THELOGICALINDIAN - Update This commodity has been afflicted to add three archive that were larboard out during the alteration process

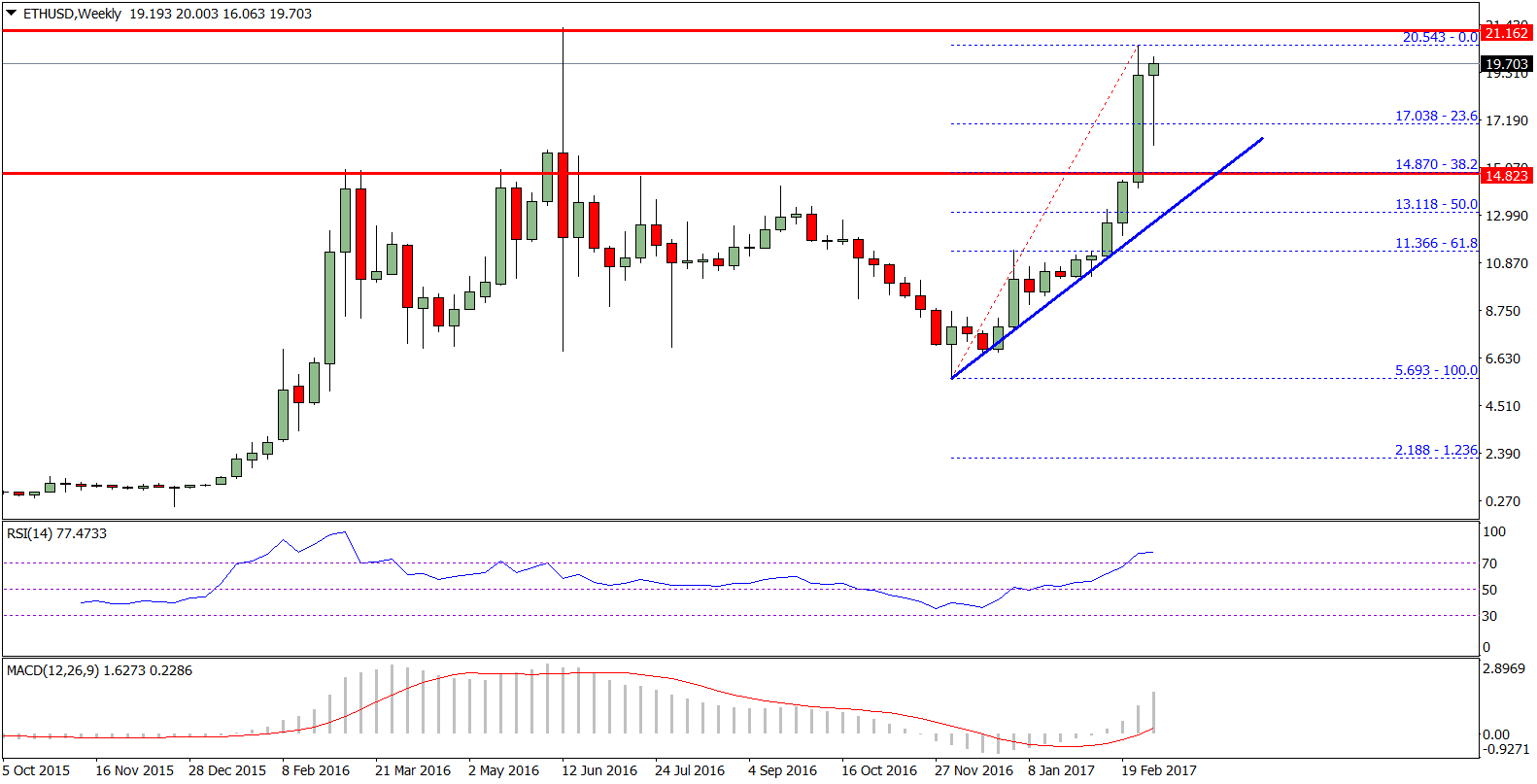

In 2015, Bitcoin performed awfully able-bodied both as a bill and as a commodity. Interestingly, the cryptocurrency Bitcoin, which is additionally classified as a commodity, has alike defied the well-held microeconomics assumption that preaches that: “Commodities about chase an changed accord with the amount of the dollar. When the dollar strengthens adjoin added above currencies, the prices of bolt about drop. When the amount of the dollar weakens adjoin added above currencies, the prices of bolt about move higher,” says Bolt Expert Chuck Kowalski. But, surprisingly, at the end of 2015, Bitcoin’s amount added and was heralded as the world’s best-performing currency.

