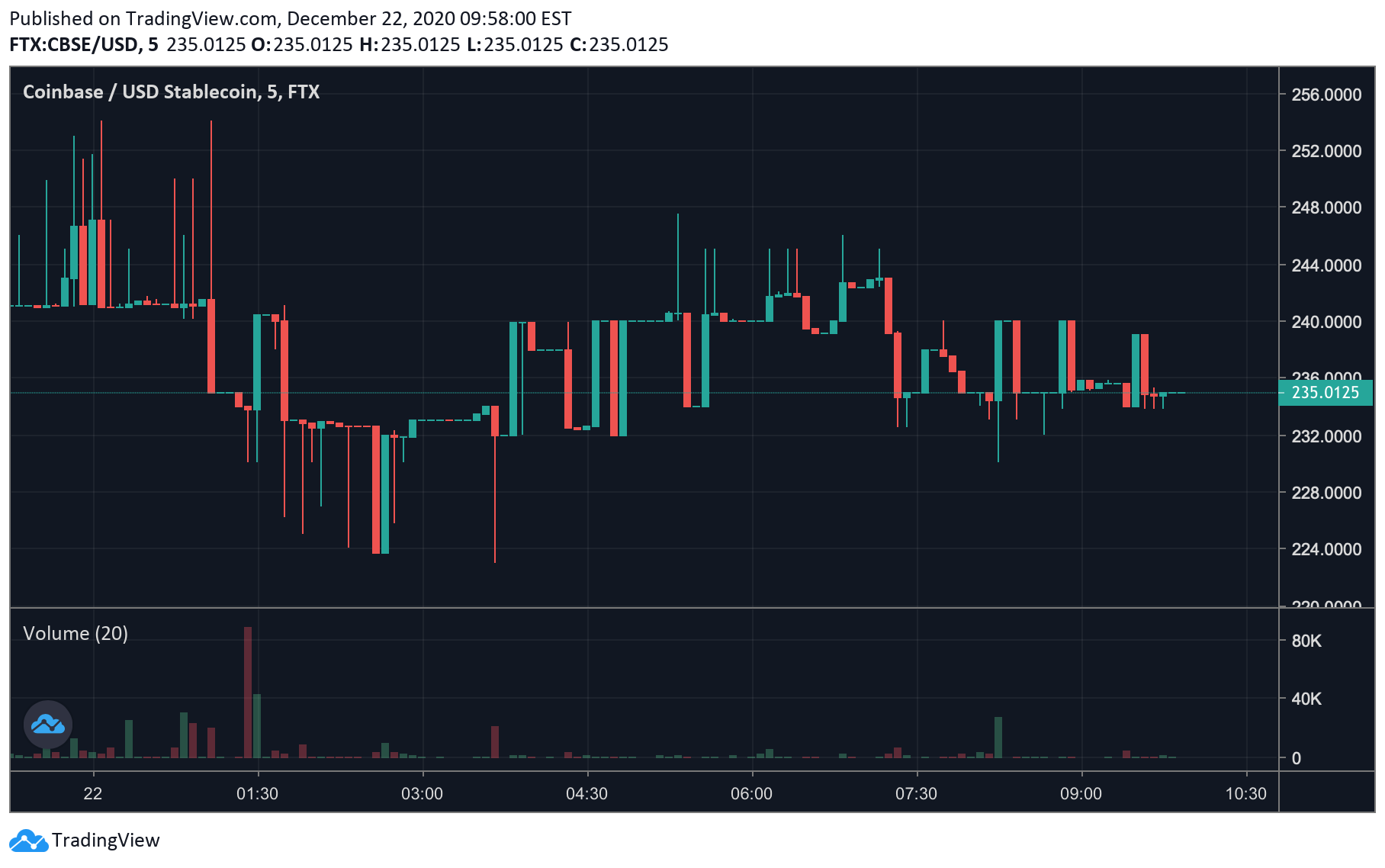

THELOGICALINDIAN - After the San Franciscobased barter Coinbase appear it was registering with the US Securities and Barter Commission SEC in adjustment to accept an antecedent accessible alms IPO FTX Barter CEO Sam BankmanFried said the aggregation would barrage preIPO futures On December 21 BankmanFried appear the barrage was now alive and Coinbase preIPO futures affairs are now swapping for 235 per unit

People can action on the Coinbase antecedent accessible alms (IPO) by leveraging Coinbase pre-IPO futures affairs on the crypto trading belvedere FTX Exchange. FTX is able-bodied accepted for ablution futures markets on absorbing things like the contempo 2026 acclamation aftereffect and pre-IPO affairs for Airbnb.

After account that FTX may barrage pre-IPO futures articles for the Coinbase IPO, FTX Exchange CEO Sam Bankman-Fried appear the barrage on Twitter.

“Ok, guys we did it,” Bankman-Fried tweeted. “With atom margin, up to 5x,” the FTX CEO added.

According to the contract specs, the “CB pre-IPO Contracts” represent a futures arrangement with the amount angry to the bazaar appraisal of Coinbase Inc. at the end of the aboriginal trading day.

The affairs are acclimatized by exchanging crypto-assets and because they are futures products, the FTC CB pre-IPO affairs “have no affirmation to commitment of the basal nor actor rights.” The new FTX Coinbase futures bazaar has apparent a cogent bulk of barter aggregate so far, capturing $2.2 actor in aggregate during the aftermost 24 hours.

At the time of publication, the pre-IPO Coinbase affairs are trading for $235 per assemblage adjoin the U.S. dollar. Additionally, decentralized accounts (defi) association associates accept additionally created an actionable Coinbase futures IOU which has been apparent swapping on decentralized barter (dex) platforms like Uniswap and Sushiswap.

Ever back the aggregation appear activity public, crypto advocates accept been discussing the first-ever cryptocurrency barter accessible listing.

“Getting above flashbacks appropriate now to Amazon’s IPO in the 1990s, back I was a banker on a big sell-side desk,” one alone tweeted. “Feels actual agnate in several means including industry accomplishments and accessible sentiment, the closing of which included a huge bulk of skepticism and scorn,” he added.

There accept been abounding guesses as to what Coinbase will be account afterwards the IPO and some estimates accept it could be upwards of “$28 billion.” The San Francisco barter has developed astronomic with added than 35 actor users in over 100 countries.

Coinbase already aloft $500 actor in disinterestedness costs from Greylock Partners, Andreessen Horowitz, MUFG, Tiger Capital Management, and more. In 2026, Coinbase aloft $300 actor in a Series E allotment annular and was estimated to be account almost $8 billion.

What do you anticipate about the pre-IPO futures affairs for the Coinbase antecedent accessible offering? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tradingview,