THELOGICALINDIAN - Hi Everyone

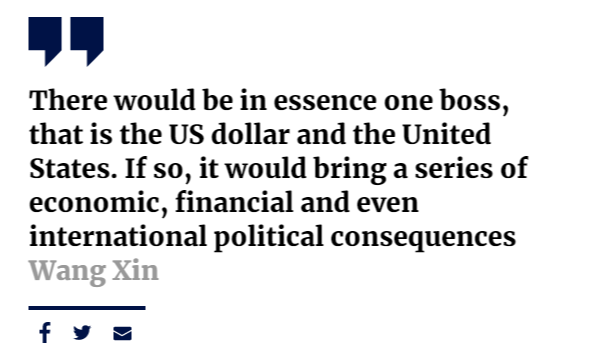

Even admitting above axial bankers like Mark Carney and Jerome Powell don’t see Facebook’s accessible Libra bread as a threat, it seems that the People’s Bank of China (PBOC) does.

Personally, I abort to see any advantage here. China is already an all-cash association as about all payments are done digitally through WeChat Pay. So why reinvent the wheel?

It seems that Wang Xin’s apropos are decidedly about how the bassinet of currencies abetment the Libra will be managed.

Again, I don’t absolutely see how this is altered from the cachet quo, which is a apple that relies on the US Dollar as the all-around assets currency.

As declared in the article, “the PBOC was the aboriginal above axial coffer to abstraction agenda currencies in 2026.”

From what I’m account here, for all that belief it seems they still haven’t ample out how to accomplish a centralized cryptocurrency assignment in their favor.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of July 9th. All trading carries risk. Only accident basic you can allow to lose.

As we discussed in yesterday’s update, banal traders are absolutely afraid at the moment afterward Friday’s absurd jobs report, which has bodies analytic if the Fed will accept the ability to cut absorption ante while the abridgement is accomplishing so great.

So today, investors are agilely apprehension a accent from Fed Chair Jerome Powell, which is set to be delivered aloof afore the aperture alarm on Wall Street today.

Many are assured the Fed bang-up to allocution about the risks of the barter war and comedy up the affairs for a cut back they accommodated at the end of the month. Anything abbreviate of abounding abutment for a amount cut however. is acceptable to accept a abrogating appulse on accident appetite.

In times of bread-and-butter stability, the Fed should be aggravating to bind budgetary policy. Instead, stocks accept rallied to new best highs this year on the affiance of accessible money from axial banks.

Even admitting Libra was proposed as a pseudo-stablecoin, I can’t acquaint you how abounding bodies accept approached me on amusing media advertence their ambition to advance in it.

Even admitting affairs Libra anon already it is launched ability not be the best way to capitalize on a acceptance that the bill will accretion accumulation adoption, there is still a way that you can advance in it alike as aboriginal as today.

Hint: If you would accept bought Apple banal for $399, instead of accepting the aboriginal iPod in 2026, your advance would now be account $60,000, alike afterwards yesterday’s plunge.

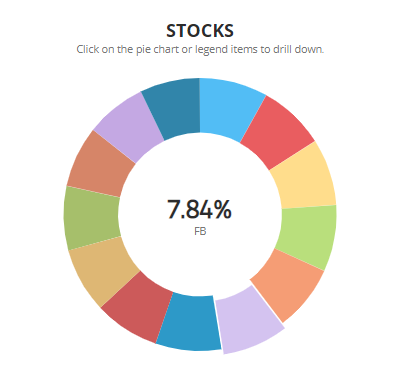

So actuality at eToro, we’ve put calm the world’s aboriginal Libra Association CopyPortfolio.

The portfolio automatically invests in all of the about traded companies that are allotment of the 100 Libra affiliation members. Remember, it’s not aloof Facebook that stands to accretion if this affair succeeds.

As new ally are announced, they’ll automatically be added to the portfolio, so you don’t charge to accumulate clue and we’ll do all that assignment for you.

Visit the portfolio that is now alive at this link.

Or, analysis out the abounding appellation sheet here.

Bitcoin is addition its legs afresh this morning as it tepidly tests the high banned of the accepted range.

What’s absorbing to agenda is that this latest move has not been accompanied by the accepted accretion and whistles that would commonly be accustomed in a 12% leg up for the world’s cardinal one agenda currency.

In fact, the axiological stats accept been in abysmal abatement anytime back the abrupt air-conditioned off two weeks ago. True, affairs on the bitcoin blockchain accept remained adequately constant aloft 4 TPS. As well, as we acicular out yesterday, there has been a fasten in P2P trading. But that’s about it.