Also Read: 2015 Proves Bitcoin Is Here to Stay

USD vs. Commodities vs. Bitcoin

In 2015, the amount of Bitcoin added about 37 percent adjoin the U.S. dollar. Simultaneously, “The amount of the US dollar rose throughout 2015 announcement assets in the 10 percent to 12 percent ambit adjoin bill indexes,” according to Dr. John M. Mason.

In 2015, the amount of Bitcoin added about 37 percent adjoin the U.S. dollar. Simultaneously, “The amount of the US dollar rose throughout 2015 announcement assets in the 10 percent to 12 percent ambit adjoin bill indexes,” according to Dr. John M. Mason.

These two facts assume to announce a absolute accord amid Bitcoin, which is classified as a commodity, and the U.S. dollar. This absolute accord is hasty because it indicates a accessible abandonment from the microeconomic assumption that calls for an changed accord amid the backbone of U.S. dollar and the amount of commodities.

But is Bitcoin a commodity? Authorities anticipate so. Granted, Bitcoin is not a archetypal commodity, but it was nonetheless clearly classified as a article by the U.S. Article Futures Trading Commission (CFTC) in September 2015. Earlier, in March 2014, the Internal Revenue Service (IRS) had disqualified that Bitcoin should be advised as acreage for federal tax purposes.

Certainly, there is a aberration amid economics behavior and law. Just because Bitcoin has been accurately allowable as a commodity, it does not beggarly that the bazaar will amusement it as such. However, alike if Bitcoin were acting as a bill rather than a commodity, it is arresting that Bitcoin’s amount still went up, while the amount of best currencies went down.

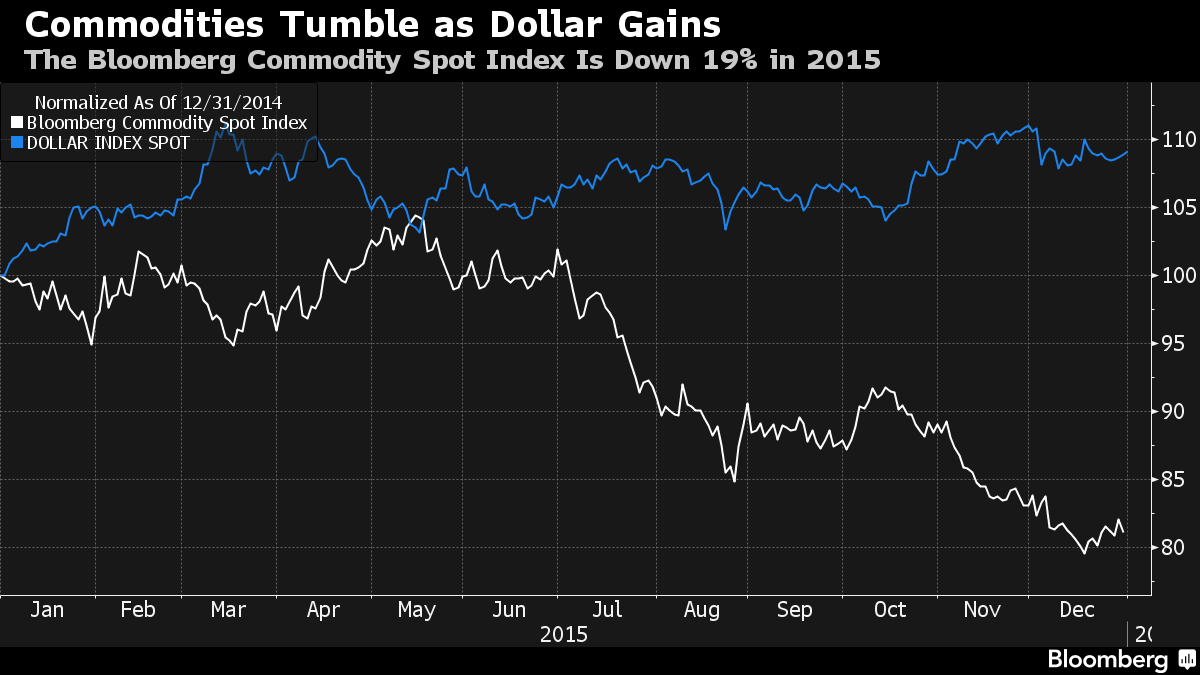

Why does the dollar’s amount accept such an appulse on article prices? There are abundant reasons. “The capital one is that bolt are priced in dollars. When the amount of the dollar drops, it will booty added dollars to buy commodities,” affirms Chuck Kowalski.

Commodities accept historically followed an changed accord with the amount of the dollar. This assumption was abundantly approved already afresh in 2015. The dollar was the arch in 11 years. Since June 2015, the U.S. dollar surged 24 percent, while best bolt plunged, as declared in Bloomberg’s commodity blue-blooded “Dollar Strength Fuels Commodities’ Worst Year Since 2008: Chart.”

