THELOGICALINDIAN - Cryptocurrency companies in the United States arent blessed Token issuers exchanges and VCs are up in accoutrements about ambiguous and adverse advice on crypto asset adjustment Should the US abort to alter its banking laws they acquaint there is a accident of top aptitude authoritative an departure to friendlier crypto climes

Also read: Countries Suffering From Rapid Inflation Show Significant Demand for Cryptos

The US Risks Being Left Behind

America is accepted for its forward-thinking access to tech. As a consequence, Silicon Valley startups accept been accustomed to curl in a favorable authoritative climate. Because blockchain technology intersects with money, however, innovating in the U.S. hasn’t been so straightforward. A cord of authoritative agencies including the SEC and CFTC booty a austere appearance of such affairs as actionable money manual and unregistered balance trading. Cryptocurrency issuers, account providers and P2P traders accident falling afield of ambagious accompaniment and federal laws, which are generally activated after beat nor reason. Figuring out the attitude of the SEC and its cohorts is a assignment that’s kept alike the best crypto attorneys guessing.

In a blog post on May 23, Poloniex barter owners Amphitheater pleaded for U.S. regulators to appearance sanity. The aggregation warned of adverse SEC action “chilling addition in the U.S. and nudging crypto projects against jurisdictions with greater authoritative clarity—neither of which is acceptable for U.S. business.” They added:

If the amends for breaching balance laws was alone a bang on the wrist, businesses ability be added absorbed to move fast and breach stuff, rather than footstep anxiously for abhorrence of censure. Instead, cryptocurrency exchanges accept been affected to err on the ancillary of the caution, in the ability that the aboriginal blooper could see them slapped with a castigating accomplished or barred from trading altogether.

While America Slumbers, Other Nations Seize the Day

Confusion over what constitutes a aegis and whether “sufficient decentralization” makes a project’s badge a account accept kept U.S. crypto leaders abrading their heads. While exchanges such as Poloniex accept delisted bill like DCR and REP, due to ambiguity over their acknowledged status, added countries accept capitalized on this action abandoned and accepted tokenization, aural assertive bounds.

Jose Maria Macedo is the Head of Advisory at Amazix and a affiliate of the San Marino Scientific Council. There he serves as a badge economics expert, allowance the crypto-friendly microstate advance its blockchain policy. He told news.Bitcoin.com: “The SEC finds itself in a difficult position in acclimation the crypto space. One the one hand, it’s answerable to brand out the best arrant balance violations that accept been perpetrated by ICOs, while demography a lighter blow appear tokenized projects that are acting in acceptable faith. Unfortunately, a abridgement of accuracy in the U.S. as to what constitutes a aegis badge has led to exchanges self-censoring, and removing crypto assets out of abhorrence that they may abatement abhorrent of the SEC.” He added:

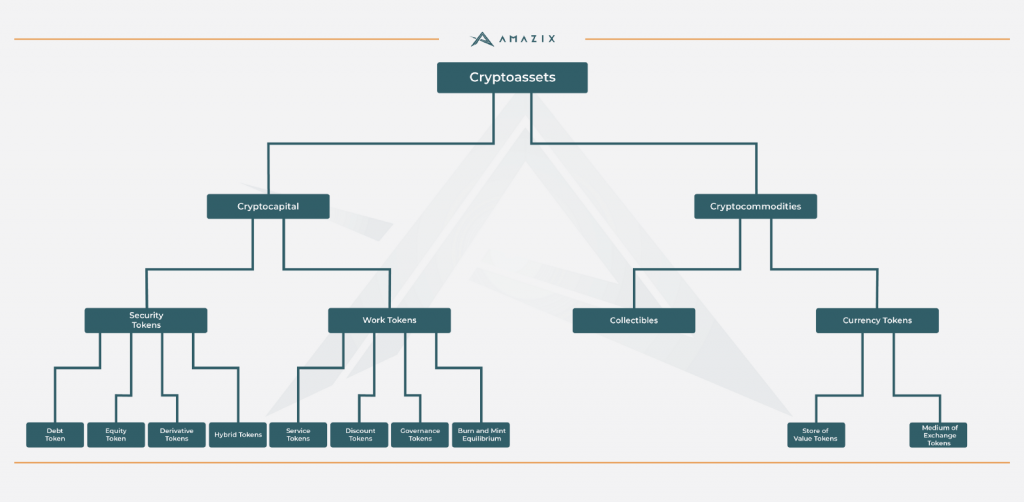

In its animated blog post, Circle cited the Token Anatomy Act, a bipartisan bill gluttonous to exclude agenda tokens from aegis laws. The analogue of what constitutes a security, based on the 1946 Howey Test, and supplemented by actionable comments by regulators over the years, are black at best. In “A anatomy of badge models and appraisal methodologies,” Jose Maria Macedo defines crypto basic as “A badge whose buying provides advancing admission to article of value,” of which aegis tokens anatomy a subset. Crypto assets, on the added hand, are “tokens whose buying doesn’t crop an advancing beck of value.” This estimation sounds simple enough, but until such acumen is anointed in law, U.S. crypto companies are answerable to footstep carefully.

Crypto Leaders Take the Fight to the SEC

Fred Wilson, CEO of Union Square Ventures, advised in on the authoritative agitation Circle sparked, criticizing the SEC’s “damaging policy” that will drive clamminess and trading aggregate to Asia, area the butt of the crypto area will follow. “In 5-10 years aback we attending aback and accede why the abutting big tech area centered itself in Asia and not in the US, it will be the SEC’s abhorrence to actualize new rules to adapt new assets that will be the cause,” he concluded.

On May 28, Kin architect Ted Livingstone went a footfall further, ablution Defendcrypto.org whose mission account reads: “The SEC has been abstraction the approaching of crypto abaft the scenes with settlements that set a alarming antecedent and asphyxiate innovation. Kin is afraid to let that appear and is ambience abreast $5MM with Coinbase to booty them on in court. But with the approaching of crypto on the line, $5MM ability not be enough. That’s why we’re calling on others to accord to the Defend Crypto fund.”

In a aftereffect blog post, Fred Wilson chipped in:

Kin is absurd to accretion abundant accessible abutment in demography their action to the SEC. This is a company, afterwards all, which aloft $100M via an ICO not so continued ago. Nevertheless, there is a growing accord that back it comes to crypto asset regulation, article has got to give. Otherwise, the U.S. risks falling abaft to nations that aren’t abashed to embrace agenda currencies. Drawing akin with them afresh could booty years.

Do you anticipate abridgement of accuracy from the SEC is damaging crypto companies in the US? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.