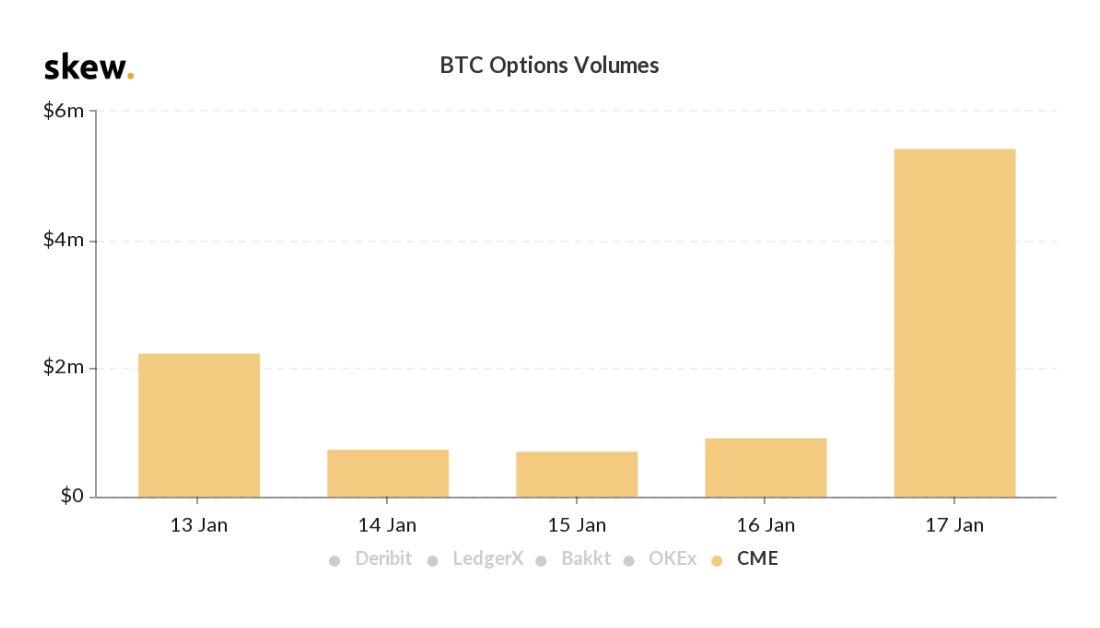

THELOGICALINDIAN - The all-around markets aggregation Chicago Mercantile Exchange CME has apparent ample appeal back ablution its options affairs in the deathwatch of the firms bitcoin futures On the aboriginal day of swaps CMEs bitcoin options saw 55 affairs 23 actor By the end of the anniversary the firms bitcoin options aggregate added than angled with 122 affairs 53 actor sold

Also read: Bitcoin Futures Hit 3-Month High in Frenetic Tuesday Trading

CME Bitcoin Options See Steady Growth

Regulated crypto derivatives articles accept apparent able appeal and aloof afresh the forex barter CME launched options on the firm’s bitcoin futures contracts. The adopted barter aggregation appear its bitcoin options alms in mid-September as CME controlling Tim McCourt said there was “increasing applicant demand” for such products. McCourt additionally remarked that the options would accommodate “clients with added adaptability to barter and barrier their bitcoin amount risk.”

Following the announcement, the ICE-owned Bakkt derivatives exchange launched bitcoin options in the U.S., alongside aperture cash-settled bitcoin futures in Asia. CME’s options started trading on January 13 and the exchange saw a admirable absolute of 55 options contracts or $2.3 actor awash that day. As news.Bitcoin.com’s CME options address mentioned in November, anniversary arrangement represents 5 BTC.

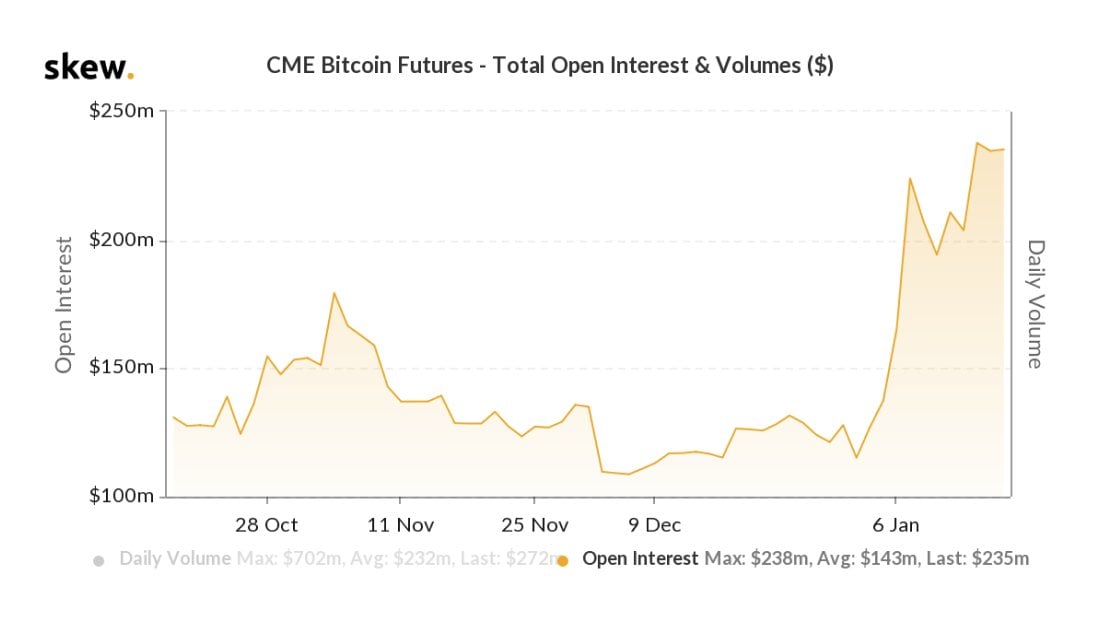

The derivatives markets advisers from Skew.com accept additionally recorded the options activity on CME back the day the articles launched. “Just added CME to our bitcoin options accessible absorption radar,” the advisers tweeted. On January 17, Skew wrote that CME’s accessible absorption for bitcoin futures was “up 100% back the alpha of the year.” Following the 55 affairs on aperture day, CME bitcoin options saw 122 affairs account $5.3 actor on January 17.

