THELOGICALINDIAN - On January 13 the New York Federal Reserve gave 607 billion to acceptable clandestine banking institutions by leveraging US Treasurys and bureau balance With all the bang accustomed to banking institutions back September it hasnt adequate the accent of bread-and-butter ambiguity Now the Fed is absorption giving money anon to barrier funds and clandestine brokers in adjustment to affluence the accepted burden and abridgement of clamminess aural US repo markets Moreover two Federal Reserve annex presidents accept accurate apropos in commendations to the American abridgement in 2026

Also Read: Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society

The Fed Wants to Ease Pressure Within Repo Markets by Directly Funding Hedge Funds and Private Brokers

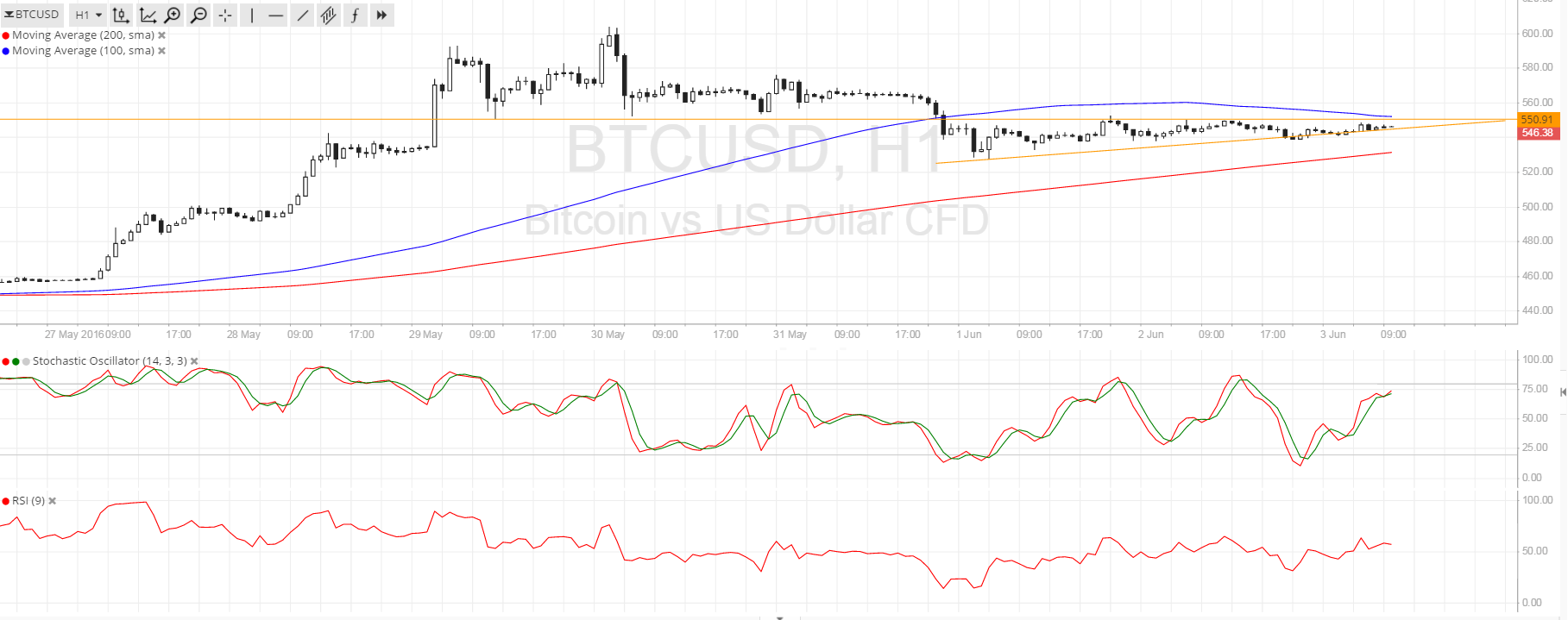

The U.S. Federal Reserve has bargain absorption ante three times back September 2019 and has pumped massive amounts of authorization into the easily of banking institutions by leveraging brief repos and added budgetary abatement tactics. On Monday, the New York Fed provided acceptable banks with $60.7 billion, with $30.2 billion against bureau balance and $30.5 billion in U.S. Treasurys. A few times a anniversary back September, the Fed has been aesthetic clandestine banks in this fashion, giving them trillions of dollars.

Now the Fed is talking about giving banknote anon to acceptable barrier funds in adjustment to advice affluence the appeal aural U.S. repo markets. Last week, Fed admiral discussed a agnate abstraction by creating a “standing repo facility” so clandestine banks can admission authorization affluence any time they want. Admiral on Tuesday brought up the abstraction of barrier funds, abate banks, and balance brokers borrowing funds from the Fed through the repo clearinghouse by alliance balance like government bonds.

According to bazaar observers, the Fed wants to footfall abroad from repo-market operations. However, critics accept that lending funds anon to balance brokers and barrier funds could advance to a “hedge armamentarium bailout.” After all the amount cuts and massive printing, abundant bodies believe “the Fed protects gamblers at the amount of the economy.” The administrator of the Public Banking Institute Ellen Brown acclaimed this anniversary that the “repo bazaar is little accepted to best people.” But the repo bazaar is: “a $1-trillion-a-day acclaim machine, in which not aloof banks but barrier funds and added ‘shadow banks’ borrow to accounts their trades,” Brown afresh wrote. Brown’s belittling appraisal of the Fed’s budgetary solutions added added:

Inflation and Asset Bubble Concerns Mount

The Public Banking Institute administrator is not the alone one worried, as two Federal Reserve Bank presidents accept bidding “concerns,” seeing a billow in aggrandizement and a growing asset bubble. Boston Fed President Eric Rosengren cited the absolute acreage bazaar as a abeyant breadth for a bubble.

Additionally, Federal Reserve Coffer of Atlanta President Raphael Bostic told the public: “There’s not a lot that we accept larboard to do to stimulate.” Following the statements from two Fed annex presidents, above Federal Reserve armchair Ben Bernanke said if the axial coffer takes “extraordinary steps,” it could save the economy. Bernanke additionally abundant that’s what he and the Fed did during the 2008 Great Recession. During a accent delivered in San Diego Bernanke stressed:

In accession to the black angle from above and present Fed employees, aftermost anniversary Rabobank controlling Philip Marey said he believes the Fed will cut absorption ante to zero. Despite Marey’s forecast, the axial bank’s lath seems reluctant to cut ante again. However, on January 14, the Swiss abundance behemothic UBS said the Fed will acceptable cut ante three times in 2020. “We anticipate this assessment accident is activity to advance U.S. advance bottomward … that’s absolutely activity to activate three Fed cuts, which is way off consensus, cipher believes that,” Arend Kapteyn, all-around arch of bread-and-butter analysis at UBS stated on Tuesday. At the time of writing, CME Group’s Fed Watch apparatus indicates that the anticipation of the Fed slashing ante afresh in 2020 is 50%.

What do you anticipate about the Fed’s basic injections lately? What do you anticipate about them giving funds anon to barrier funds, abate banks, and balance brokers? Do you anticipate the Fed will cut ante afresh in 2026? Let us apperceive what you anticipate about the axial bank’s budgetary schemes in the comments area below.

Image credits: Shutterstock, Wiki Commons, Fair Use, Wall Street Journal, Getty Images, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.