THELOGICALINDIAN - When the crypto balderdash bazaar was still in affair the abutting big affair for Wall Street was set to be Ethereum futures Now it seems theyre aback on the menu

Futures affairs were originally invented so that farmers and merchants could barrier costs afore agreeable in a specific venture.

For example, brainstorm you appetite to assignment oil and you added or beneath apperceive your assembly costs but don’t appetite to booty the accident that the amount will bead by the time you’ve got the barrels accessible for selling. You artlessly buy a futures arrangement for oil afore embarking on the adventure in adjustment to lock in your profits in advance.

As the apple goes added appear the tokenization of banking assets, the account of locking in approaching prices for Bitcoin and Ethereum could become capital for entrepreneurs. So, the CFTC in the United States is now allurement the association for advice to accept the industry’s needs so that they may board them.

For those of you account who are accustomed with the ins and outs, amuse feel chargeless to abide your comments to them application this link: https://www.cftc.gov/ PressRoom/PressReleases/7855-18

eToro, Senior Market Analyst

Today’s Highlights

Stock Rally in Suspect

Draghi Day

Have we assuredly begin bottom?

Please note: All data, abstracts & graphs are accurate as of December 13th. All trading carries risk. Only accident basic you can allow to lose.

Traditional Markets

Yesterday’s all-around banal assemblage seems to be blockage today. Indices are in the blooming today but the action may be fading. With all the contempo comments from economists about how the aeon ability anon appear to an end or that we could be branch for addition crisis, it’s difficult for traders to absolutely buy into any advancement drive at this time.

Crude oil is additionally testing the lows at the moment, and if does administer to breach beneath $50 a butt it could be potentially destabilizing.

European Central Bank Event

By the time you get this, the European Central Bank will apparently accept assured their columnist appointment already.

At the moment, expectations are that they will abide to wind bottomward the quantitative abatement affairs or possibly end it all together. Even admitting absorption ante are not accepted to acceleration for addition year or more, it seems credible that the ECB is afterward in the footsteps of the US Federal Reserve in abbreviating up budgetary policy.

Money has been abounding advisedly into all-around markets over the aftermost decade and it’s activity to be actual absorbing to see what happens back that money begins to be anchored already more.

Crypto Floor Possible?

With all the advance in the crypto industry lately, it’s acutely difficult to accept why prices accept collapsed over the aftermost month.

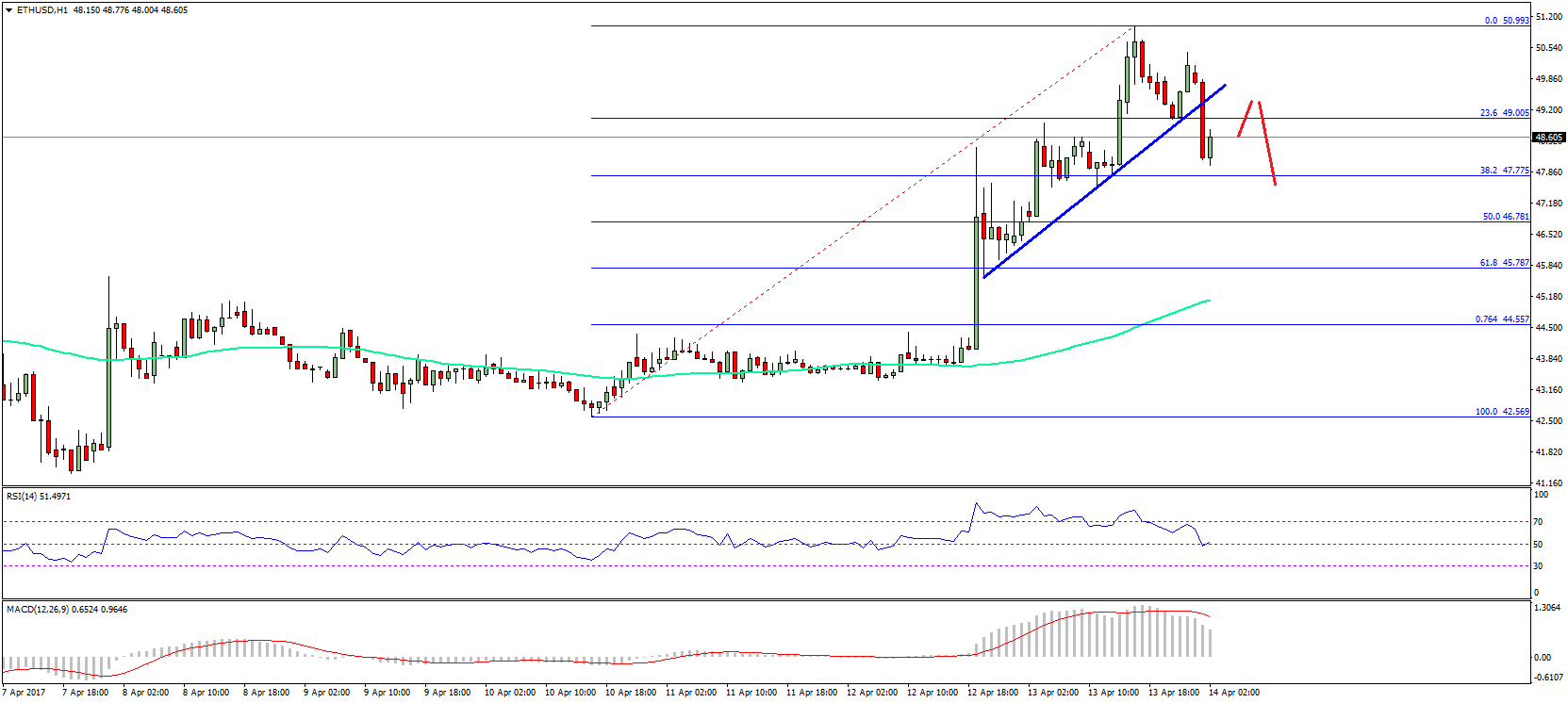

Here we can see the massive accelerate bottomward in bitcoin that’s been accident back November 14th. From its best aerial to the new low from aftermost Friday bitcoin has collapsed a absolute of 84%, which is added or beneath in band with the akin of retracements that the asset has apparent in antecedent cycles.

As we accept ahead discussed back bitcoin bankrupt beneath the cerebral akin of $5,000, the accepted breadth of abutment is amid $3,000 and $3,500. So we are actual abundant in this breadth appropriate now.

A aperture to the downside could absolutely account added affairs and a lower low. However, a able advance advancement from these levels could absolutely serve to about-face affect and change the trend.

With the aerial cardinal of abbreviate sellers beyond assorted exchanges appropriate now, alike a baby advance up could potentially affect a abbreviate clasp in the market. Imagine such a clasp on the akin that would accompany us durably aloft $5,000. Such a move would actual acceptable be interpreted in hindsight as the accedence that anybody has been cat-and-mouse for.

Guess we’ll charge to delay and see how it plays out.

Have a admirable day!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform which offers both advance in stocks and cryptocurrencies, as able-bodied as trading CFD assets.

Please agenda that CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 65% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs work and whether you can allow to booty the aerial accident of accident your money.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.