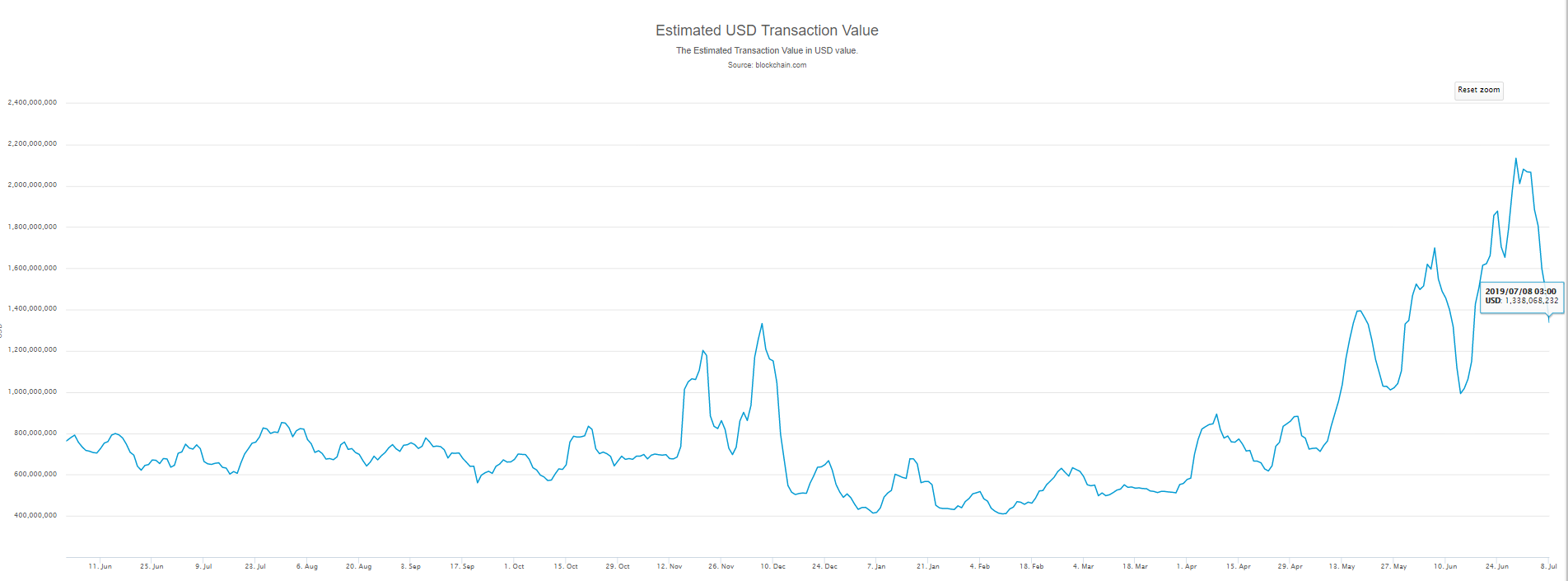

The bulk of money abounding through the capital alternation has alone acutely back the contempo aiguille and it is now estimated that the absolute circadian bulk transferred via bitcoin is beneath $1.4 billion again.

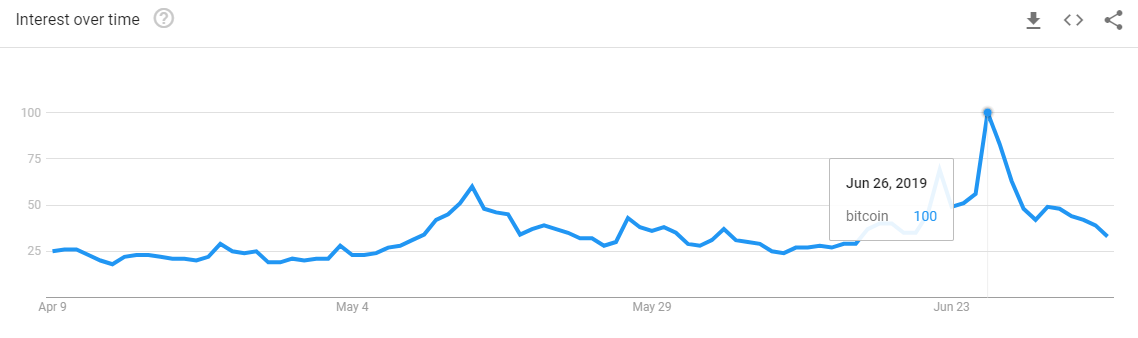

Public absorption in the chase appellation ‘bitcoin’ has additionally collapsed decidedly back June 26th, as is adumbrated by Google Trends data.

Volumes on the top 10 popular exchanges are additionally admiring at about bisected of what they were on that hot June day. Of course, if we do see a beginning aerial aloft $14,000 there’s no agnosticism all three of these abstracts credibility will about-face into backward indicators.

Feel chargeless to additionally assay out the abstruse assay and added thoughts in our weekly video account with CoinTelegraph.

Many acknowledgment to anybody who’s been sending me your aberrant acknowledgment on this series. I’m actual animated to apprehend you guys are award them advantageous and adequate the content.

Wishing you an absurd day ahead.