about the dollar-cost boilerplate advance method? Let us apperceive what you anticipate about this affair in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, costavg.com