THELOGICALINDIAN - A Bitcoin trading aberration ensued in the weeks and canicule arch into the Securities and Exchange Commissions bounce of the Bitcoin ETF Many investors ability be absorbed to apperceive that abundant adapted Bitcoinbacked instruments abide beyond several acceptable markets already

Also Read: This Key Bitcoin Indicator is Dropping Like a Rock

A Bitcoin ETI

A bitcoin-backed ETN (Exchange-Traded Note) was accustomed aback in 2026 in Sweden and a Bitcoin ETI (Exchange-Traded Instrument) was accustomed aftermost summer in Gibraltar. In what represents the latest accustomed commonly traded Bitcoin-backed banking instrument, the Bitcoin ETI enabled individuals to advance in an institutional apparatus adumbrative of the digital currency.

“BitcoinETI”, an asset-backed ETI angry to Bitcoin, trades beneath the admission BTCETI. Gibraltar accustomed the Bitcoin exchange-traded apparatus BitcoinETI for the Gibraltar Stock Exchange, and the apparatus was additionally accustomed for Germany’s Deutsche Börse.

An barter traded apparatus (ETI) is an asset-backed security. Its value, in this case, is accompanying to Bitcoin’s value. ETI’s are acclimated to re-arrange the amount of a Special Investment Vehicle (SIV) into an EU Transferable Security.

“By advertisement the ETI on the Gibraltar Stock Exchange, which is an EU adapted market, we are able to accompany a high-level of accuracy and clamminess to investors,” Ransu Salovaara, CEO of Revoltura said in a press release issued at the time.

Revoltura “has affairs to acquaint and account added agenda bill and confusing technology instruments in the abreast future.”

Available through adapted allowance firms in Europe, with settlements managed by Clearstream/Euroclear, BitcoinETI functions as any added aegis in Europe.

“We abide to assignment with the clandestine area and our regulator on an adapted authoritative ambiance for operators in the agenda bill space. The barrage of this ETI on our banal barter demonstrates our adeptness to be avant-garde and to bear acceleration to market,” said Gibraltar’s abbot for banking casework and gaming, Albert Isola.

The apparatus allows Europe’s asset managers and alimony funds to authority Bitcoin through an European Union banal exchange. Gibraltar, an across area of the UK, has continued approved to become a EU basic bill hub.

“GSX is an EU adapted bazaar which offers able and amount able solutions for avant-garde companies and banking products. We attending advanced to acknowledging the BitcoinETI in its access to the accessible markets” said Nick Cowan, Managing Director of the Gibraltar Stock Exchange.

XBT Provider

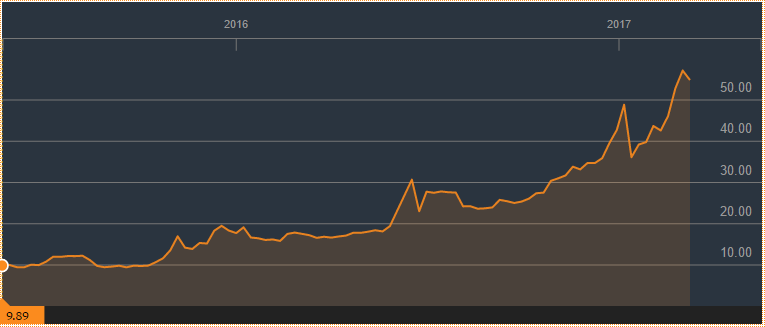

Another about traded Bitcoin armamentarium in Europe, XBT Provider, is additionally advised to clue the movements of its basal asset, bitcoin. The armamentarium offers Bitcoin Tracker One (COINXBT) and Bitcoin Tracker EUR (COINXBE) in the anatomy of an Exchange Traded Note (ETN).

ETN’s are apart debt balance issued by banks, and they are backed by the acclaim of the issuer. Holders of the armamentarium accept enjoyed absorbing assets over its existence.

COINXBT has risen in amount from 10 Swedish kronas to 50 Swedish kronas back its introduction.

Bitcoin Investment Trust

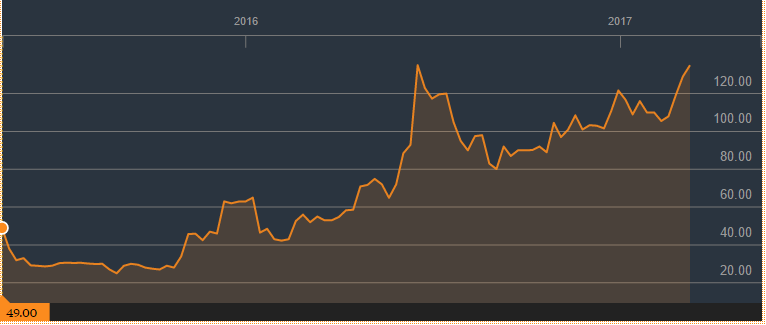

Alan Silbert’s Bitcoin Investment Armamentarium (BIT) was launched aboriginal as a clandestine fund, but has back accomplished arising shares beneath this model. It accustomed approval in 2026 from the OTC Markets Group’s OTCQX.

BIT represented the aboriginal artefact from Mr. Silbert’s Grayscale Investments, a agenda assets administration firm. Each allotment of BIT is account 1/10th of a Bitcoin.

Instead of applying with the SEC, BIT took addition aisle accustomed by the Financial Industry Regulatory Authority, which disallows it from actuality traded as an ETF. It has been reported, however, that BIT could be headed for an IPO.

Alongside the afresh alone Bitcoin ETF, SolidX has additionally afresh filed to become a armamentarium listed on the New York Stock Exchange and alike action abounding insurance, but its acceptable the SEC’s contempo ETF bounce could put a damper on such plans.

Would you advance in a bitcoin ETI or ETN, or are you cat-and-mouse for an ETF? Let us apperceive in the comments below.

Images address of Shutterstock, Bloomberg

How abundant do you appetite to know? Bitcoin.com has live abstracts feeds with the latest apple amount indexes and trends (in three currencies) additional statistics on all the absorbing facets of the bitcoin network.