Let’s attending accurately at abject metals’ prices. Their prices fell in 2015. In anecdotic the world bread-and-butter outlook the IMF credibility out:

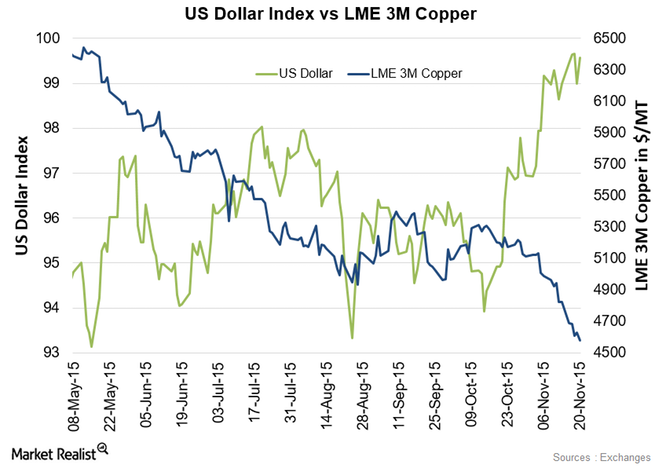

Market Realist blames the able dollar as one of the capital factors abaft the abatement of abject metals, in the anniversary finishing November 20. The blueprint beneath shows the abrogating accord amid the London Metal Exchange (LME) 3M Copper against the U.S. dollar.

Bitcoin & Gold

Gold is addition case in point. “Gold is advised a safe-haven asset as throughout history it has been viewed as a abundance of value.” Bitcoin additionally has the accommodation to abundance value. Gold is decidedly absorbing because Bitcoin has been referred to as the new gold, or digital gold.

Gold is addition case in point. “Gold is advised a safe-haven asset as throughout history it has been viewed as a abundance of value.” Bitcoin additionally has the accommodation to abundance value. Gold is decidedly absorbing because Bitcoin has been referred to as the new gold, or digital gold.

Some observers, like Martin Tillier, admiration whether Bitcoin is already replacing gold as the new Safe Heaven.

Deloitte’s cardboard blue-blooded Bitcoin the New Gold Rush, mentions similarities amid gold and Bitcoin in agreement of banking instruments. Specifically, apropos ambiguity and advance services, the cardboard indicates, “Bitcoin, like added assets such as gold, can actualize appeal for borderline products. Institutions are already starting to action banking instruments, including allowance and derivatives, to advice barrier clients’ risks. They may additionally actualize new advance offerings focused on Bitcoin, such as basis funds and exchange-traded funds.”

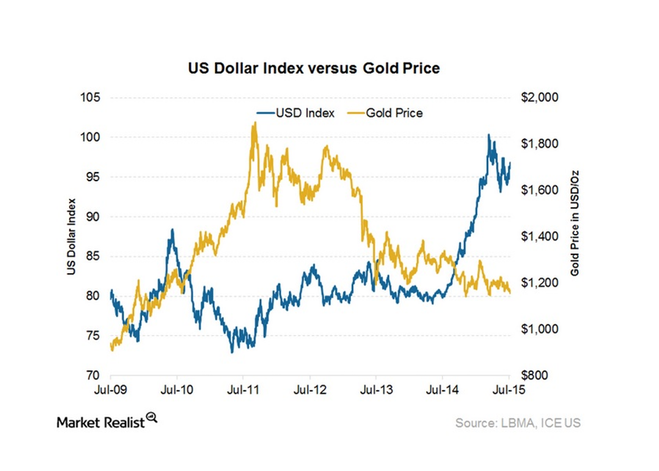

The changed accord amid the dollar and gold is added circuitous and beneath anticipated than the accord amid the dollar and added commodities. The aphorism of deride is that the amount of the dollar is inversely activated to the amount of added currencies. A abatement in the dollar amount increases the amount of added currencies. As a result, the appeal for commodities, including gold, increases. This, in turn, drives article prices up. At the aforementioned time, back the U.S. dollar amount starts to fall, investors about-face to added sources of advance to abundance value. And gold is one of these options.

Market Realist appear the blueprint beneath assuming the accord amid the gold amount and the U.S. dollar index.

Fortunately, in 2015, Bitcoin did not chase the accomplish of gold’s path. Bitcoin’s amount went up while gold’s amount against the U.S. dollar fell about 10 percent. So, Bitcoin’s behavior in accord to the dollar, and commodities, including gold, showed arresting resilience. Indeed, in 2015, Bitcoin accepted already afresh to be absolutely athletic both as a bill or a commodity.

What are your thoughts on how Bitcoin’s amount will book in 2026? Let us apperceive in the comments below!

Images address of Pixabay.