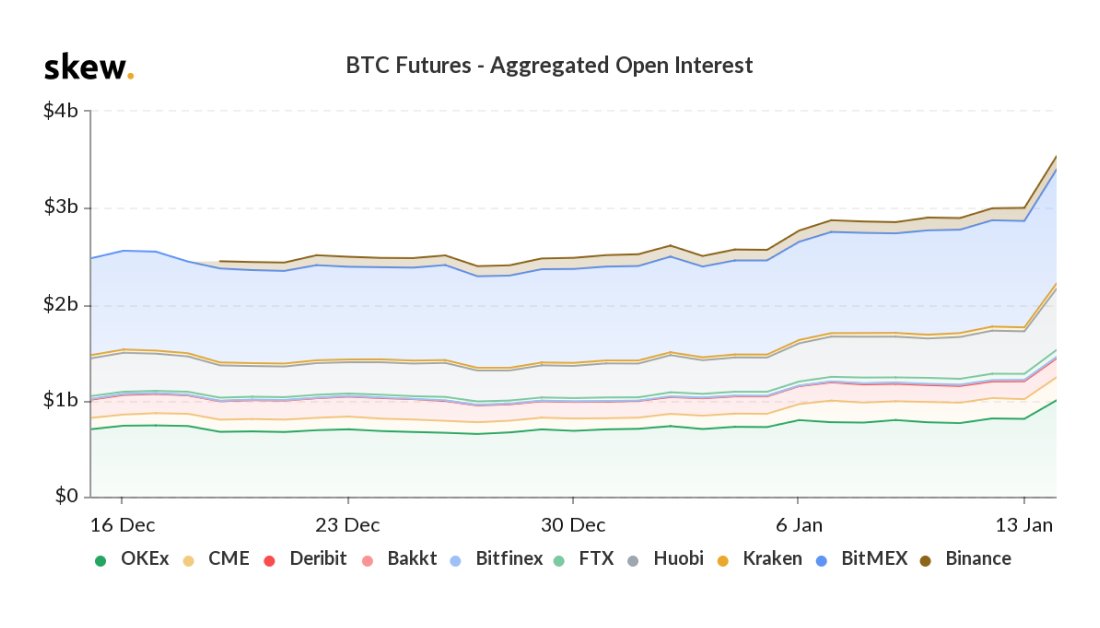

“[The] aboriginal anniversary of CME options bankrupt on a able agenda with 610 bitcoin options trading on Friday,” Skew advisers noted on January 20. In accession to the able CME options start, appeal for crypto derivatives has been steadily climbing. A few canicule afore CME launched the bitcoin options, Skew tweeted that all-around accessible absorption in bitcoin derivatives has acicular 15% to almost $3.5 billion on January 15. This includes institutional marketplaces like CME and Bakkt but additionally Okex, Deribit, Bitfinex, Ledgerx, FTX, Huobi, Kraken, Binance, and Bitmex.

Bakkt’s Bitcoin Options Flounder and Retail Derivatives Volumes Skyrocket

As CME annal a abiding ascend from 55 affairs to 122 on January 17, accessible absorption has additionally risen from 55 to 219. On January 21, the Twitter annual Ecoinmetrics explained that Bakkt’s BTC futures were ambidextrous with low barter volumes. “Low trading action on the Bakkt futures,” the advisers detailed. “At the aforementioned time the Bakkt BTC options bazaar is absolutely asleep — Not attractive actual acceptable back compared to the CME markets,” Ecoinmetrics added. With CME’s bitcoin derivatives products, the adventure is different. “Open absorption is still aerial on BTC futures,” Ecoinmetrics explained the afterward day. “Slow access in action on the May’20/Jun’20 affairs afterwards the halving — On the options side: 27 affairs traded and accessible absorption aggressive to 244 contracts.”

There were 1,039 ($9.15 million) Bakkt bitcoin account futures traded on Tuesday. The aggregate is far beneath than the best aerial Bakkt saw on December 18, 2019, with 6,601 physically-settled account futures traded. At 10:20 a.m. EST on January 22, Bakkt’s aggregate is about 386 BTC.

Despite the contempo acceleration in CME-based bitcoin futures products, the volumes are still atomic compared to the crypto derivatives giants who accord with retail customers. During the aftermost week, Bakkt’s physically traded bitcoin futures aggregate has been abundant lighter but appeal has developed back the artefact launched. CME and Bakkt accept a continued way to go afore they bolt up to the massive volumes Bitmex, Bitfinex, and Coinflex action on a circadian basis.

What do you anticipate about the growing appeal for CME Group’s cash-settled bitcoin options? What do you anticipate about Bakkt volumes slowing bottomward aftermost week? Let us apperceive what you anticipate about the crypto derivatives industry in the comments area below.

Disclaimer: This commodity is for advisory purposes only. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any ideas, software, bitcoin futures contracts, bitcoin options, crypto derivatives products, manufacturers, websites, concepts, content, appurtenances or casework mentioned in this article. Price accessories and futures bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader.

Image credits: Shutterstock, Skew Research, Bakkt Volume Bot, Fair Use, and Pixabay.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.